NEO is a next generation smart economy platform (formerly Antshares) and means new and young in Greek. NEO has had a monumental rise to fame and most know NEO for its explosive growth. However, when you look under the hood there is a lot to discuss.

Called the “Chinese Ethereum” NEO has a lot of hype but, does it live up to it?

Law as code

First, let’s discuss smart contracts. According to Black’s law dictionary, a contract is: “An agreement, upon sufficient consideration, to do or not to do a particular thing.” Sounds simple right? Contract law is a deep rabbit hole that spans a myriad of offshoots which many dedicate their lives to but there is one key shift in this digital age, the law is now programmed code.

In the US, the ESIGN act passed federally in 2000 which legalized the use of digital signatures as a legally binding construct. In China, a similar contract law and legal use of digital signatures were put on the books in 2007. This means the legal system now has a bridge with the digital realm and opens a plethora of new opportunities for digital contracts.

Meet Smart Contracts – a digital, borderless and trust-less new way for two or more parties to interface.

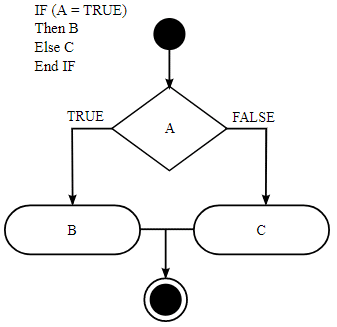

Contracts govern an agreement between two (or more) individuals and/or parties. If X occurs then Y is provided. If X does not occur, here is Z recourse. This ties in quite nicely with the conditional programming structure in computer science where “if-then-else” expressions can easily be built around traditional contract law in effect making law into code.

If-Then-Else Diagram

Digital keys and signatures are the new pens inking their presence on digital (used to be paper) contracts. Contracts that have now been coded and re-imagined in a new way for the digital age through platforms like NEO.

The NEO system includes:

- Delegated Byzantine Fault Tolerance (DBFT) algorithm – This is a consensus mechanism (instead of the traditional proof of work/stake) that allows the system to resist the Byzantine Generals problem and maintains consensus even if some nodes bare malicious intentions

- NeoX – This system will create the ability to execute and operate across various Blockchains

- NEO Contract – Is the mechanism for creating smart contracts seamlessly in scalable, high performance environments that integrates pre-existing codebases (e.g. C#, VB.Net, F#, Java, Kotlin)

- NeoFS – This is a service which allows decentralized storage (like a peer to peer Dropbox)

- NeoQ – A lattice-based cryptographic mechanism which creates problems that cannot be solved by quantum computers and ensuring being quantum-proof

NEO is often called the Ethereum of China, but why?

NEO is positioned as a “public cloud” and is part of a much bigger strategy by the Chinese government in establishing pre-eminence as a Blockchain platform industry leader. They want developers, in general, to use their tools and platform and develop the ecosystem. We are already seeing this with the City of Zion team.

Privately funded OnChain seeks to lead the pack

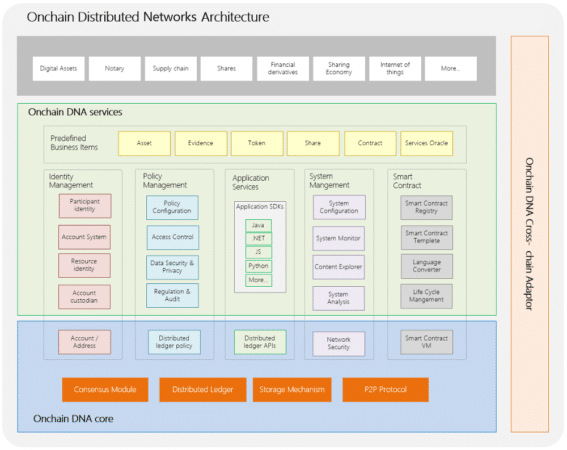

Voted as a top 50 Fintech Chinese company by KPMG, OnChain is a sleeping giant. If NEO is a public cloud, OnChain is a private cloud being used by corporations and other large establishments. The goal is for OnChain to be the Microsoft or Apple of the Blockchain. They are the first Chinese team to create DNA (Distributed Networks Architecture). DNA supports applications, cross-chain interoperability, and can integrate with traditional business systems and networks.

“Our vision is to make Onchain a truly universal Blockchain framework. Utilizing different plug-in modules, our framework could be applied to a public chain, a consortium chain or even a private chain. Our cross-chain adaptor module, currently under development, creates interoperability among these different chains.” ~Da HongFei, co-founder of NEO and OnChain

Other noteworthy partnerships include talks with the Japanese Ministry of Economy, Trade and Industry as well as providing enterprise-grade blockchain powered email for Alibaba’s Ali Cloud.

Why does this matter for NEO?

Eventually, there will interoperability between both NEO and the OnChain networks which will allow unprecedented reach and usage for both networks in tandem.

How is NEO different than Ethereum?

NEO supports many additional code bases (e.g. C#, VB.Net, F#, Java, Kotlin) while Ethereum has its own proprietary language called Solidity, which requires developers to learn that before any development can take place. This means a longer learning curve and barrier to entry which could hinder the number of developers that can enter the ecosystem.

Critiques concerns and weaknesses

NEO essentially has a 100% pre-mine as well as proof of stake model which allows users to derive additional coins (in the form of GAS) by holding them in a wallet. NEO “distributed” coins through a crowdfunding event which allowed people to invest but, NEO still made money from the sale. Since there was no mining and only issuance of tokens this greatly centralizes the distribution.

As mentioned in our previous article, NEO was divided into two batches: 50 million which were sold via crowdfunding (and given to early contributors) while 50 were reserved to be “managed” by the NEO Council.

The “lock out” period ended on October 16, 2017 releasing funds for use for development and other purposes:

- 10 million NEO go to NEO developers and NEO Council members

- 10 million NEO as incentives for developers in the NEO ecosystem

- 15 million NEO invested in other auxiliary Blockchain projects used by NEO

- 15 million NEO earmarked for “contingencies”

Some may feel that these multiple millions of NEO are in the hands of the developers could cause dumping on the market and other actions that might affect the price or morale of the economy.

Also, some of the areas mentioned above are a bit vague and could be hard to distinguish if funds are being used to those exact parameters. (Which may end up changing as the project evolves.)

In addition, as with all cryptocurrency initiatives, there must be a network effect of adoption for anything substantive to happen long term. This has not fully taken place yet on a developer use level with NEO despite all the hype and potential offered by this initiative.

Strengths and Opportunities for NEO

NEO has a sister company OnChain that’s already a “made man” in terms of the financial services industry. It is also currently working with the Chinese and Japanese government along with large corporations including Alibaba.

NEO is considered more of an open-source public cloud model which will be separate from OnChain but can also be interconnected in terms of the cross chain functionality as we will see more of with NeoX.

GAS rewards you for holding NEO

Similar to “ether” with Ethereum operating as fuel for using the ecosystem, GAS serves a similar function. The difference with NEO is that GAS was given its own special status as a token. (Similar to Steemit tokens, STEEM and Steem Dollars, SBD).

GAS is a Proof of Stake like incentive generated with each new NEO block. The release will entail 8 GAS per block reduce by 1 each year (So year 2 will be 7 GAS, year 3, 6 and so on). This will go until 100 million GAS are produced after which there will be no further GAS produced.

NEO produces GAS for holders which is needed to use the NEO network and suite of services. This would presumably create buying pressure (demand) as its used for the ecosystem which is good for holders. The more projects using the NEO network the more demand for GAS tokens.

So, is NEO a “next-generation smart economy”?

That has yet to be determined. We know that digital signatures and as a result, contracts are legit, legal and copacetic. Building on this legal basis is a great start. The key will be, do people actually use the system and is there demand?

Nonetheless, NEO and its team are making big moves to grow deep roots in the Asian continent and beyond (as seen in Western regions). The developer focused architecture will most definitely pay off as they onboard new developers faster than other projects which have steeper learning curves.

Current rapid technology adoption in Asia as a whole plus their critical role as manufacturers (including ASICs for mining) makes that region (where NEO is based) a hotbed of development. Asian markets like China, Japan, and many other nations are quietly becoming powerhouses in the Blockchain and FinTech industry.

For NEO to be aligned with that bodes well for their future growth and trajectory.

Is NEO…the one? We shall see.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.