TLDR

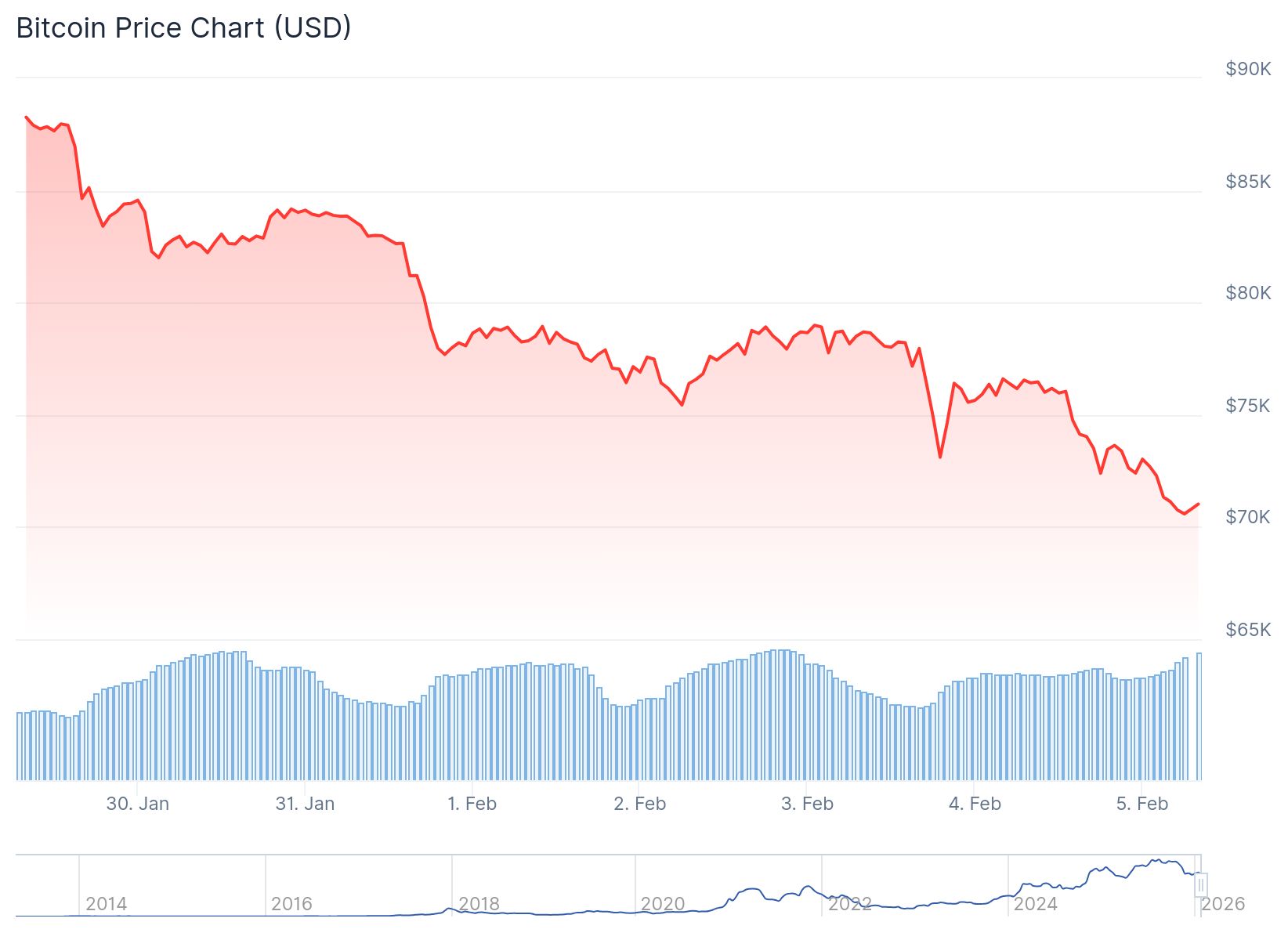

- Bitcoin fell below $71,000, dropping 7.5% in 24 hours and nearing a 14-month low as selling pressure increased across crypto markets

- The total crypto market cap lost $128 billion, falling to $2.41 trillion amid weak risk appetite and declining liquidity

- U.S. spot Bitcoin ETFs flipped from net buyers to net sellers, with the Coinbase premium staying negative since October

- Leveraged long liquidations reached $283 million in 24 hours, forcing more selling and increasing market volatility

- Global tech stocks crashed on AI spending concerns, with the Nasdaq falling and Asian markets down sharply, pulling crypto lower

Bitcoin dropped below $71,000 on Thursday as selling pressure spread across cryptocurrency markets. The world’s largest cryptocurrency fell 7.5% over 24 hours, touching lows near $70,700.

The decline followed sharp drops in global technology stocks. Asian equities fell for the fifth time in six sessions. South Korea’s Kospi index dropped around 4% as AI-linked stocks came under pressure.

The total crypto market cap lost $128 billion in 24 hours. The market fell to $2.41 trillion as bearish sentiment continued. Investors pulled back from risk assets amid macro uncertainty and declining liquidity.

Bitcoin is now trading in the mid-$70,000 range after briefly testing lower levels. The price remains above the critical $70,000 support level. This threshold has historically attracted buying interest during previous selloffs.

A breakdown below $70,000 would mark a 14-month low for Bitcoin. Such a move could trigger more forced liquidations. Analysts warn this could push prices down to $65,360 under stressed conditions.

Institutional Demand Weakens

U.S. spot Bitcoin ETFs have turned from net buyers to net sellers. This shift created a year-over-year demand gap measured in tens of thousands of Bitcoin. The funds were net accumulators at this time last year.

📉 $1.6B IN BITCOIN ETFs SOLD IN JAN, 3RD LARGEST IN HISTORY

U.S. spot Bitcoin ETFs saw –$1.61B in net outflows in January, the 3rd largest monthly ETF sell-off in history.

Institutions weren’t buying the dip.

They were selling it.🔥 pic.twitter.com/P7OpknEHZ1— Coin Bureau (@coinbureau) January 31, 2026

The Coinbase premium has remained negative since October. This indicates U.S. investors are not stepping in despite lower prices. Historically, sustained bull markets have coincided with strong U.S. spot demand.

On-chain data from CryptoQuant shows full bear market signals. The Bull Score Index sits at zero while Bitcoin trades far below its October peak. The market is operating with a thinner buyer base and tighter liquidity.

Glassnode data points to weak spot volumes across exchanges. Selling pressure is not being met with sustained buying. The issue appears to be declining participation rather than panic selling.

Stablecoin expansion has stalled for the first time since 2023. USDT market cap growth turned negative. This typically signals reduced trading activity and weaker risk appetite across crypto markets.

Tech Selloff Spreads to Crypto

The Nasdaq fell during U.S. trading hours on disappointing earnings reports. Companies like Alphabet, Qualcomm and Arm reinforced fears that AI investment may be peaking. These concerns spread to Asian markets overnight.

MSCI’s Asia tech index declined sharply as investors moved away from risk assets. Mounting concern over AI spending and stretched valuations drove the selloff. Bitcoin has increasingly traded as a high-beta risk asset during equity drawdowns.

Wenny Cai, COO at Synfutures, said Bitcoin’s move below $71,000 accelerated broader deleveraging. “Liquidations have been heavy, sentiment has swung risk-off, and price action is now being driven more by balance-sheet mechanics than narrative flow,” Cai said.

Leveraged long liquidations reached $283 million over 24 hours. These forced closures accelerated downside momentum. If liquidation pressure continues, the total market cap could retest support near $2.36 trillion.

Commodities also saw sharp moves during the selloff. Silver plunged as much as 17% and gold fell over 3%. This extended a brutal unwind that triggered heavy liquidations in tokenized metals products.

Prediction markets show traders expect no change at the Federal Reserve’s April meeting. Only modest expectations exist for a June rate cut. This limits the prospect of near-term liquidity relief for risk assets.

President Donald Trump recently said a Fed chair who wanted to raise rates would not have gotten the job. This remark tempers earlier optimism about central bank independence. The policy narrative adds pressure to already weak market conditions.

CME Group is exploring the launch of its own crypto-style token. CEO Terry Duffy said the initiative would focus on margin and tokenized collateral use cases. This signals continued institutional interest despite current market weakness.