XRP currently trades near $3.00, holding firm as traders anticipate the SEC’s decision on multiple XRP spot ETF applications expected between October 18 and 25. The outcome could be pivotal: analysts project that approval may unlock billions in inflows, potentially driving prices toward $4.00 or even $5.00 by month’s end.

Meanwhile, Avalanche (AVAX) continues to attract institutional attention following its $675 million SPAC investment deal and expanding DeFi footprint. The token trades in the low $20s, showing technical resilience and bullish divergence across major indicators.

Alongside these established assets, one emerging project, MAGACOIN FINANCE, is gaining traction among analysts for its verifiable smart contracts, community-driven ecosystem, and rising presale volume.

XRP: Whale Activity and ETF Catalysts

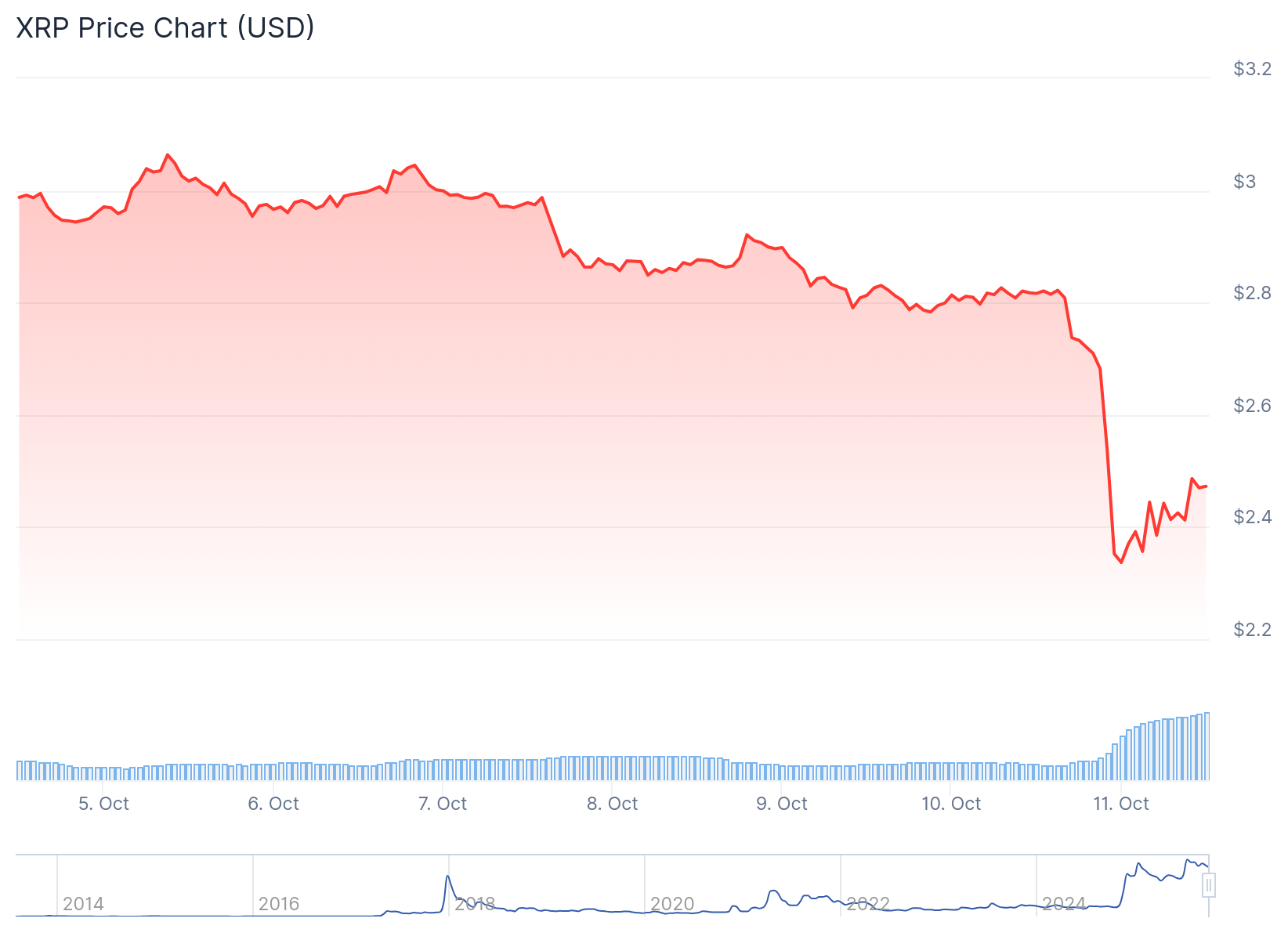

XRP’s price chart shows signs of life underneath. The past week saw an impressive rise in overall on-chain Whale activity, as it repeatedly got trapped.

The speculation surrounding ETFs has played a significant role in revitalizing confidence. According to analysts from JPMorgan and Bloomberg, the mid-October decision window could be a turning point. They believe that, if approvals follow, $4–$8 billion in early institutional inflows can happen. If XRP experiences this level of inflow, expect it to easily reach $3.20. Following that, XRP will target $4.00 – $4.50 range.

XRP Price Chart: CoinGecko

Analysts from Standard Chartered predict that if the momentum keeps going, we could see highs between $5.50 and $6.00 by year-end. Ripple’s ecosystem is expanding beyond the realm of ETFs as it brokering new partnerships within Europe’s payment networks and roll-out Ripple USD (RLUSD). With the whale activity and ETF hype, XRP’s setup is similar to previous breakouts.

Avalanche (AVAX): Institutional Inflows and Technical Support

Avalanche has certainly remained one of the more structurally strong Layer-1 networks. AVAX is trading around $21-23 and has given multiple bullish signs on the daily chart, including a rising channel pattern and a rising RSI off oversold levels. Data sourced on-chain indicates that there has been whale activity worth over $6 million in the last 48 hours. This resembles behavior seen prior to the AVAX rallies in late 2023 and mid-2024.

Avalanche has received a huge investment of $675 million via SPAC that will support its network and ecosystem expansion. According to analysts, large-scale funds show confidence with their activity while DeFi integration and cross-chain partnerships continue to grow. With technical resistance seen in the $26 – $28 region and RSI showing early recovery, AVAX may be positioned for a clearer recovery through November.

Emerging Altcoin Opportunity

As investors shift toward undervalued assets, MAGACOIN FINANCE emerges as one of the best altcoins to consider buying this October, based on multiple analysts’ assessments of presale growth and audited credibility.

MAGACOIN FINANCE’s appeal lies in its clear fundamentals: limited supply, community-driven governance, and a transparent presale model that integrates smoothly with wallets such as MetaMask, Trust Wallet, and Coinbase Wallet.

The project’s expansion across multiple ecosystems and its scarcity-based design are fueling consistent demand. Analysts suggest it could complement large-cap positions in XRP and AVAX, offering both diversification and higher growth potential as institutional and retail liquidity rotates back into emerging assets.

Conclusion

The current oversold market may be presenting a strategic entry point for long-term investors. XRP offers ETF-driven upside potential, AVAX provides institutional depth and technical recovery setups, and MAGACOIN FINANCE delivers a verifiable, community-led alternative that is gaining global traction.

Experts highlight MAGACOIN FINANCE’s successful Hashex audit and ongoing verification on Certik as major proof of reliability, reinforcing investor trust in its presale model.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.