TLDR

- Crypto market cap jumps $109 billion to $4.01 trillion after US inflation data comes in lower than expected at 2.7% year-over-year

- Bitcoin struggles at $120,000 resistance level despite market rally, while altcoins like Ether lead gains

- Ether tops $4,600 for the first time since November 2021, up over 50% in a month

- Treasury Secretary Scott Bessent suggests Fed should consider 50 basis point rate cut in September, boosting markets

- Cardano, Solana, XRP, and Litecoin all post strong daily gains of around 8%, outperforming Bitcoin

The cryptocurrency market experienced a massive rally as the total market capitalization jumped $109 billion to reach $4.01 trillion. The surge came after US inflation data showed consumer prices rising 2.7% year-over-year, below the expected 2.8%.

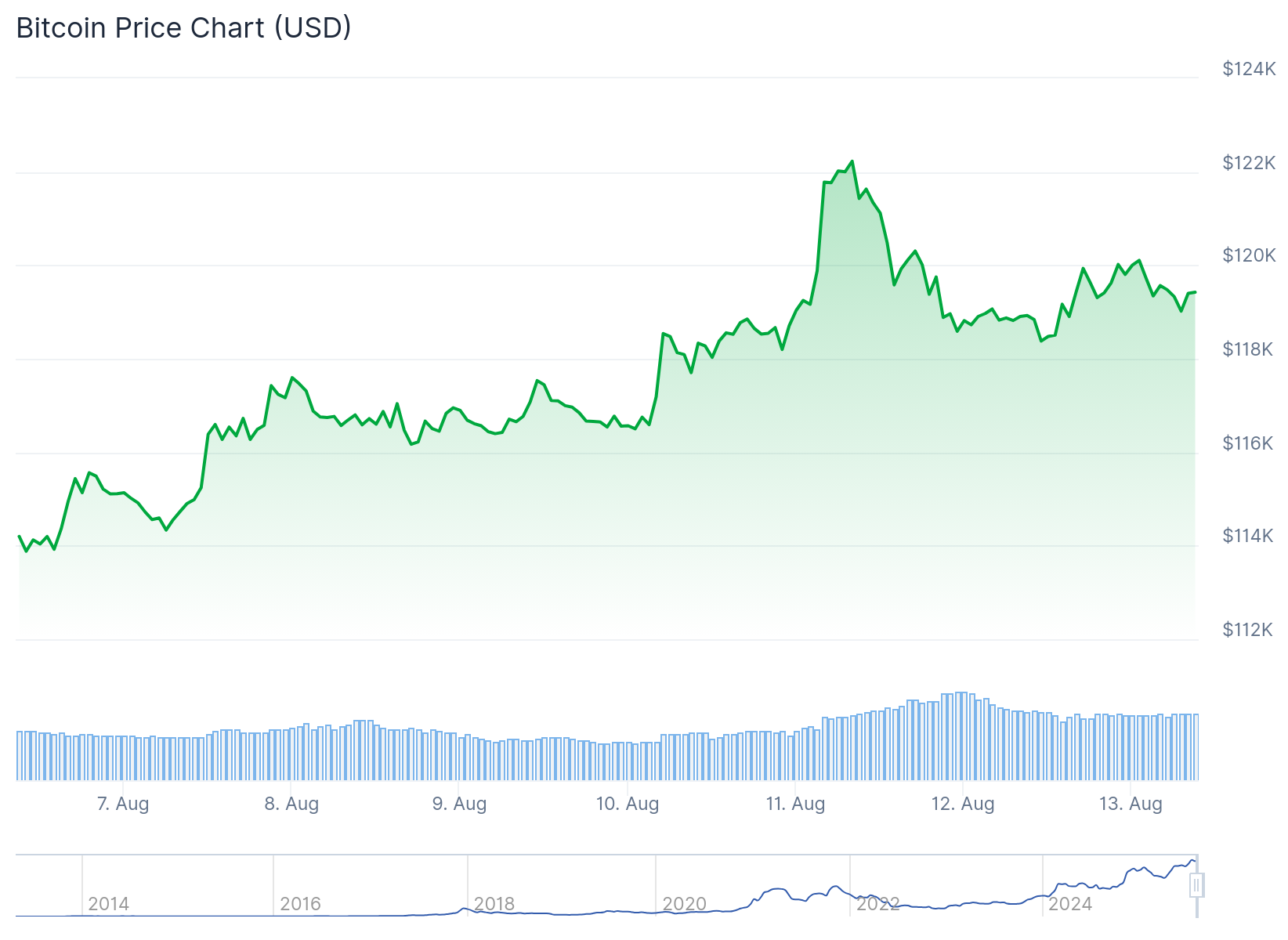

Bitcoin crossed back above $120,000 but remains stuck at this resistance level. The world’s largest cryptocurrency has struggled to break through this key barrier despite positive market momentum.

Altcoins led the charge with Ether topping $4,600 for the first time since November 2021. The second-largest cryptocurrency is now up more than 50% over the past month with continuing bullish technical signals.

Cardano gained about 8% over 24 hours while Solana and Litecoin posted similar gains. XRP climbed 3.5% as most major altcoins outperformed Bitcoin during the rally.

Rate Cut Speculation Fuels Rally

The market surge accelerated after Treasury Secretary Scott Bessent suggested the Federal Reserve should consider a 50 basis point rate cut at its September meeting. Bessent told Fox News that the Fed could have cut rates in June with accurate data.

🚨 BREAKING: US Treasury's Bessent urges the Fed to slash rates by 50 bps this September 🇺🇸 pic.twitter.com/ciC489wXhq

— Trader Edge (@Pro_Trader_Edge) August 13, 2025

Markets had already priced in a 25 basis point move for September. The possibility of a larger 50 basis point cut appeared to drive additional buying across crypto markets.

Bessent has been tasked by President Trump with selecting a replacement for Fed Chair Powell. His comments carry weight despite not being a Federal Reserve member himself.

The dollar weakened against all major currencies as equity markets also gained more than 1%. Bitcoin bulls stayed on the sidelines during the broader market rally.

Bitcoin Faces Key Resistance

Bitcoin’s next target sits at $122,000, a level within reach given its correlation with US equities. Following the positive inflation report, Bitcoin’s performance mirrors stock market movements.

If equities maintain strength, Bitcoin could break resistance toward the $122,000 target. The cryptocurrency’s positive correlation with traditional markets continues to influence its price action.

Investor selling remains a concern for Bitcoin’s price trajectory. Profit-taking could trigger a pullback below the $117,261 support level, which would invalidate the bullish outlook.

The total crypto market cap faces resistance at the current $4.01 trillion level. Breaking through could push the market toward $4.05 trillion in the near term.

A fall below $3.89 trillion support would erase recent gains. Such a decline would push the market cap back to $3.81 trillion and undermine the current upward trend.

Central Asia saw its first spot Bitcoin ETF launch as Fonte Capital introduced BETF on the Astana International Exchange. The fund offers regulated cryptocurrency exposure through BitGo custody services.

Pantera Capital revealed it invested $300 million in digital asset treasury companies including BitMine Immersion and Twenty One Capital. These companies hold major cryptocurrencies across operations in the US, UK, and Israel.

Final Thoughts

Why is crypto up today? Cooler-than-expected US inflation and fresh speculation of a bigger Fed rate cut have sparked a surge, with traders jumping back into the market.