TLDR

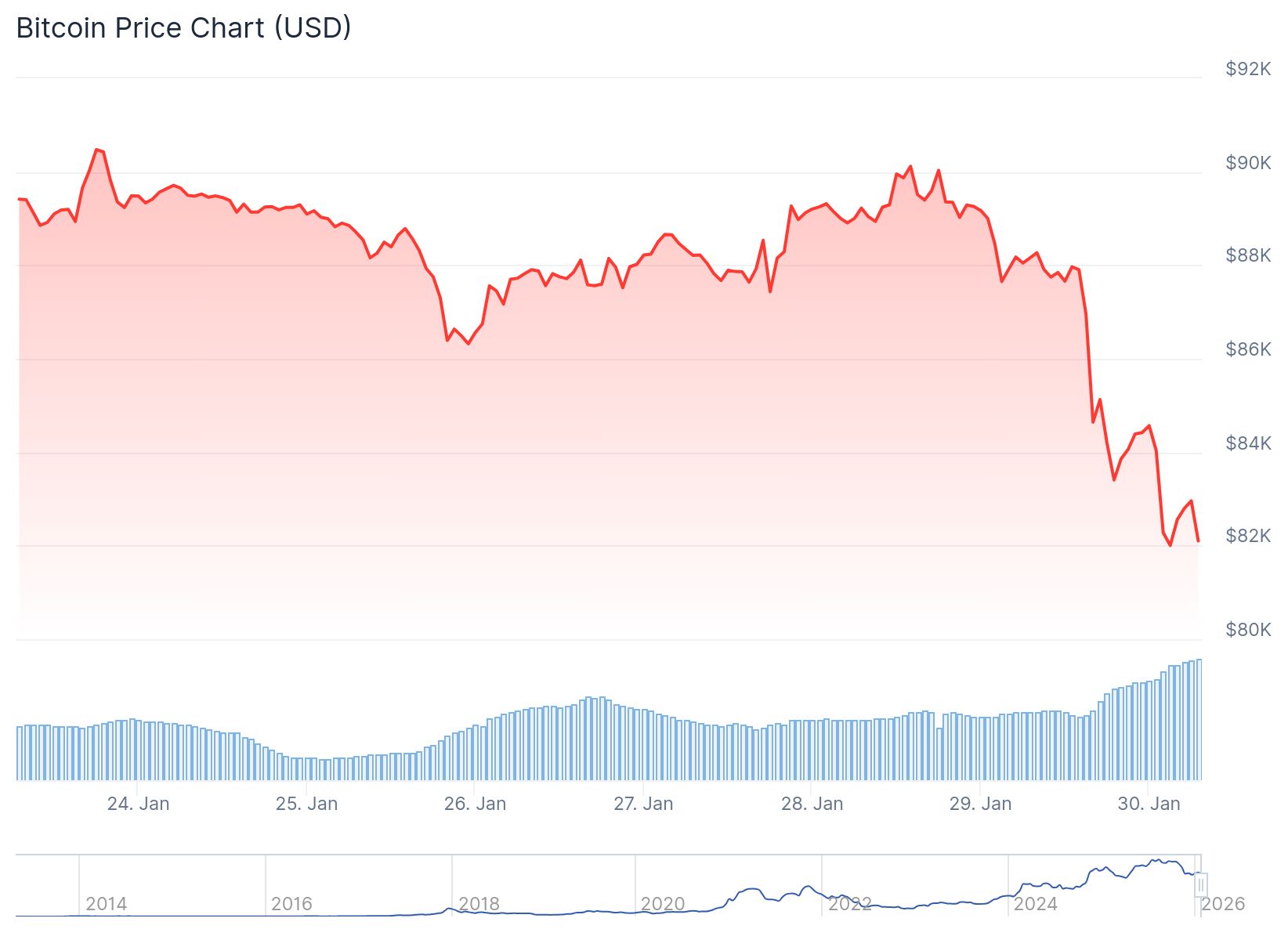

- Over $1.68 billion in crypto positions were liquidated in 24 hours, with 267,000 traders forced out as bitcoin dropped to $81,000

- Long positions made up 93% of liquidations, with bitcoin seeing $780 million and ethereum $414 million wiped out

- Hyperliquid led exchanges with $598 million in liquidations, followed by Bybit at $339 million and Binance at $181 million

- Reports suggest Trump administration plans to nominate Kevin Warsh as Federal Reserve chair, with his anti-quantitative easing stance potentially reducing market liquidity

- Total crypto market capitalization fell 6% in 24 hours, losing roughly $197 billion as part of a broader global market sell-off

The cryptocurrency market experienced a sharp downturn over the past 24 hours, resulting in $1.68 billion in liquidated positions across major exchanges. According to CoinGlass data, roughly 267,370 traders were forced out of their positions during the sell-off.

Long positions bore the brunt of the damage, accounting for $1.56 billion or nearly 93% of total liquidations. Short positions made up just $118 million, showing how heavily traders had bet on price increases before the decline.

Bitcoin led the losses with approximately $780 million in liquidations. Ethereum followed with more than $414 million wiped out during the same period.

The largest single liquidation was an $80.57 million BTC-USDT position on HTX exchange. This highlighted that even platforms with deep liquidity cannot protect oversized leverage when market momentum shifts rapidly.

Bitcoin fell to around $82,982 at time of reporting. The cryptocurrency broke down from a broadening ascending wedge pattern, which technical analysts say projected a 12.6% decline.

Exchange Liquidations and Market Impact

Hyperliquid topped the liquidation charts with $598 million, with over 94% consisting of long positions. Bybit recorded $339 million in liquidations, while Binance logged $181 million.

Long exposure dominated across all three major platforms. This concentration showed how aggressively traders had positioned for upside moves.

Liquidations happen when leveraged traders cannot meet margin requirements. Exchanges then forcibly close positions to prevent further losses.

In fast-moving markets, this creates a feedback loop. Forced selling pushes prices lower, which triggers more liquidations in a cascading effect.

The total crypto market capitalization dropped 6% over the past 24 hours. This wiped out roughly $197 billion, bringing the total market cap to near $2.79 trillion.

The decline was part of a broader market shock. More than $3 trillion was erased from gold, silver, equities, and cryptocurrencies within an hour.

Federal Reserve Chair Speculation

The Trump administration reportedly plans to nominate Kevin Warsh as the next Federal Reserve chair, according to Bloomberg. Warsh has opposed quantitative easing policies in the past.

Kevin Warsh is rumored to be the incoming Fed Chair, with Trump's announcement expected tomorrow. The spike in Polymarket odds suggests a leak.

Warsh has advocated for a structural overhaul of the Federal Reserve and a "new Treasury-Fed Accord."

He posits that an AI-driven… pic.twitter.com/E4wzy3uy5b

— Alex Krüger (@krugermacro) January 30, 2026

His potential appointment could reduce market liquidity. This stance may put pressure on risk assets, including cryptocurrencies.

Analysts suggest the sell-off was driven less by new bearish sentiment than by overcrowded leverage unwinding. Heavy long liquidations often mark the clearing of speculative excess.

This process resets funding rates and open interest. While it does not guarantee a market bottom, it removes weak positions.

Bitcoin’s next major support level sits near $80,787. The cryptocurrency previously lost the $84,592 support level, confirming the broader drawdown.

A recovery would require reclaiming $84,592 as firm support. This would signal stabilization and renewed buyer confidence among investors.