TLDR

- The total crypto market cap dropped $74 billion to $3.59 trillion as investors took profits and trading activity decreased.

- Bitcoin is trading at $108,179, holding above the $108,000 support level but facing mounting selling pressure.

- Federal Reserve Chair Jerome Powell suggested another rate cut in December isn’t guaranteed, which strengthened the U.S. dollar and cooled risk appetite.

- Bitcoin ETFs saw $1.15 billion in outflows last week, with major funds from BlackRock, ARK Invest, and Fidelity losing capital.

- Over $400 million in liquidations occurred across the crypto market in 24 hours as leveraged traders faced margin calls.

The crypto market experienced a sharp decline today, with the total market capitalization falling $74 billion to reach $3.59 trillion. The downturn affected most digital assets as investors pulled back from risk and reduced their trading activity.

Bitcoin is currently trading at $108,179, maintaining its position above the critical $108,000 support level. However, selling pressure continues to build across the broader market.

The market decline comes after a positive weekend for digital assets. Most altcoins followed the downward trend, with some tokens seeing double-digit percentage losses.

The total crypto market cap is now approaching a test of the $3.56 trillion support level. This marks a key threshold that could determine the market’s near-term direction.

If the market fails to hold above $3.56 trillion, further decline to $3.50 trillion could follow. Such a move would deepen losses for investors and reinforce bearish sentiment across the sector.

Federal Reserve Policy Weighs on Markets

The Federal Reserve emerged as a primary driver behind today’s market movement. After implementing a 25-basis-point rate cut in October, Fed Chair Jerome Powell indicated that another rate cut in December is not certain.

POWELL STRIKES A CAUTIOUS TONE ⚠️

• Today’s cut was about risk management

• December cut “far from” a done deal

• Strongly differing views within the FedThe message, don’t get too comfy, the next move isn’t guaranteed ❌ pic.twitter.com/KF36DLN8GP

— Wise Advice (@wiseadvicesumit) October 29, 2025

This hawkish shift strengthened the U.S. dollar and quickly reduced risk appetite across global markets. Treasury Secretary Scott Bessent added to the cautious tone by warning that past rate tightening has already slowed economic growth.

Market expectations for an immediate rate cut declined to less than 70%, according to the FedWatch Tool. The uncertainty around monetary policy has led investors to move away from riskier assets like cryptocurrencies.

Bitcoin could slip below $108,000 and test the $105,000 support zone if bearish conditions persist. This would erase a portion of recent gains and further dampen market sentiment.

On the other hand, a rebound from $108,000 could push Bitcoin to retest $110,000. A successful recovery above this level would strengthen the bullish case and potentially lead to a move toward $112,500.

Bitcoin ETF Outflows Signal Institutional Retreat

Institutional investors have been pulling capital from Bitcoin ETFs in recent days. Last week alone, spot Bitcoin ETFs tracked by Fairside saw $1.15 billion in outflows.

#BITCOIN WEEKLY ETFS HAVE RECORDED $607.35M OUTFLOWS LAST WEEK! 🔴 pic.twitter.com/4OLsDQizY9

— The Moon Show (@TheMoonShow) November 2, 2025

The withdrawals came predominantly from major funds operated by BlackRock, ARK Invest, and Fidelity. These persistent outflows indicate profit-taking and rising risk aversion among large investors.

The market experienced over $400 million in liquidations within 24 hours. Leveraged traders faced swift margin calls as volatility increased and prices moved against their positions.

Bitcoin dropped below $109,500 from a technical perspective, triggering a cascade of automatic sell orders. The breakdown set off further volatility as traders rushed to exit positions.

Long-term holders, often referred to as whales, transferred over $1.8 billion worth of Bitcoin to exchanges. These movements raised fears of larger sell-offs as these holders moved coins to platforms where they could be sold.

More than $100 million was liquidated in a single hour during the peak of the downturn. The rapid liquidations amplified the selling pressure and contributed to the market’s decline.

Stablecoins on Ethereum have reached roughly $165 billion in reserves, placing the network among the world’s largest reserve holders. Despite this milestone, ETH’s price has dipped below $4,000 as investors await signs of renewed momentum.

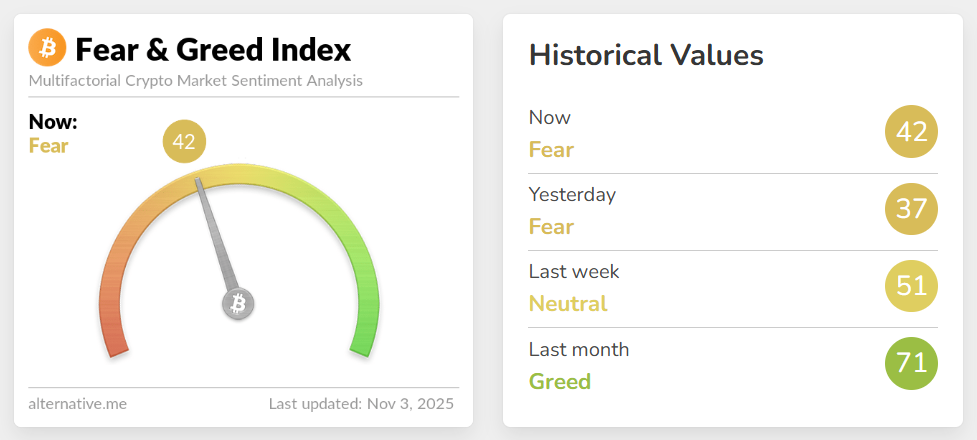

The Crypto Fear & Greed Index is currently hovering in the “Fear” zone. Many traders have rotated into stablecoins or taken short positions as they brace for potential further corrections.

Traders are also feeling uneasy ahead of upcoming U.S. jobs data. Combined with concerns about prolonged tight monetary policy, this has created a defensive market environment.

The market now sits at a critical juncture with the $3.56 trillion support level being tested. A stabilization of global macro conditions within the next 48 hours could allow the market to rebound toward $3.67 trillion.