TLDR

- WLFI, a Trump-backed DeFi project, introduces a token buyback and burn program after a 41% price drop in September.

- The WLFI team plans to purchase tokens from the open market and permanently remove them from circulation.

- A community vote passed with 99% approval for the buyback and burn mechanism to reduce circulating supply.

- WLFI’s strategy focuses on liquidity positions on Ethereum, BNB Chain, and Solana to fund the buyback.

- Market analysts anticipate the buyback and burn strategy will drive WLFI’s price surge due to reduced token supply.

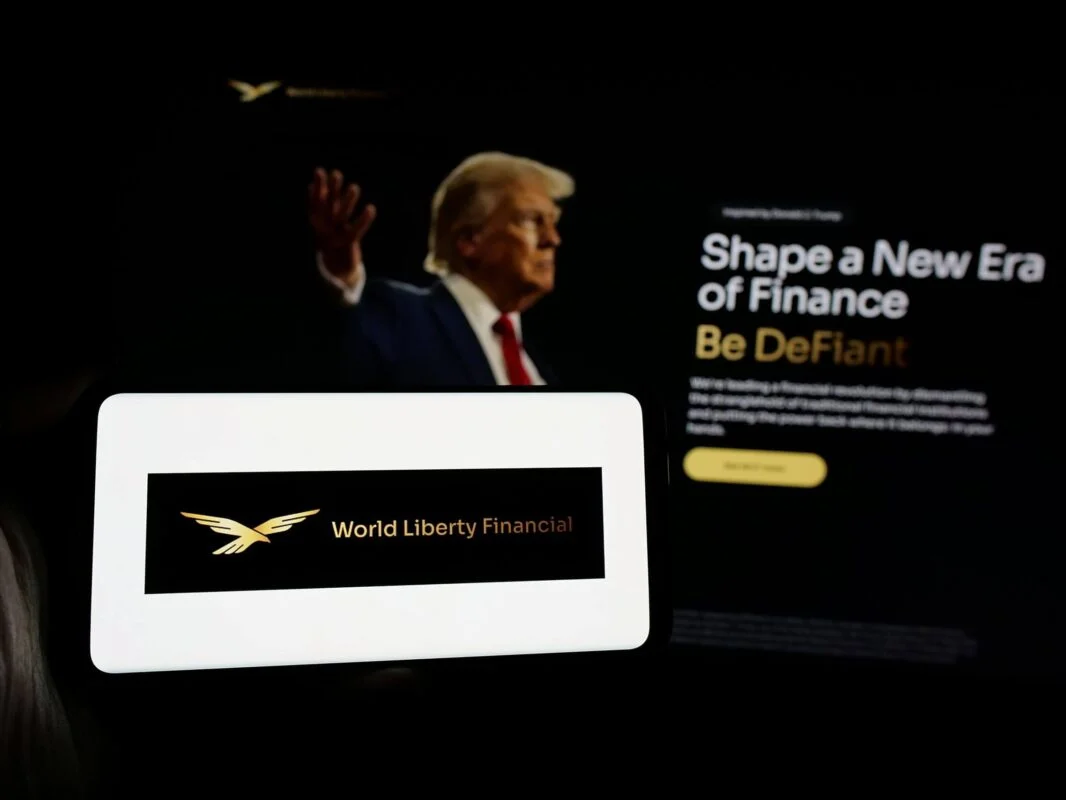

The decentralized finance (DeFi) project World Liberty Financial (WLFI), backed by the Trump family, has unveiled a token buyback and burn program. This decision follows a 41% decline in the value of WLFI tokens in September. The WLFI team announced that the buyback and burn mechanism will launch this week.

WLFI to Implement Token Buyback & Burn Program

World Liberty Financial (WLFI) has confirmed plans to implement a token buyback and burn program after a sharp 41% drop in its token price. WLFI tokens, which had previously reached an all-time high of $0.33 on September 1, are now trading at $0.19. The WLFI team shared that the initiative aims to reduce the circulating supply, boosting the token’s value by making it more scarce.

The buyback and burn mechanism was introduced after a community vote passed with overwhelming support. The proposal received 99% approval from WLFI holders.

“This strategy will help stabilize the price of WLFI as we reduce supply in the market,” the WLFI team stated in their announcement.

🦅 Governance Update:

The community has voted to use 100% of WLFI Treasury Liquidity Fees for Buyback & Burn, passing with almost unanimous support.

The team will begin implementing this initiative this week, and all buybacks & burns will be transparently posted once conducted.

— WLFI (@worldlibertyfi) September 25, 2025

WLFI plans to utilize the fees generated from liquidity positions on Ethereum, BNB Chain, and Solana to purchase tokens on the open market. The team will then send these tokens to a burn address, permanently removing them from circulation. WLFI’s commitment to this initiative has sparked optimism among analysts, who predict a potential bullish surge in the token’s price.

Token Buyback and Burn Strategy Explained

The token buyback and burn mechanism focuses on liquidity controlled by WLFI. The fees generated from liquidity positions owned by the project will fund the buyback. However, fees from third-party or community-controlled liquidity pools will not be included in the process.

By implementing this strategy, WLFI aims to create a deflationary effect, where each transaction reduces the circulating supply of tokens. The project anticipates that the burn rate could reach approximately 4 million WLFI tokens daily. This would eliminate nearly 2% of the total supply annually, potentially driving up demand and increasing the token’s value.