- Built for business: Corporate smart contracts made easy

- Ethereum Virtual Machine & Bitcoin UTXO verification

- Datafeeds & oracles make QTUM broadly useful

- Proof of Stake 3.0: The only PoS smart contracts platform

- Blockchain on mobile: Run smart contracts using light clients

- The QTUM founding team, investors, & completed crowdsale

What is QTUM?

QTUM (pronounced “quantum”) is a Singapore-based blockchain technology that bridges Ethereum’s smart contracts on top of Bitcoin’s stable blockchain while using proof of stake for verification. By doing so, QTUM hopes to increase the range and interoperability of smart contract applications, especially for business and institutional purposes. In addition, QTUM will implement tools, templates, and other plug-and-play smart contract options to make it easier for businesses to build and execute smart contracts.

The idea behind QTUM is making smart contracts easier and more secure while offering interoperability with leading cryptocurrencies such as Bitcoin and Ethereum. The foundation for QTUM’s code is Bitcoin’s blockchain, but the QTUM developers have abstracted and added layers to the Bitcoin blockchain that allow the Ethereum virtual machine for smart contracts to run on top of Bitcoin. As such, QTUM benefits from new developments in the Bitcoin and Ethereum communities, and smart contracts built on Ethereum can easily be ported over to QTUM as well.

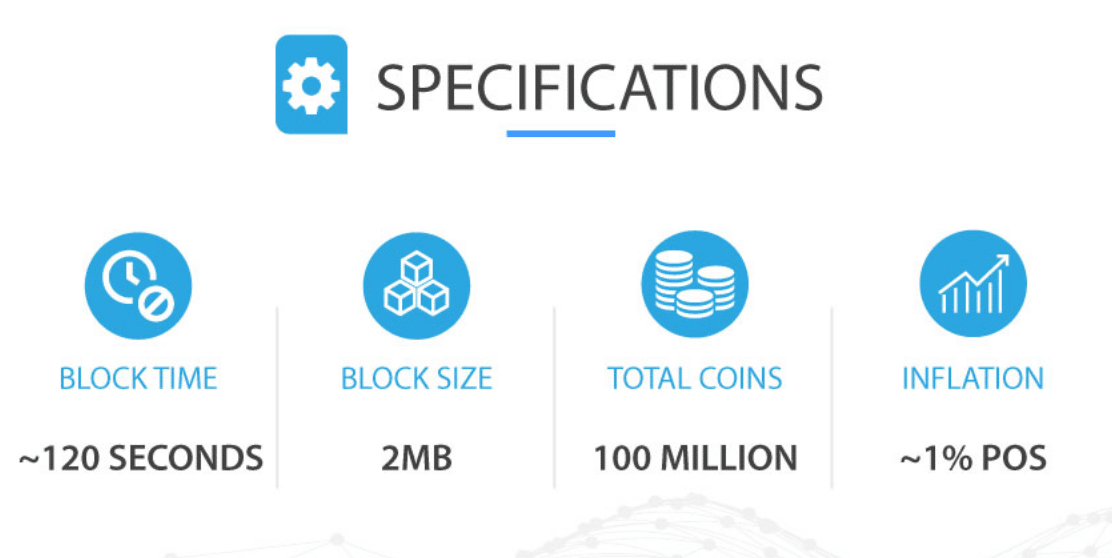

After an initial crowdsale in March, QTUM’s mainnet went live in mid-September, 2017. As of writing, QTUM is the 16th most valuable cryptocurrency by market cap, according to CoinMarketCap, with an overall valuation of $1.1 billion. In this post, we’ll take a look at the technology behind QTUM, its team, and the possibilities it holds for democratizing corporate smart contracts.

Built for business: Corporate smart contracts made easy

Although anyone can use QTUM, the QTUM foundation is focused on business applications of smart contracts. Their goal is facilitating the transition from legacy systems in aging organizations over to blockchain-based solutions that increase automation and decrease cost. This might take the form of a company creating its own tokens to power some of its goods and services. Alternatively, blockchain decentralization might help with self-executing supply chain management. A distributed ledger has immediate applications in risk reduction and cybersecurity, and contracts can be secured and executed autonomously.

These solutions seem promising for businesses, but in practice, many of these options aren’t feasible with the current state of blockchain technology. According to the QTUM team, Ethereum still has stability flaws that are yet to be resolved, and its reliance on account balances rather than unspent transaction outputs makes it incompatible in scenarios where Bitcoin interoperability or certain scaling scenarios are required (see below on UTXO verification).

Even though Bitcoin is the most stable and secure blockchain available, the Bitcoin network poses its own challenges. First, it’s not Turing-complete, meaning programming smart contracts directly on the Bitcoin is not possible. Additionally, according to Patrick Dai, one of the founders of QTUM, enterprise developers may be wary of creating a private Bitcoin blockchain clone because it uses proof of work and requires miners for consensus.

QTUM’s solution provides the best of both worlds. Allowing the ease of programming found on the Ethereum network to combine with the stability and security of the Bitcoin blockchain. In addition, the QTUM developers will provide tools, blueprints, and pre-built smart contracts that will enable the quick construction of new decentralized apps (DApps) and other blockchain-based use cases for businesses.

Ethereum Virtual Machine & Bitcoin UTXO verification

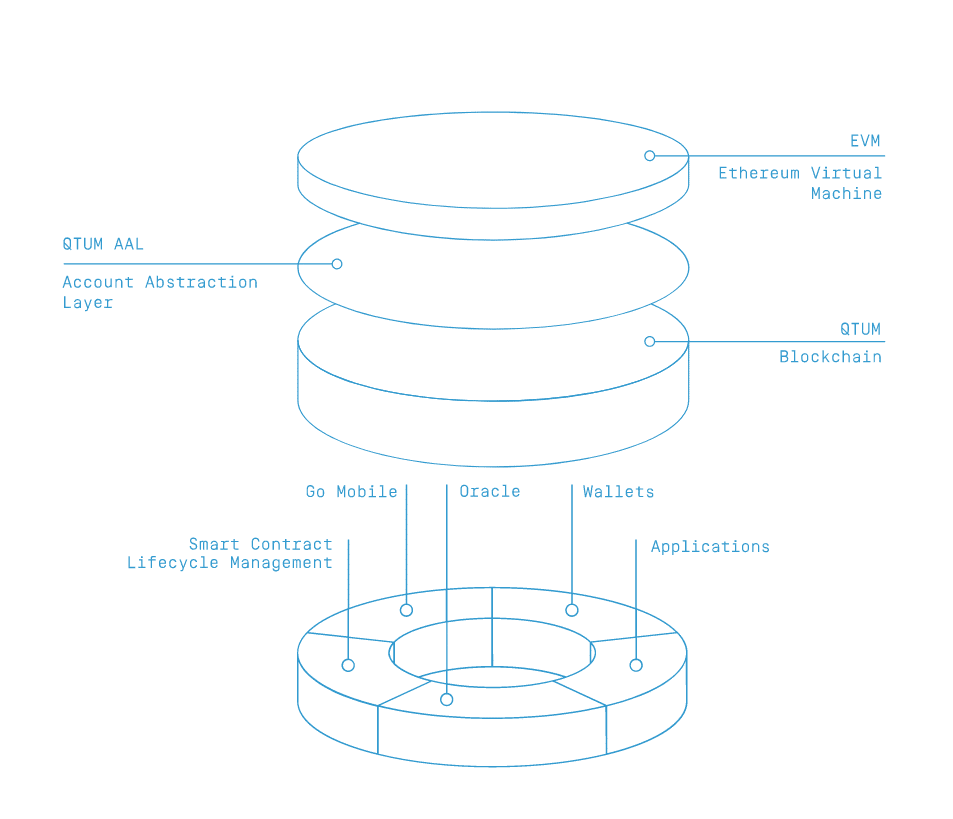

QTUM bills itself as a bridge between Bitcoin’s stability and Ethereum’s technology. Specifically, this means that QTUM runs a version of the Ethereum Virtual Machine (EVM) – the thing that makes smart contracts possible – on top of Bitcoin’s blockchain. The problem is a fundamental incompatibility between the ways Ethereum and Bitcoin store data.

The Ethereum blockchain ledger utilizes account balances, much like a bank in the way that we’re used to thinking about it. However, the Bitcoin ledger uses unspent transaction outputs (UTXOs) as markers of value. Account balances are simpler and easier to write code around, which is why Ethereum uses them. However, according to the QTUM team, with UTXOs it’s more straightforward to validate transactions, and you can process multiple transactions at the same time regardless of sequence. This makes UTXOs more secure and scalable.

So, if the Ethereum Virtual Machine is built on a system that uses account balances, it’s a serious technical challenge to deploy the EVM on the Bitcoin blockchain. QTUM solves this challenge with an Account Abstraction Layer that converts the blockchain’s outputs into account balances and facilitates the transfer of information between the EVM and the UTXO-based blockchain. This abstraction layer is QTUM’s biggest technological contribution.

The consequence of this merger between Ethereum and Bitcoin is the updates developed for either platform will apply to QTUM as well. For instance, QTUM has already implemented SegWit and other Bitcoin Improvement Projects. The shared code also means DApps that run on Ethereum can easily be run on QTUM as well.

Datafeeds & oracles make QTUM broadly useful

In addition to combining the best of Bitcoin and Ethereum, QTUM also supports the integration of outside data feeds and something that the team is calling “oracles.” These are essentially APIs of sorts that allow external devices to supply and acquire information from the smart contracts operating on the QTUM platform. Oracles are trusted parties on the network that can supply data, perform off-network calculations, and aid in computations.

The acceptance of outside data and processing is necessary for many potential applications of smart contracts in business. This is especially true for applications that would require heavy processing power since smart contracts that run on the virtual machine require every node on the network complete the calculations. We need trusted outside parties to provide computing power off-network to keep virtual machines from becoming overused.

Proof of Stake 3.0: The only PoS smart contracts platform

Another key feature of QTUM’s smart contract solution is implementing proof of stake (PoS) in place of proof of work (PoW) as currently used on the Bitcoin and Ethereum blockchains. The implementation makes QTUM the only blockchain where proof of stake powers smart contracts.

The importance of proof of stake for smart contracts shouldn’t be underestimated. While blockchain offers many efficiency upgrades for business users, those increases are undermined when you consider the inefficiency of proof of work mining. The QTUM development team met with stakeholders in finance, logistics, and manufacturing to explore the differences between proof of stake and proof of work in terms of practical applications. Efficiency and security were their top concerns with proof of work, and staking made more sense from an institutional perspective.

Blockchain on mobile: Run smart contracts using light clients

A major hurdle standing in the way of widespread adoption of smart contract-based DApps is their inability to be managed by a light client. A light client is a node on the blockchain network that does not keep a full history of the blockchain. Instead, every time you log on, it only traces back a few of the most recent/relevant blocks in the chain to verify transactions.

Traditionally, light clients haven’t been supported in conjunction with smart contract management. Creating, deploying, and altering a smart contract required you to run a full node of the network. In cases where you had slow connections, low storage, or used a mobile phone, smart contracts weren’t available.

QTUM changes that and opens the door for smart contract management from your mobile phone or on a new computer within a quick timeframe. This is possible because QTUM uses UTXO technology that enables simple payment verification (SPV). SPV enables light clients to verify transactions without needing to run a full node. You could execute a smart contract from your mobile in a few taps, bringing the disruptive technology of blockchain to mobile applications.

The QTUM founding team, investors, & completed crowdsale

The QTUM team is Asia-based, and much of their marketing efforts and outreach have appealed to Asian markets, specifically the Chinese market. More than one website has called QTUM, “the Chinese Ethereum.”

“All in all, I believe them to be the best team out of China and Asia. This has led them to see where improvements are needed in smart contract platforms, learn from mistakes of ethereum, focus on the region they know best.”

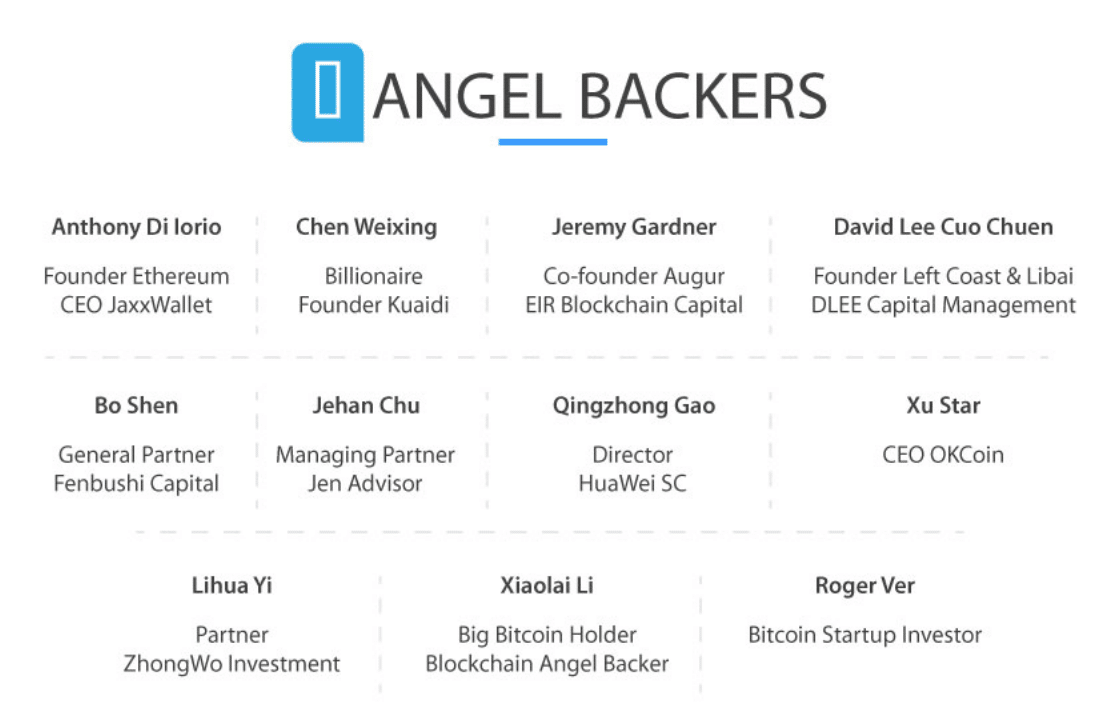

Aside from Di Iorio, QTUM raised $1 million in private early-stage funding for the project from 11 angel investors that helped build the testnet and initial implementation of the idea. Subsequently, in March 2017, QTUM completed a crowdsale that raised $15.6 million in just over 5 days.

QTUM has also retained advisors from PwC to help with regulatory compliance and accounting. They seem poised to make a serious entry into the business side of smart contracts, especially in Asia. QTUM is certainly worth watching closely over the coming months for major growth.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.