TLDR

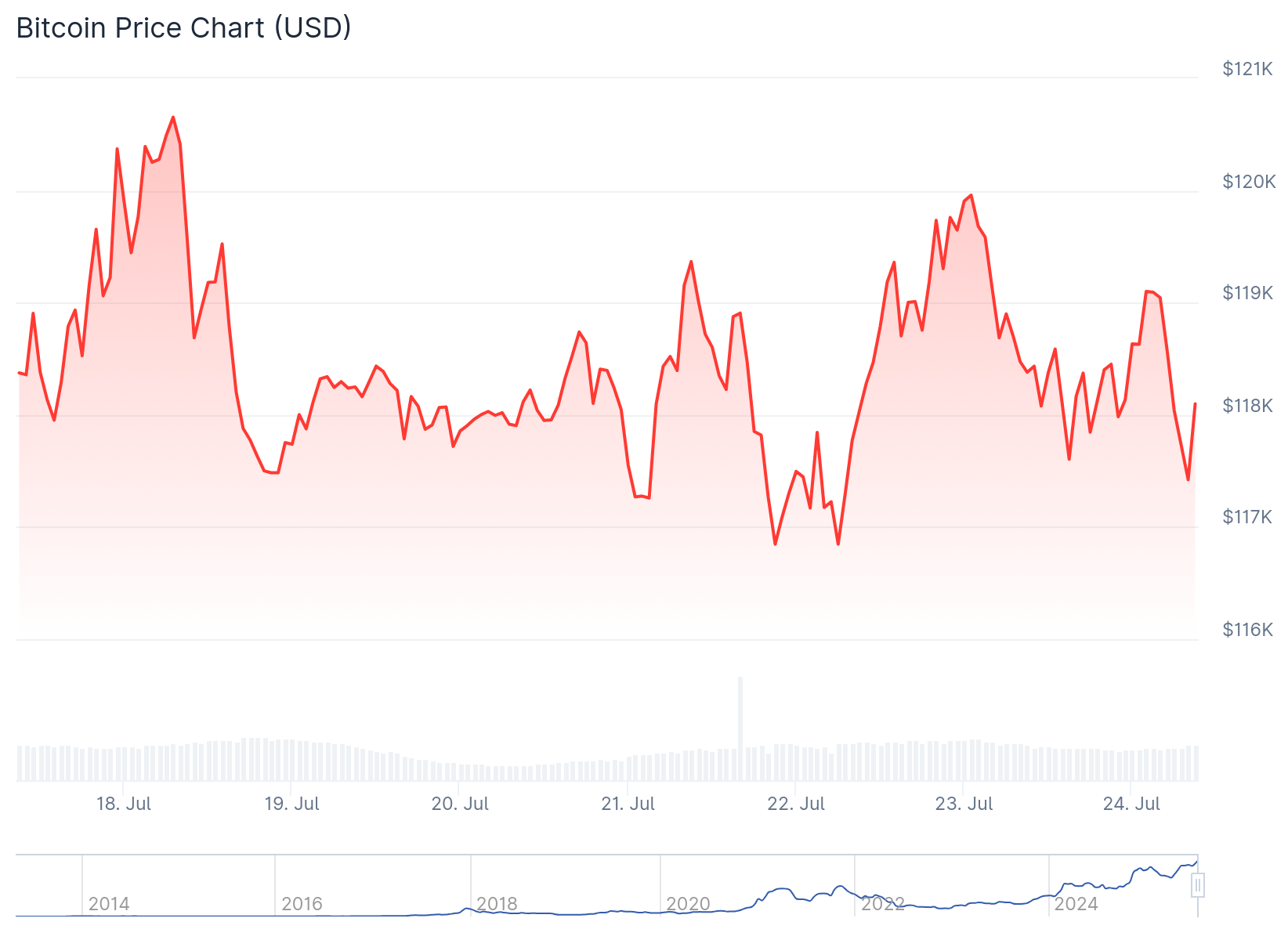

- Bitcoin consolidates near $118,000 after hitting record highs around $123,200 earlier this month

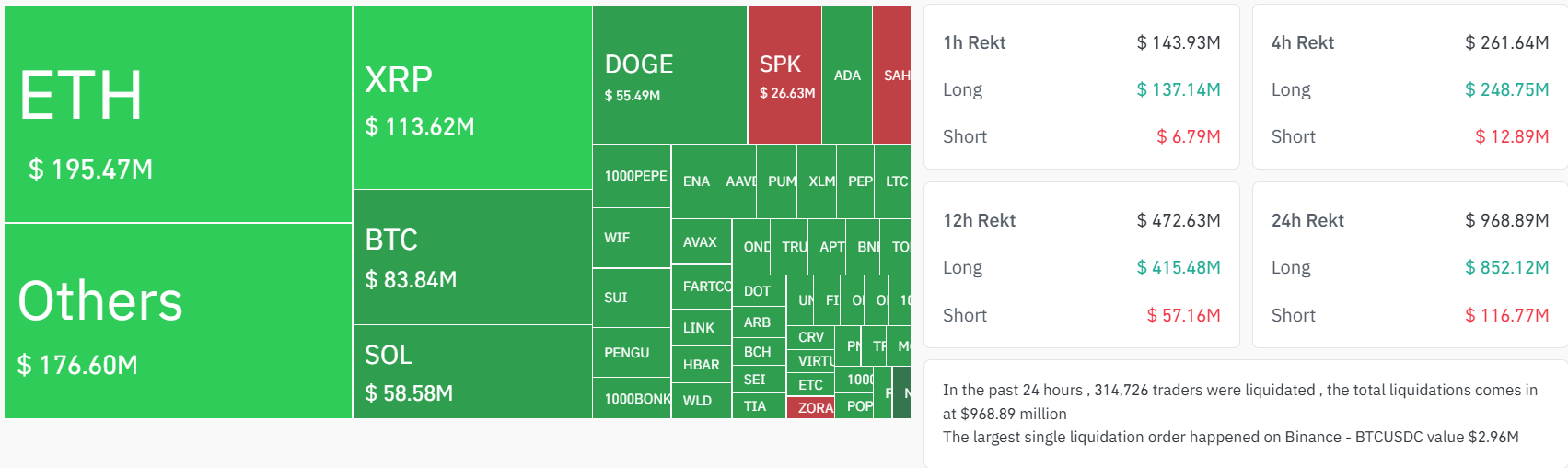

- Over $968 million in liquidations hit the market, mostly from leveraged long positions on altcoins

- Ethereum ETF inflows reached record $2.2 billion last week while Bitcoin funds stagnated

- Major altcoins including XRP, Solana, and DOGE dropped 5-8% in 24 hours

- Total crypto market cap declined 1.4% to $3.88 trillion as derivatives market saw 11% drop

The cryptocurrency market experienced a pullback today as traders took profits following recent strong rallies across major digital assets. Bitcoin currently trades at $118,120, showing minimal movement in the past 24 hours after consolidating from record highs.

The market downturn comes after Bitcoin reached peaks around $123,200 earlier in July before entering its current consolidation phase. This type of pullback is common after strong upward movements in cryptocurrency markets.

Altcoins faced steeper declines with XRP dropping 8.53% in 24 hours and Solana falling more than 5% to $190.03. DOGE, ADA, and XLM also declined by more than 7% during the same period.

Liquidations Drive Market Weakness

Large-scale liquidations contributed to the market weakness with $968 million in positions closed, primarily affecting leveraged altcoin trades. The liquidations were mostly long positions, indicating traders had been overly optimistic before the correction.

Over $700 billion worth of open interest in futures and options was liquidated in one day. This represented an 11% decline in the derivatives market and amplified the downward price movement.

Institutional Money Shifts Focus

Ethereum ETFs saw record inflows of $2.2 billion last week while Bitcoin funds experienced stagnation. This rotation of institutional money may be reshaping risk distribution across the cryptocurrency market.

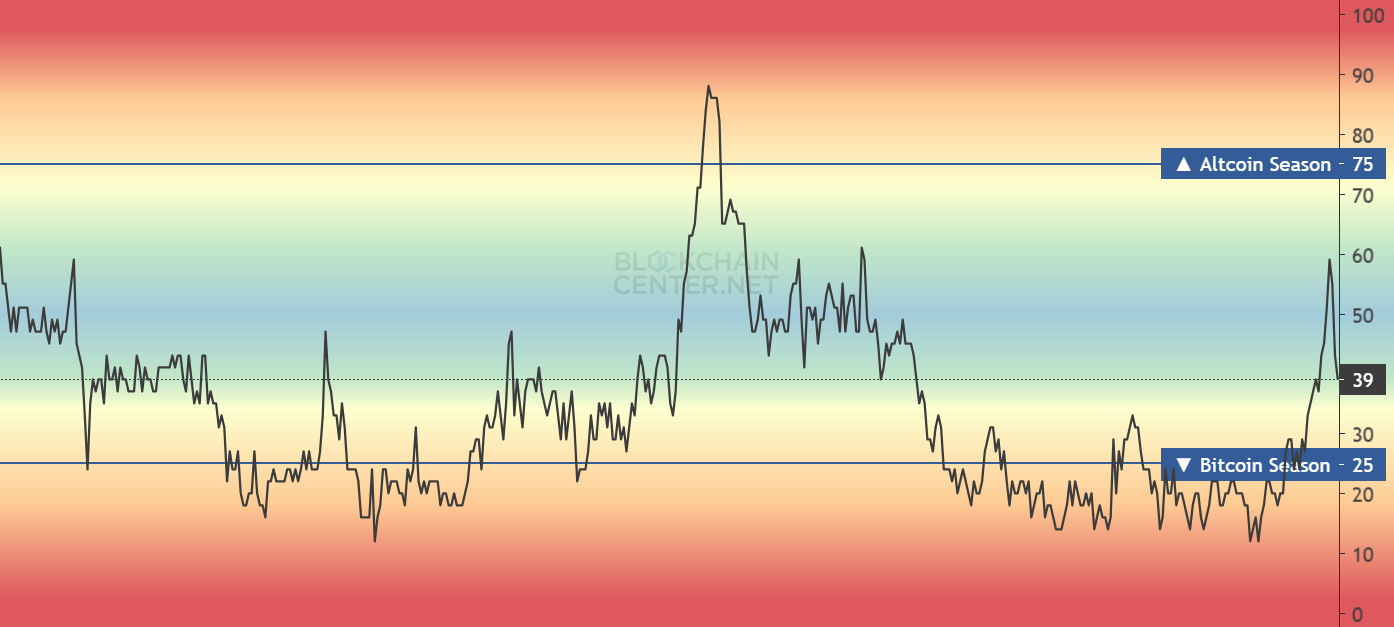

Bitcoin’s market dominance dropped 5.4% over the past 30 days, though it stabilized around 60.88% in recent weeks. The decline means less capital is flowing into alternative cryptocurrencies.

The total cryptocurrency market capitalization now stands at $3.88 trillion, down 1.4% in the last 24 hours. Trading volume also decreased by 13% across the board.

The Altcoin Season Index currently sits at 39 out of 100, indicating the market has not entered a true altcoin season. For that to occur, the index would need to climb above 75.

External factors including Federal Reserve meetings and U.S. Treasury policy developments are contributing to trader caution. Macroeconomic concerns and trade uncertainties are prompting investors to reduce risk exposure.

The Fear and Greed Index remains elevated, showing highly speculative sentiment persists in the market. This combination of high speculation and leverage use has amplified both recent rallies and current declines.

Market analysts suggest this appears to be a healthy pullback rather than the start of a larger correction. These types of consolidation periods often provide entry points for long-term investors after sustained bullish periods.

Final Thoughts

In conclusion, to answer the question “Why is crypto down today? – the market pullback is a natural response to profit-taking after recent strong rallies, with liquidations and shifting institutional interest further contributing to the decline. Despite external factors and speculative sentiment, this dip may present opportunities for long-term investors.