- What is Solana?

- How to Stake Solana (SOL): Become a Solana Validator

- Solana: History & Founder

- The SOL Token: Tokenomics and Where to Buy

- Solana's Biggest Investors

- Solana Vs. Ethereum: How Do They Differ?

- Final Thoughts: Solana and the Centralization Dilemma

- Frequently Asked Questions

Solana is a permissionless and smart contract-capable blockchain platform designed with the goal of optimal performance, high transaction throughput, and fast transaction speed; powered by its native taken SOL, Solana rivals layer-1s such as Ethereum (ETH) and Avalanche (AVAX).

In this Solana basics guide, you’ll learn how the protocol works by reviewing its main components and other important aspects, such as the largest DApps on the ecosystem, tokenomics, and how it compares to Ethereum.

What is Solana?

Solana is a layer-1 blockchain, meaning it is the base layer infrastructure, as opposed to layer-2s and sidechains, which are parallel chains connected to layer-1.

Solana uses two consensus algorithms: Proof-of-Stake and Proof-of-History.

Proof of History (PoH) is Solana’s backbone—it timestamps all transactions on the blockchain to prove they took place at a given time. It’s essentially a cryptographic clock that confirms those transactions in sequential order. PoH maintains the safety of the Solana network by proving the legitimacy of all transactions taking place in real time.

In Proof-of-Stake (PoS), network participants must stake a certain amount of SOL tokens to become validators and verify transactions. The PoS algorithm brings a network of validators to verify the timestamps and confirm the transactions.

How to Stake Solana (SOL): Become a Solana Validator

Users who want to run a validator node must meet the computational requirements (CPU with 12 cores, 2.8GHz, and RAM 128GM, for instance) and stake SOL. There isn’t a minimum amount of SOL to become a validator, but participating in consensus requires a “Vote Account,” which has a rent-exempt reserve of approximately 0.026 SOL.

Validators must vote on each block they receive; the voting cost is 1.1 SOL per day. This means a validator must stake enough SOL to make profits and not drain their wallets on voting fees. The other option is to attract enough users to stake on your validator node.

Users can stake SOL to earn rewards and help secure the network, which can be allocated to one or multiple validators.

Solana staking rewards depend on:

- The initial inflation rate, which is 8%. This figure is reduced by 15% yearly until it reaches a fixed rate of 1.5% annually.

- The total number of staked SOL.

- Validators’ uptime and commissions.

Solana: History & Founder

Anatoly Yakovenko, a former engineer at multinational Qualcomm, founded Solana in 2017, publishing the whitepaper the same year. His goal was to create an infrastructure that could overtake proof-of-work and proof-stake networks.

Greg Fitzgerald and Eric Williams joined Yakovenko in developing the Solana testnet and creating Solana Labs, headquartered in San Francisco, California. Yakovenko announced the creation of the Solana Foundation in 2020, a Swiss nonprofit that supports and promotes Solana’s growth.

The SOL Token: Tokenomics and Where to Buy

SOL is Solana’s utility token used to pay fees for running smart contracts on transactions on the network. The other use case is staking and voting on government proposals.

Think of it as Ethereum’s ETH.

SOL’s total supply is capped at 511,616,946 tokens. As of September 1st, 2022, there are 349,510,121 SOL tokens in circulation, roughly 66.2%. The distribution phase started in 2019 through an Initial Coin Offering, divided into five funding rounds, of which four were private sales.

The initial distribution is as follows:

- 38% to the Community Reserve Fund (managed by the Solana Foundation)

- 15.86% to Seed Round investors

- 12.5% to the Solana Foundation

- 12.5% to team members

- 5.07% to Validator Sale investors

- 1.84% to Strategic Sale investors

- 1.6% to Public Auction Sale investors.

SOL’s highest price was $258.93 on November 6th, 2021. SOL is a popular crypto, so chances are you’ll find it listed on most cryptocurrency exchanges, including Binance, Kraken, Coinbase, etc.

Solana’s Biggest Investors

Solana is backed by numerous crypto VC firms and digital assets institutions worldwide, including Alameda Research, CMS Holdings, BlockTower Capital, and Andreessen Horowitz (a16z).

Solana has raised a total of $335.8 million in 9 rounds from at least 37 investors. The last round took place on August 19th, 2021. Solana Ventures is the blockchain’s investment arm and has invested in at least 16 projects across GameFi, NFTs, and DeFi.

Solana Vs. Ethereum: How Do They Differ?

Each blockchain has its advantages and disadvantages. It all comes down to what fits best for you or your project. Ethereum transiotioned from PoW to PoS in September. Since both blockchains are technically running on the PoS algorithm, it all boils down to their different designs and how they implement security, so here’s a quick rundown on both:

Solana’s Scalability and Transaction Speed

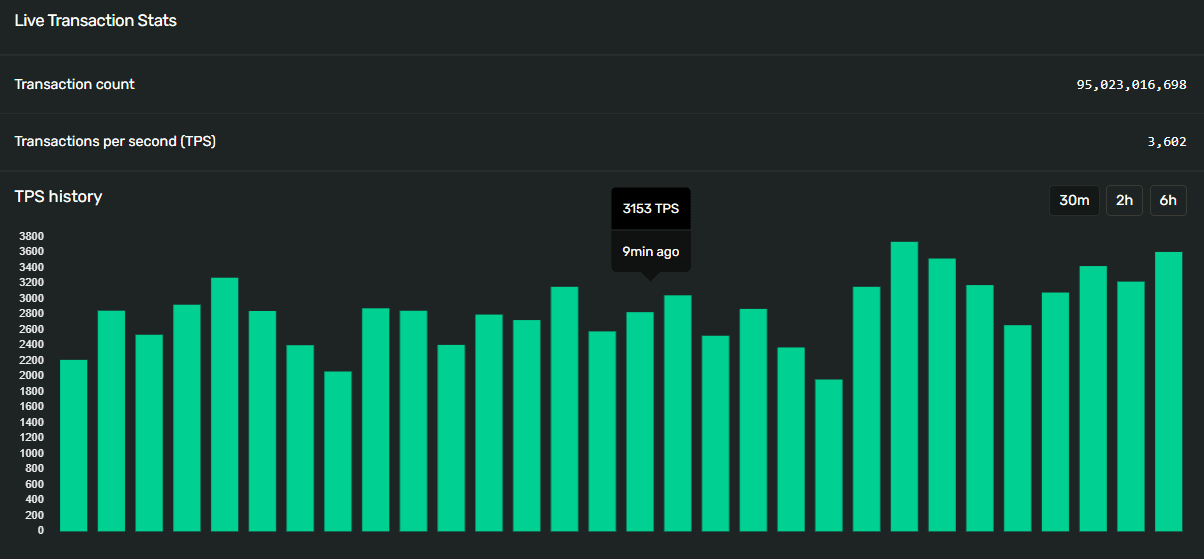

Metrics show Solana can process around 3,500 to 4,000 transactions/second, while Ethereum can deal with 10 to 15 TPS. Solana claims the network can reach hundreds of thousands of TPS, but this claim has never been proved.

Solana’s Number of DApps

While it experienced tremendous growth throughout time, Solana nowhere edges the amount of work that Ethereum deals with daily. The number of decentralized applications (DApps) on Solana is hard to track as more projects are being built daily, but DappRadar estimates more than 350 projects.

Some of the top DApps on Solana are:

- Magic Eden: the largest NFTs marketplace in the Solana ecosystem.

- Solend: Solana’s leading decentralized lending protocol where users can leverage long and short, borrow, and earn interest on their crypto funds.

- Saber: a decentralized exchange (DEX) offering cross-chain interoperability between Ethereum, Binance Smart Chain (BSC), Polygon, and more.

On the other hand, Ethereum hosts roughly 2,500 to 3000 DApps, including Polygon PoS Bridge, Uniswap V3, Curve, Compound, and Arbitrum. These projects make up Ethereum’s over $50 billion in Total Value Locked (TVL), while Solana has $1.40 billion, as per data from DeFi Llama, making it the fourth largest ecosystem.

Security Aspects

Whether one blockchain system is more secure than another is always debatable. Neither Solana nor Ethereum has the perfect infrastructure, so it’s better to balance the pros and cons of each platform.

On the one hand, Ethereum is older than Solana — launched in mid-2015— so it has undergone more audits and security research. Therefore its flaws and vulnerabilities are better known to the public. Proof of Work blockchains are considered less prone to attacks than PoS protocols but have lower throughput and are highly energy consuming.

Solana was launched in 2020, entering the industry with a far more complex architecture than Ethereum. The protocol champions speed and throughput. But it also has a slight advantage over classical PoS systems since it uses a combination of PoS and its mechanism, PoH, which orders transactions depending on the execution time rather than transaction fees, protecting the network from front-running attacks.

Final Thoughts: Solana and the Centralization Dilemma

Solana emerged in the early 2020s as the alternative option for users looking for a scalable and cost-efficient blockchain. It has established itself as one of the top networks for regular users and blockchain developers.

Solana is in the “Ethereum killers” club; layer-1 protocols offer similar features to Ethereum but have improved characteristics.

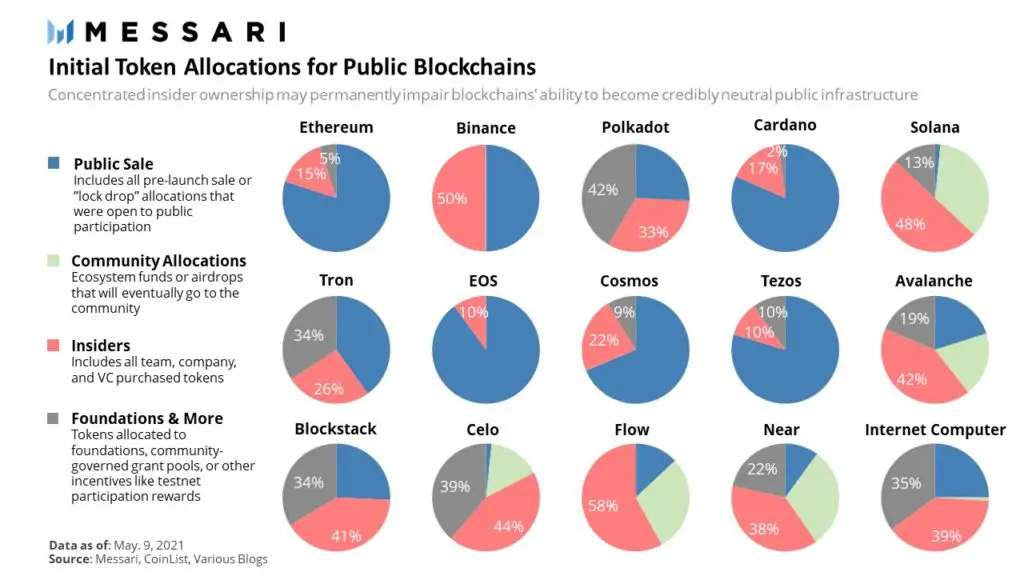

However —like any other protocol— certain aspects of it have drawn criticism. Critics mainly highlight Solana’s centralized ecosystem. Half of SOL tokens are owned by VC firms and insiders, and roughly 20 of over 1,100 validators on Solana control over 35% of the overall stake.

However, things are taking an interesting turn for Solana. The post-merge event has raised criticisms for Ethereum since more than 40% of network blocks were added by two entities: Coinbase and Lido.

top 7 entities controlling >2/3 of the stake is pretty disappointing to see tbh pic.twitter.com/VBipyFUM7g

— Martin Köppelmann 🦉💳 (@koeppelmann) September 15, 2022

Frequently Asked Questions

How many transactions can Solana support per second?: Solana offers 3,500 to 4,000 transactions per second and can theoretically scale to 65,000 TPS.

Has Solana been hacked before?: Solana’s core code hasn’t been attacked since the protocol launched, but like most ecosystems, several projects within Solana have been victims of exploits, hacks, and other attacks. In early August, hackers drained over $5 million out of Solana wallets, which was attributed to a private key exploit tied to mobile hot wallet Slope. In February, Wormhole, Solana’s largest cross-chain bridge, suffered a large-scale attack, losing $320 million.

How much are transaction fees on Solana?: Solana’s base transaction fee is $0,00025.

Does Solana Support NFTs?: Solana is home to numerous NFT projects and marketplaces, Magic Eden being the most popular for buying and selling NFTs.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.