TLDR

-

The crypto market lost $66 billion in value, dropping to $3.83 trillion.

-

Bitcoin is rangebound around $118,335, with support at $117,261 and resistance at $120,000.

-

Altcoins like Cardano, XRP, and Dogecoin saw larger declines, some over 6%.

-

Regulatory delays by the U.S. SEC on altcoin ETFs triggered further sell-offs.

-

Traders are rotating capital from altcoins to Bitcoin amid uncertainty.

The crypto market fell sharply on July 29, 2025, losing $66 billion in total market value over the past 24 hours. The total crypto market cap now stands at $3.83 trillion.

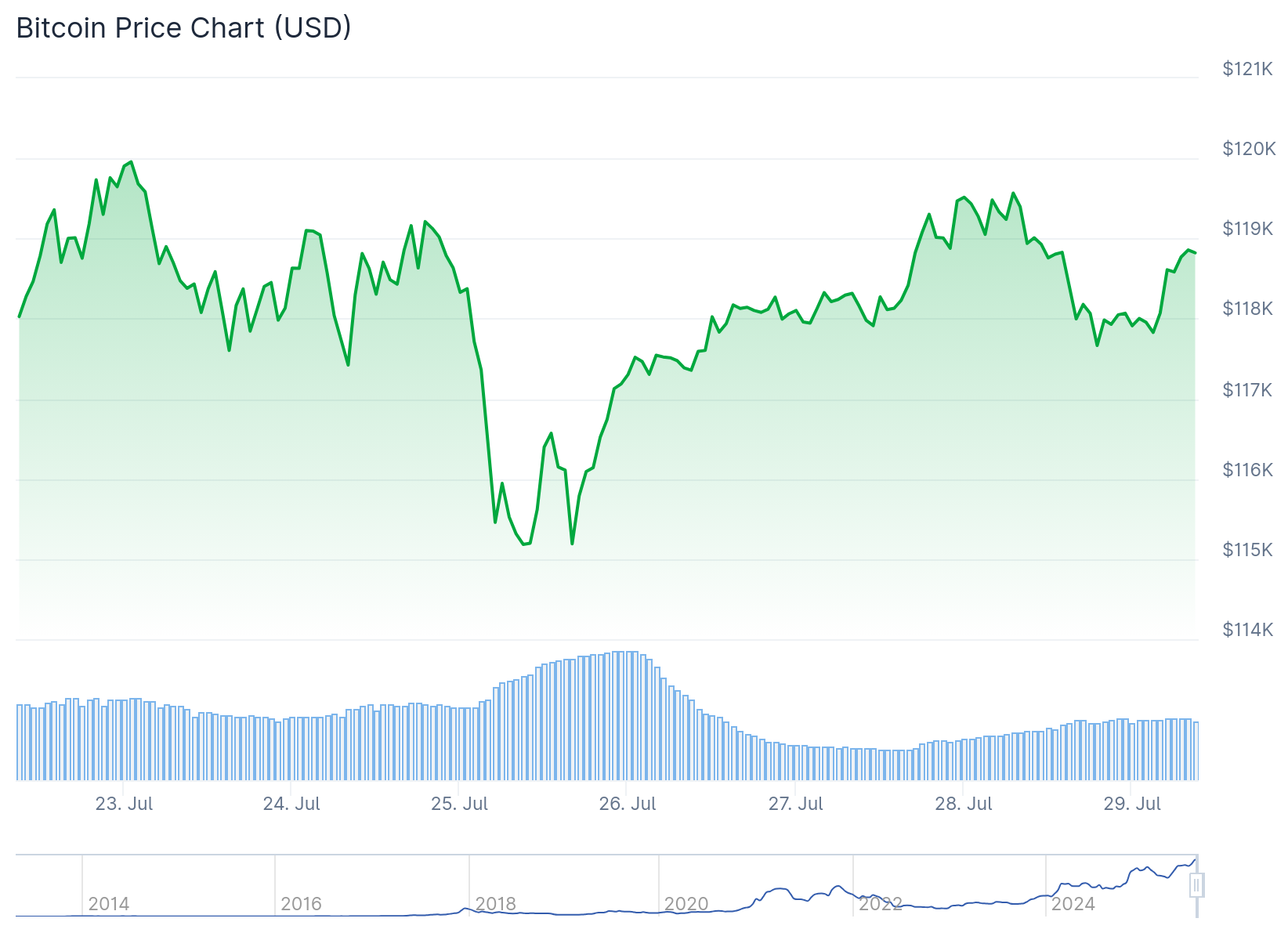

Bitcoin is trading at $118,335. It has stayed in a tight range between $117,261 and $120,000 for over two weeks.

If Bitcoin breaks above $120,000, it could rise to $122,000. A drop below $117,261 might lead to further downside.

Ethereum is trading above $3,700. It fell 2.5% in the last 24 hours but remains supported by ongoing spot ETF inflows.

XRP declined 4% and is currently trading just above $3. Cardano and Dogecoin posted even sharper losses.

Cardano is down over 6%, and Dogecoin has dropped more than 7% in the same period.

Regulatory Delays Hit Altcoin Sentiment

A key reason for the market dip is the U.S. SEC’s decision to delay approval of new altcoin ETFs. While Bitcoin and Ethereum ETFs were approved, altcoins like Solana and others remain in limbo.

The Truth Social Bitcoin ETF decision has been delayed until September 18. The Grayscale Solana Trust conversion will now be decided by October 10.

These delays have caused traders to reduce exposure to smaller tokens. Many investors are rotating funds from altcoins into Bitcoin.

This shift reflects caution among traders who are reacting to regulatory uncertainty in the United States.

Market Support and Outlook

The total crypto market cap is currently holding support above $3.81 trillion. A drop below this level could bring it down to $3.73 trillion.

Yesterday, the market had reached $3.89 trillion before retracing. This indicates mixed sentiment.

Bitcoin’s RSI is still above the neutral level, showing that bullish momentum is present despite low volatility. Investors are closely watching for a break in Bitcoin’s range, which could direct the next market trend.

The crypto market remains under pressure as traders react to regulation and recent gains. Volatility is expected to continue in the short term.