TLDR

- CME XRP futures hit an all-time high with $9.02B in volume and 6,000+ contracts.

-

XRP futures open interest reached a record $7.5 billion, signaling strong institutional demand.

-

Traders place 78% odds on a Ripple ETF approval in 2025, with $144K in Polymarket trading volume.

-

Derivatives market for XRP sees bullish sentiment with a 32% increase in options trading volume.

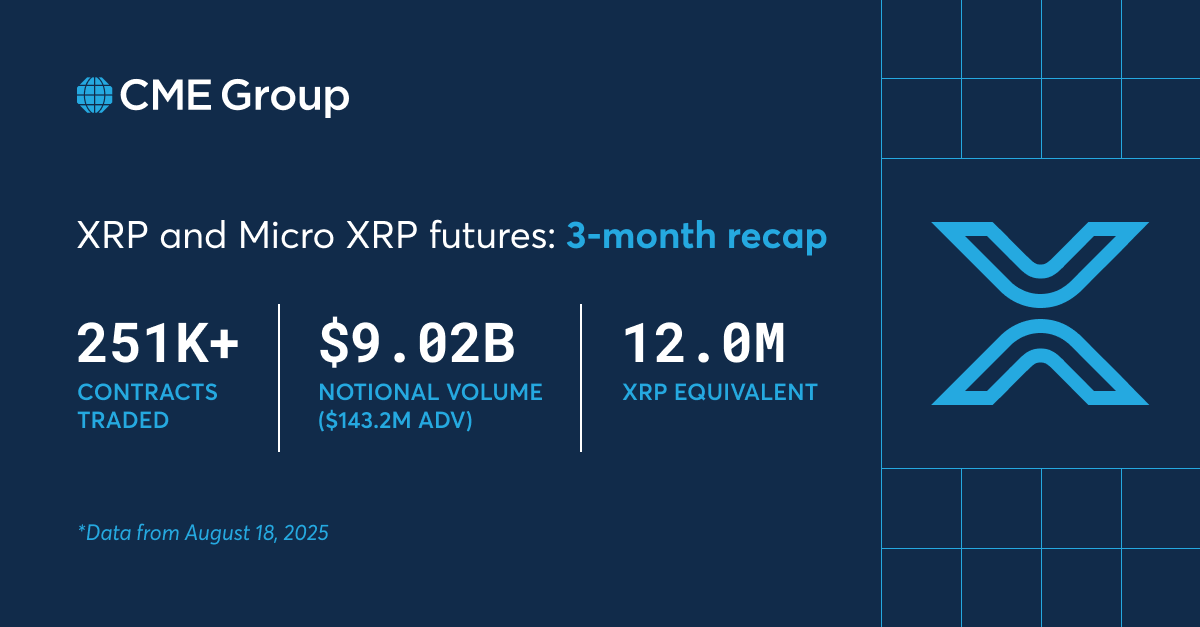

CME Group’s XRP futures have hit a new record, with an impressive $9.02 billion in turnover. This marks the highest volume recorded on the platform for XRP futures, reflecting increased interest from institutional traders. The surge in futures activity comes amid rising speculation that a Ripple ETF could be approved soon, with traders becoming more optimistic about the asset’s future.

The CME Group, a leading derivatives marketplace, has also reported that over 251,000 XRP contracts have been traded over the last three months. XRP futures have gained popularity as a tool for speculation and hedging in regulated markets.

Surge in XRP Futures Open Interest

On August 18, open interest for CME’s XRP futures hit an all-time high, surpassing 6,000 contracts. This milestone indicates a growing conviction among professional traders about the potential of XRP.

- Source:X

The surge in open interest is viewed as a clear signal that market participants are positioning themselves in anticipation of future price movements.

With an average daily volume of $143.2 million, CME XRP futures have become a widely traded product. The liquidity surrounding XRP futures is increasing, suggesting a healthy and evolving market. XRP’s inclusion in CME’s crypto derivatives suite alongside Bitcoin and Ethereum solidifies its standing among institutional investors.

Rising Speculation Around Ripple ETF Approval

Traders are also betting on the likelihood of a Ripple ETF approval. Recent data from Polymarket shows that the odds of an XRP ETF being approved in 2025 have jumped to 78%, up from a previous estimate below 70%. This growing optimism has driven increased trading activity, with more than $144,000 in contracts on the prediction market.

The rise in approval odds aligns with a broader market sentiment that regulators may soon provide clearer guidance for digital assets like XRP.

If the ETF is approved, it would allow more institutional investors to gain exposure to XRP through a regulated vehicle, further cementing its legitimacy.

Global XRP Derivatives Market Shows Strong Bullish Positions

Outside of CME, XRP derivatives trading on global exchanges has seen substantial activity. Coinglass data reports that XRP’s global derivative trading volume has reached $7.52 billion. While this marks a decrease from previous highs, the open interest remains solid at $7.5 billion.

Additionally, options trading in XRP has surged, with volumes increasing by 32% and open interest rising by 45%.

The growing popularity of options contracts suggests that traders are positioning themselves for further price increases. On platforms like Binance, the long-short ratio for XRP derivatives is heavily skewed toward long positions, indicating that many traders expect XRP’s price to rise.