After months of consolidation, the crypto market may be nearing its next parabolic breakout, with the XRP price again catching investor attention. Analysts believe renewed institutional activity and Ripple’s expanding use cases could push the XRP price toward $200, a 1,000% rally from current levels.

Yet, beneath the surface, a lesser-known altcoin trading under $0.1 is stealing liquidity from the majors. With early metrics pointing to a potential 50,000% run before the month ends, Paydax Protocol (PDP) is drawing early interest from savvy investors who see it as the next breakout project.

Why The XRP Price Could Surge Toward $200 As Institutions Reengage

The XRP price is once again catching institutional attention. Ripple’s growing role in global settlements, coupled with rising network activity and investor confidence, positions the XRP price for a breakout. Analysts suggest that if institutional adoption continues at this pace, the XRP price could realistically approach the $200 mark in the coming cycle.

However, while Ripple’s momentum builds, a more compelling storm is forming in the DeFi space. Paydax (PDP), a sub-$0.1 altcoin, is gaining traction for its innovative cross-chain liquidity framework, allowing smooth movement of assets across multiple networks. This utility-driven design is attracting early investors who see Paydax as the next evolution of what the XRP price started years ago.

The resemblance between the two projects is striking. Where XRP modernized institutional payments, Paydax aims to decentralize liquidity itself by connecting crypto’s fragmented ecosystems into one unified DeFi layer. With growing community traction and rising on-chain interest, this altcoin could mirror the XRP price’s early success, offering even greater upside for early adopters.

Compelling Transition From XRP Towards DeFi Innovation

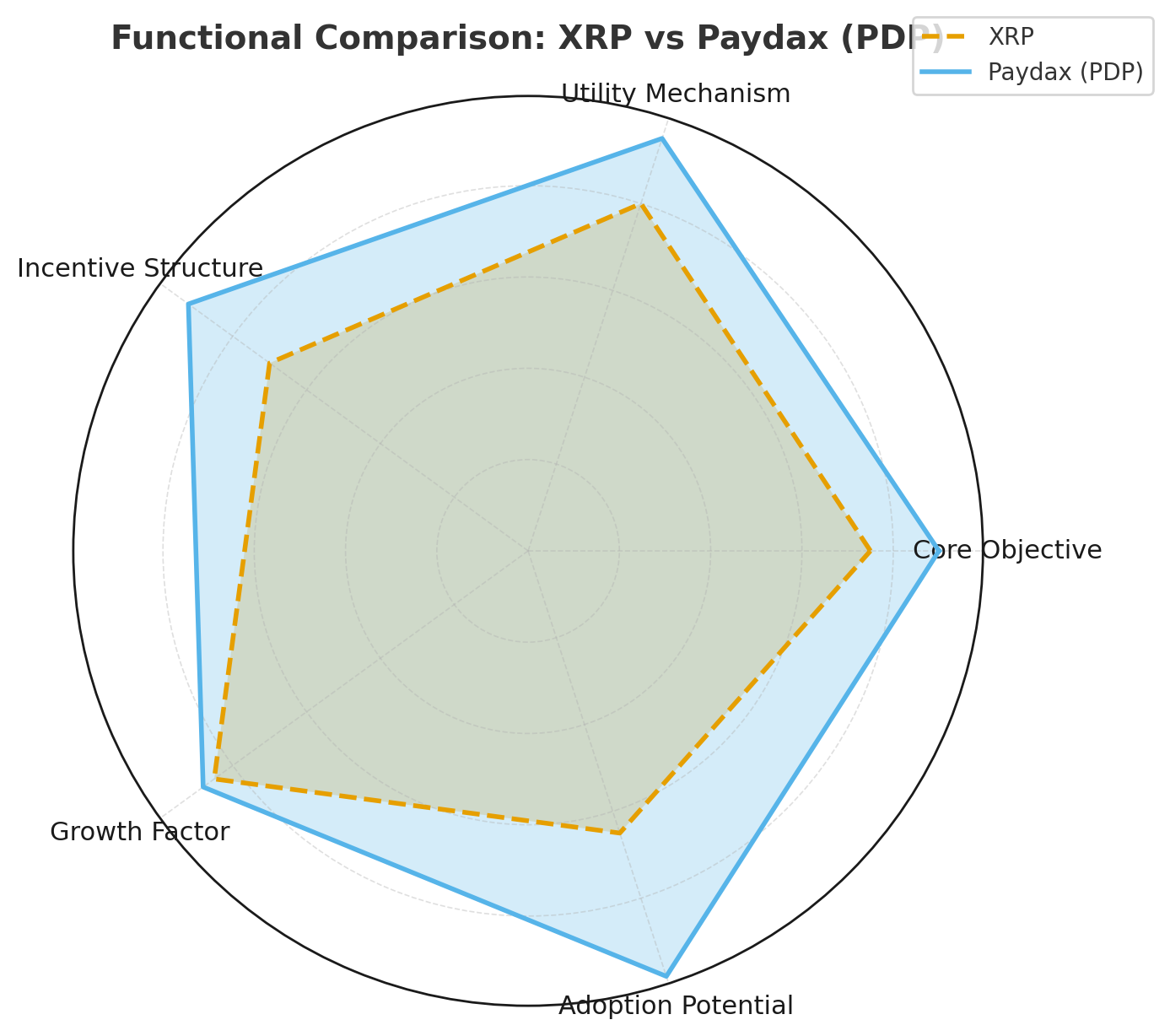

When comparing blockchain pioneers and emerging DeFi solutions, XRP and Paydax Protocol (PDP) share a common theme: solving real-world inefficiencies. XRP improved cross-border payments for institutions, while Paydax is bringing similar practical utility to decentralized finance, rewarding users and liquidity providers through innovative on-chain mechanisms:

- XRP

- Core Objective: Simplify cross-border settlements for financial institutions.

- Utility Mechanism: It acts as a bridge asset between currencies, improving speed, cost, and liquidity.

- Incentive Structure: Transaction efficiency and reduced costs for banks.

- Growth Factor: Driven by institutional adoption and regulatory milestones.

- Paydax (PDP)

- Core Objective: Decentralize and automate liquidity across multiple blockchain ecosystems.

- Utility Mechanism: Audited smart contracts with adaptive staking pools that adjust rewards based on network activity.

- Incentive Structure: Tokenized rewards tied to on-chain activity, scaling with participation.

- Growth Factor: Early presale positioning, network expansion, and DeFi integration — combining scarcity with functional utility.

Source: Paydax Protocol

XRP solved real-world banking inefficiencies, while Paydax is applying those lessons to DeFi, creating a self-sustaining ecosystem where users earn through participation and liquidity provision. Together, this comparison highlights how functional utility drives adoption, whether in traditional finance or decentralized networks.

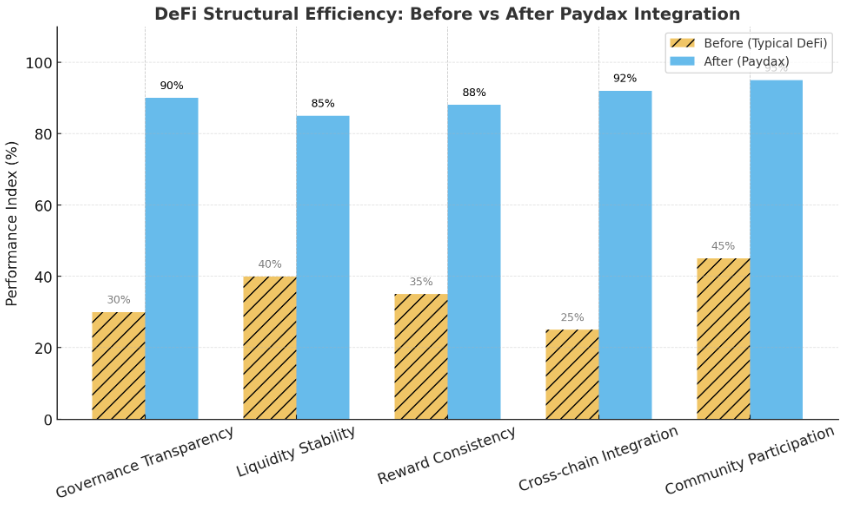

From Governance To Growth, Paydax Tackles DeFi’s Core Issues

While the XRP price continues to build momentum within institutional finance, Paydax (PDP) is addressing the deeper structural issues that have long limited the DeFi sector, from governance opacity to liquidity instability. At the foundation of Paydax’s approach is verified governance. With a fully doxxed team and smart contract audit by Assure DeFi, Paydax restores the credibility often missing in early-stage DeFi projects.

In addition, PDP altcoin holders don’t just speculate — they vote on upgrades, influence rewards, and help the system grow through community governance. Paydax also tackles the volatility and fragmentation that plague DeFi markets with automated on-chain safeguards that dynamically balance staking rewards and transaction flow. This promotes ecosystem stability even under high-volume conditions.

Source: Paydax Protocol

At its current presale price of $0.015, Paydax’s (PDP) model provides a credible framework for sustainable DeFi growth — one that analysts suggest could underpin a potential 50,000% rally as adoption expands. In essence, Paydax (PDP) isn’t just another altcoin; it’s a practical response to DeFi’s growing pains, and early investors are recognizing the advantage of getting in before the solution becomes mainstream.

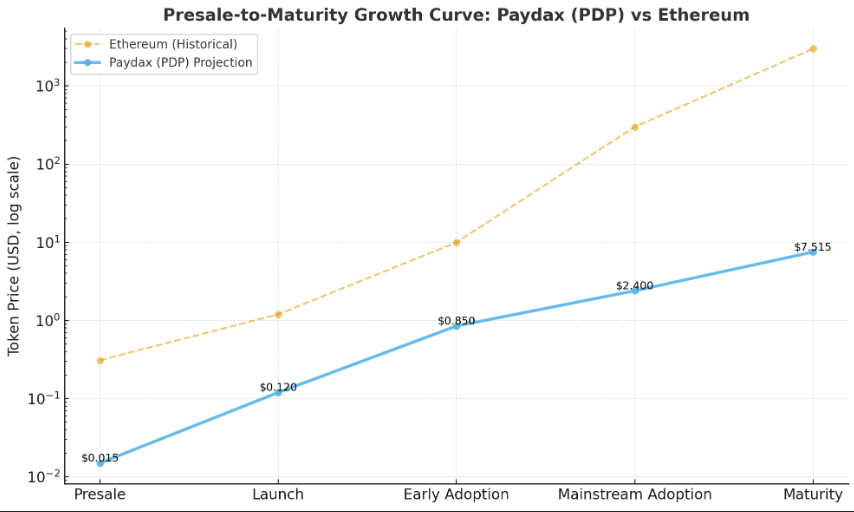

Investors’ Shift From XRP’s Potential Gains to Paydax’s (PDP) Explosive Surge

When the XRP price traded at fractions of a cent, few could have predicted its meteoric rise to over $3.60 within a year. Early adopters who recognized its utility in simplifying cross-border payments saw unprecedented gains. That same combination of real-world utility, network effect, and strategic positioning now serves as a blueprint for identifying the next breakout opportunity in DeFi.

Source: Paydax Protocol

Paydax (PDP) is emerging as that opportunity. At just $0.015, the altcoin is already solving persistent DeFi challenges. Early metrics from a presale that has raised nearly $1.2 million in a few days suggest PDP could see a 50,000% surge as adoption accelerates. For investors eyeing the next wave of DeFi growth, the stars are aligning — with a 25% bonus via code PD25BONUS.

Join The Paydax Protocol (PDP) presale and community:

Website: https://pdprotocol.com/

Telegram: https://t.me/PaydaxCommunity

X (Twitter): https://x.com/Paydaxofficial

Whitepaper: https://paydax.gitbook.io/paydax-whitepaper

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.