- How Does Tether (USDT) Work?

- Who Uses Tether (USDT)?

- What Are the Concerns with Tether (USDT)?

- Final Thoughts... Legitimacy TBD

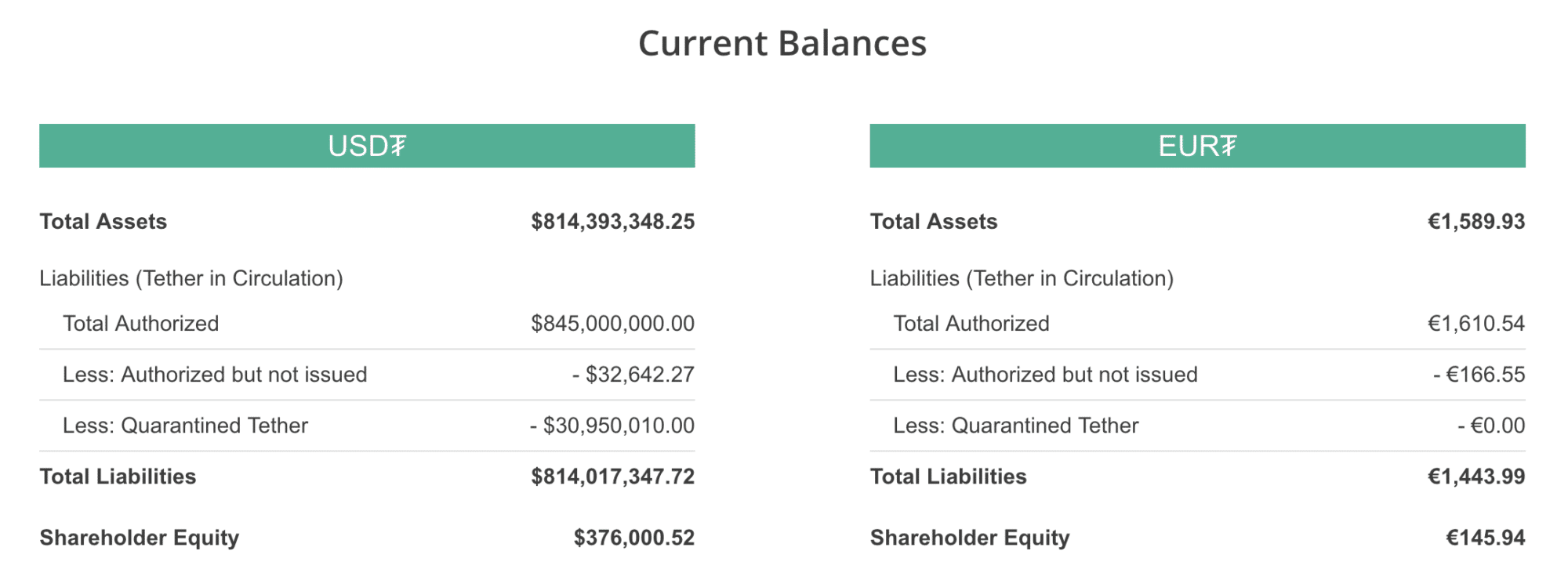

Tether is a cryptocurrency pegged to traditional fiat currencies and backed 1:1 by reserves of these traditional currencies held in accounts under Tether’s control. There are currently Tether tokens backed by US Dollars (denoted by the symbol USD₮) and by Euros (denoted by EUR₮). A Tether token pegged to the Japanese Yen (JPY₮) is on the way. These reserves are guaranteed by the promise of regular audits of the reserve accounts by the Tether Foundation.

The mission of Tether is to bring the ease of transfer, record keeping ability and other benefits of a blockchain-based digital currency to traditional fiat currencies. This allows merchants or traders to convert digital currencies into their fiat value, transfer these fiat-pegged tokens as easily as other digital currencies, and price services or products in traditional currencies while avoiding the overhead of converting digital currencies into fiat currencies.

How Does Tether (USDT) Work?

Tether Limited, the business entity in charge of Tether, is responsible for accepting fiat deposits and withdrawals and creating and destroying Tether in accordance. They also manage the Tether website that allows storage and transfer of Tethers, work on Tether integrations with exchanges and other third parties, and have custody of the fiat reserves backing the Tether tokens. The Tether Foundation has said that it’s dedicated to transparency and will regularly publish public audits by external auditors to their Transparency Page.

The Tether technology works by embedding metadata in the Bitcoin blockchain itself via the Omni protocol. The Omni protocol allows for the creation (or granting) and destruction (or revocation) of digital tokens represented by metadata on the Bitcoin blockchain. These tokens, including Tether, can be stored in the Omni wallet and their circulation can be viewed on the blockchain through the Omnichest viewer.

You can store, buy and sell Tether through the Tether mobile wallet site.

Who Uses Tether (USDT)?

The implication that Tether tokens can be treated as Dollars or Euros has led to the adoption of Tether as a major trading pair on most of the larger exchanges. Bitfinex, Bittrex, Poloniex, and Binance do not deal in fiat currencies at all but have dedicated USDT markets for most of the major coins. Traders use Tether to hedge their trades and to get in and out of the crypto markets they are trading in.

The circulation of Tether is approaching 1 billion tokens, and more and more are being created as more and more funds reportedly flow into the Tether reserve accounts. As the circulation of tether continues to increase, the use of these tokens as a replacement for USD and other fiat currencies as a store of value increases as well.

What Are the Concerns with Tether (USDT)?

As the use of Tether as a replacement for fiat currencies grows on major exchanges, the Tether price of Bitcoin and other currencies is now synonymous with the fiat price, meaning buying and selling with Tethers is influencing the price in “real” money. As long as a Tether is truly representative of a fiat note like the dollar, this isn’t an issue.

However, there are some concerns surfacing recently about the legitimacy of Tether’s reserves and as to whether the company intends to honor their promise of audits. There are a lot of rumors floating around about the relationship between Bitfinex (the largest cryptocurrency exchange by volume) and Tether, with allegations of money laundering, collusion, and fraudulent Tether “printing.”

Bitfinex and Tether have come out in the press and promised an accredited audit to squash these concerns, calling the claims slander and dismissing any allegation of wrongdoing on their part. Further articles on new developments related to these allegations are on their way and will be updated as we go along.

That being said, the Tether whitepaper addresses these concerns and others, like the possibility that Tether Limited goes bankrupt or that Tether Limited attempts to take off with the money. They note that nearly all exchanges and third parties who manage crypto assets face these same risks, and therefore they are not a special case.

They tout their accounting and transparency process to eliminate the risk of bad behavior on the part of Tether employees or leadership, and they note that in the event of Tether Limited filing bankruptcy the reserves of fiat backing the tokens themselves will remain safe and redeemable.

Final Thoughts… Legitimacy TBD

In 2019, the Office of the Attorney General for the Southern District of New York announced an investigation into Tether Ltd, which as brought ghosts of the past into the mainstream conversation again. Whether Tether seemingly intentionally opacity in disclosing its USD collateral is mischief, strategy, or sheer mismanagement, the cryptocurrency and broader regulatory ecosystem are looking at this current investigation to shine some light. One argument posted on Medium positions Tether as being one of the greatest exit scams in motion, and is worth the read for those willing to explore further.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.