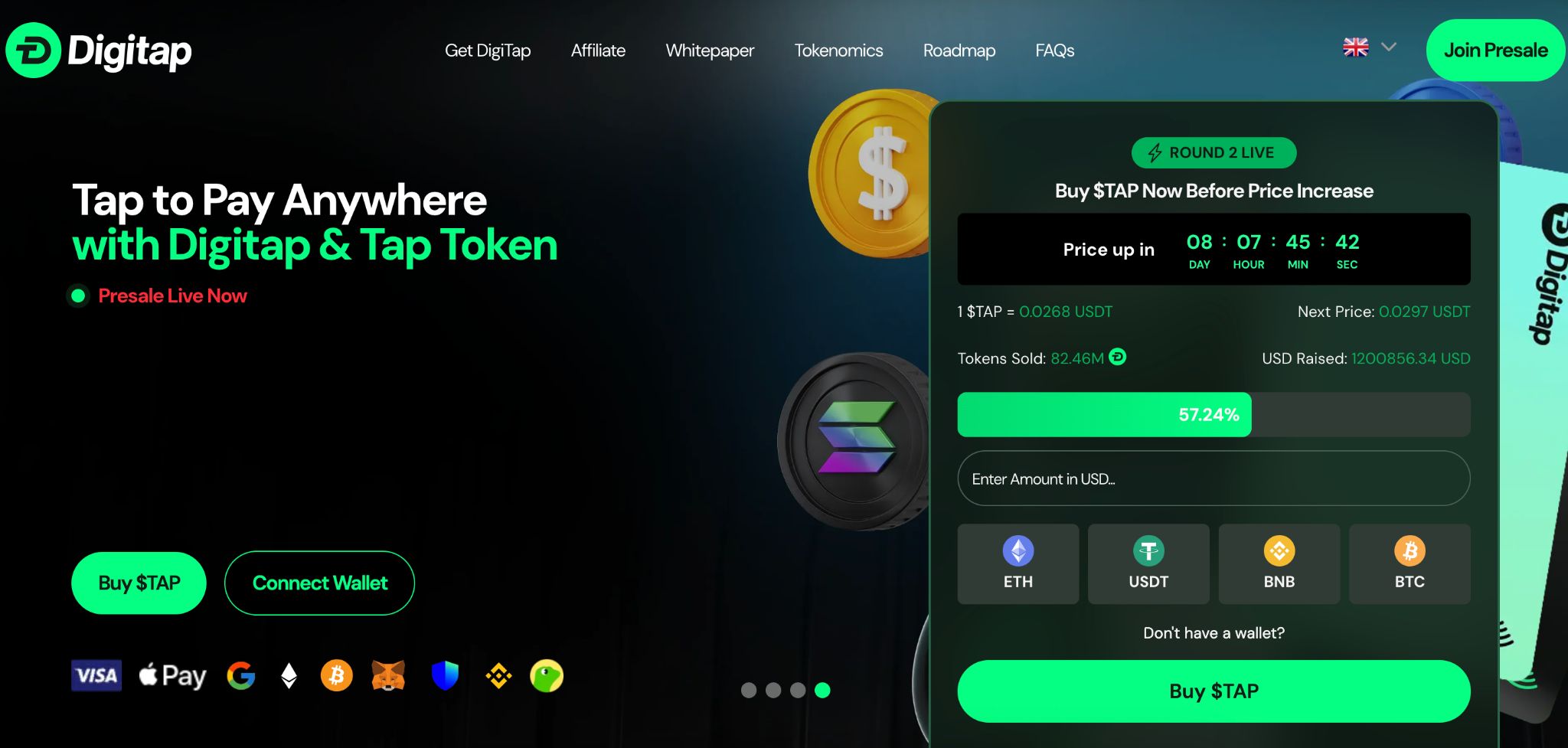

The crypto market is breathing again after last week’s correction, but the real story isn’t in small gains. Binance Coin (BNB), Solana (SOL), and Ripple (XRP) have all managed modest recoveries, yet none have matched the momentum behind Digitap ($TAP). The banking token has become one of the most-discussed presales of Q4, having quickly raised over $1.2M.

What makes this moment so striking is how Digitap has pulled ahead while the broader market still feels cautious. Digitap’s app is live in both the Apple App Store and Google Play Store, giving users an immediate way to bridge crypto and fiat.

This combination of real-world use and strong token metrics has led analysts to label $TAP as one of the best cryptos to invest in right now.

The Market’s Modest Bounce Hides Deeper Shifts

The market’s latest uptick has sparked optimism, but the gains in major altcoins have been restrained. Solana trades around $200, up 8% weekly, but down 6% monthly. BNB hovers above $1,100, up less than 3% weekly. XRP remains near $2.65 following its earlier decline, up 8% weekly but down 9% monthly.

The sideways trading suggests that these established brands have limited upside. All three of these coins trade relatively close to their all-time highs, having seen explosive price multipliers in previous cycles. The time to buy these majors was during the regulatory challenges, or for SOL when it was contending with the FTX scandal. All this early upside is already gone.

The sideways trading suggests that these established brands have limited upside. All three of these coins trade relatively close to their all-time highs, having seen explosive price multipliers in previous cycles. The time to buy these majors was during the regulatory challenges, or for SOL when it was contending with the FTX scandal. All this early upside is already gone.

While these coins are stabilizing, institutional sentiment has become more selective. Investors are increasingly preferring projects with immediate use cases and identifiable cash flow. This trend has driven attention away from speculative L1 tokens and toward fintech applications.

As market volatility continues, these differences matter. The coins leading the previous bull run may not dominate the next one. For investors looking at fundamentals, the best cryptocurrency to buy right now could be one with direct payment utility rather than speculative trading value.

Legacy Altcoins Face Pressure to Deliver Real Utility

BNB, SOL, and XRP have all reached maturity as major network players. But their market movements increasingly depend on macro conditions rather than innovation. As central banks weigh interest rate cuts and liquidity returns to risk assets, these tokens may rebound, but they no longer offer explosive potential. Most, like BNB, also trade very close to all-time highs.

BNB continues to rely on growth in the Binance ecosystem, but tighter regulation has curbed its expansion pace. Solana remains a strong network for developers, though outages and congestion concerns persist. XRP, despite favorable legal developments, struggles to expand its institutional use cases beyond remittances.

Against this backdrop, Digitap’s model appears timely. It targets an underserved market — the 1.4 billion unbanked adults worldwide. With its no-KYC onboarding in eligible regions and multi-currency support, it offers a direct pathway to accessible finance. This focus has fueled investor confidence, even in a conservative market environment.

The contrast between established altcoins and rising fintech tokens is becoming clear. Coins like BNB and Solana represent infrastructure; projects like Digitap represent usability. As markets evolve, utility-based adoption tends to outperform hype cycles. That’s precisely what’s happening here.

Digitap Surges Past $1M Milestone: Confidence Follows

Digitap is the world’s first omni bank with Visa compatibility, global IBANs, a live exchange, a functional app, international payments, and 24/7 support.

Very few early-stage projects achieve this kind of traction before listing, especially in a market still recovering from a correction — the project’s ability to raise that $1.2M without heavy marketing pushes signals strong organic demand.

The numbers tell the story: nearly 80M tokens sold and a current $TAP price of $0.0268. Soon this will increase automatically to $0.0297 — an 11% jump between stages. The current price is also 80% discounted from its launch price of $0.14. These gains reflect growing trust among both retail investors and early-stage backers.

The numbers tell the story: nearly 80M tokens sold and a current $TAP price of $0.0268. Soon this will increase automatically to $0.0297 — an 11% jump between stages. The current price is also 80% discounted from its launch price of $0.14. These gains reflect growing trust among both retail investors and early-stage backers.

Digitap’s appeal lies in being both live and scalable. It is not a roadmap project waiting for a future release. The app already lets users hold and spend funds across fiat and crypto through a simple interface. The hybrid model, combining compliance readiness with open participation, also serves as a bridge between traditional banking and decentralized finance.

Digitap’s appeal lies in being both live and scalable. It is not a roadmap project waiting for a future release. The app already lets users hold and spend funds across fiat and crypto through a simple interface. The hybrid model, combining compliance readiness with open participation, also serves as a bridge between traditional banking and decentralized finance.

Another defining factor is sustainability. 50% of platform profits are automatically directed toward token burns and staking rewards, creating a model that benefits long-term holders. This structure is one reason analysts are comparing Digitap’s early growth to projects like Solana in 2021. Except this time, it’s tied to tangible product adoption rather than speculative hype.

The Road Ahead for Digitap and Market Implications

Digitap’s growth story is still unfolding, but the early signs are promising. The combination of working infrastructure, growing user activity, and transparent tokenomics has made it one of the most closely watched presales in the industry.

In many ways, this moment feels like the early phase of past success stories. Just as BNB, XRP, and SOL once dominated speculative attention, $TAP is now commanding focus for its fundamentals. The difference is that it already operates in the real world as a live omni-bank with customers, transactions, and product validation.

For those looking for an accessible, working solution bridging fiat and crypto, Digitap may represent not just another token opportunity but the start of a larger shift in how digital banking and DeFi converge.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale: https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app