TLDR

- XRP shows bullish momentum with 73% of top traders on Binance going long, creating a 2.70 long/short ratio not seen in weeks

- Technical analysis suggests XRP could reach $10-$15 during Wave 3 Elliott Wave pattern, with intermediate targets at $4.12, $5.31, and $6.16

- XRP broke resistance at $3.23 and climbed over 2.5% to near $3.30 on strong trading volume and institutional demand

- Fibonacci extension levels provide multiple profit-taking zones, with aggressive targets reaching $13.59 if Wave V materializes

- Short-term focus centers on breaking $3.31 resistance to target the $3.50-$3.66 range for continued upside

XRP has captured attention from both technical analysts and traders as the cryptocurrency demonstrates strong bullish momentum. Recent analysis points to targets between $10 and $15 based on Elliott Wave theory.

The price action shows XRP forming higher lows while breaking through key resistance levels. This pattern suggests the beginning of what analysts call Wave 3, typically the strongest phase of an Elliott Wave cycle.

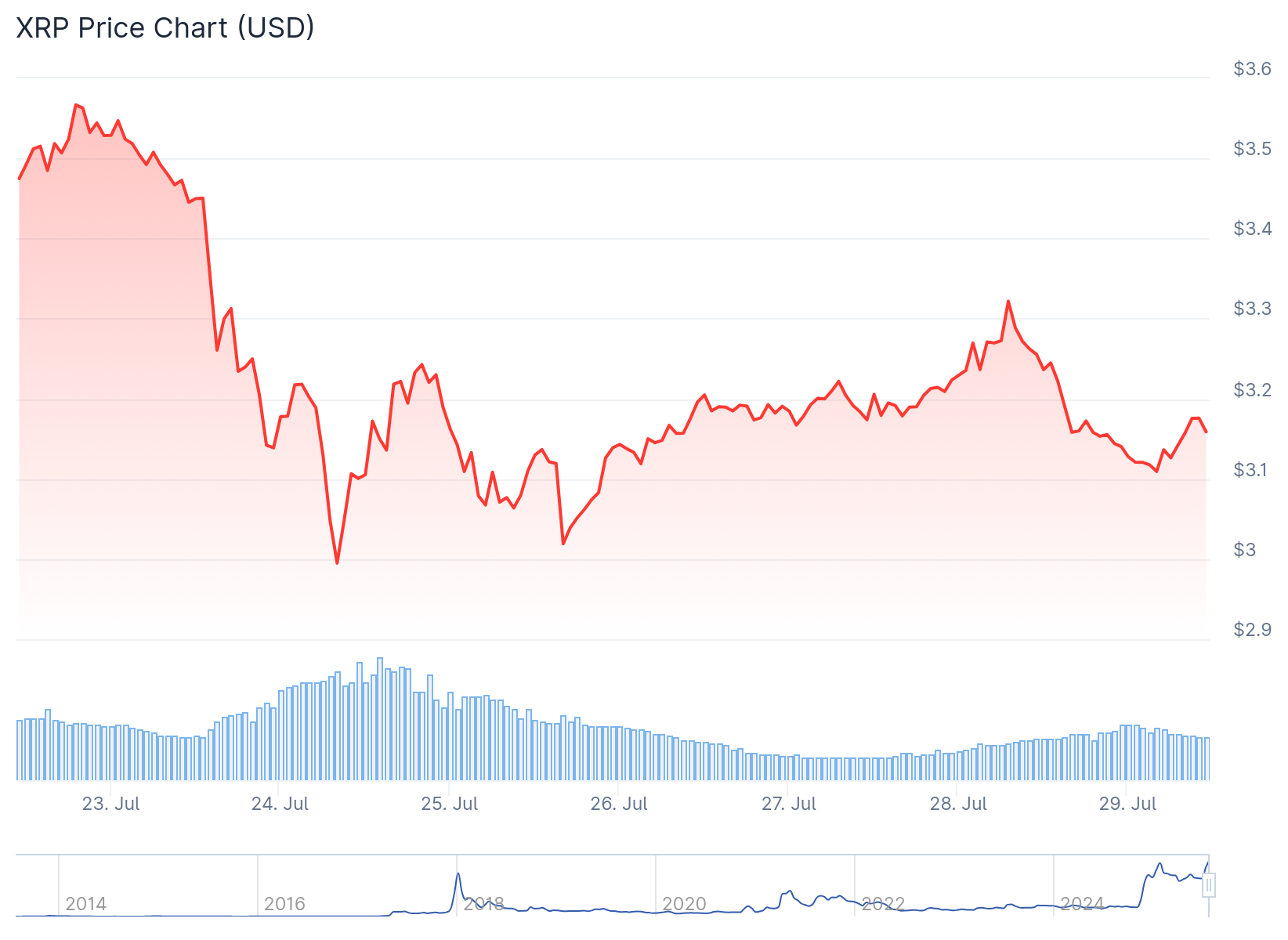

XRP recently broke resistance at $3.23 after months of consolidation. The move marks what crypto analyst XRPunkie identifies as the end of Wave IV and the start of a powerful Wave 3 leg.

The current structure shows upward-sloping exponential and simple moving averages. These technical indicators reflect growing momentum favoring buyers over sellers.

On July 28, XRP rose over 2.5% to close near $3.30. The recovery from early session lows came with increased trading volumes and late-session buying pressure.

Trading data shows well-defined ascending channels with higher lows forming between $3.16 and $3.22. Despite facing resistance near $3.23, XRP’s ability to break and hold above $3.30 indicates sustained bullish strength.

Volume spikes reached 81.78 million at 4 PM and 69.06 million at 5 PM. These levels exceeded the 24-hour average by wide margins, confirming accumulation activity.

Fibonacci Targets Create Roadmap

Technical analysis using Fibonacci extension levels identifies multiple resistance points ahead. Short-term targets include $4.12, $5.31, and $6.16 based on standard Fibonacci ratios.

Those fib levels above could be some little Take Profits area for the Wave 3? I believe it could over extend to reach $13. Which is my target of $10-$15. We shall see. $XRP pic.twitter.com/EFtiMnwKRl

— XRPunkie (@Shawnmark7899) July 25, 2025

More aggressive projections reach $7.55 and $9.45. The 3.618 extension around $13.59 represents a potential ceiling for extended bullish moves.

These levels serve as profit-taking zones within the projected third wave. Traders can use these checkpoints to manage positions along XRP’s anticipated rally.

The analyst emphasizes maintaining current market structure for these targets to materialize. Continued bullish momentum could push XRP toward or beyond these upper zones.

Trader Sentiment Shifts Bullish

Binance data reveals a strong shift in trader positioning toward bullish bets. As of 1:00 PM UTC, 72.96% of top trader accounts held long positions while just over 27% maintained short positions.

This creates a long/short account ratio of 2.70, levels not seen in recent weeks. The sentiment extends beyond large traders, with 71.6% of all accounts taking long positions.

The global long/short ratio across all participants reached 2.52. While this doesn’t guarantee immediate price increases, such positioning typically precedes larger moves.

Interestingly, traders maintain reasonable position sizes despite bullish sentiment. The long/short ratio by position dropped from 2.95 to 2.76, showing risk management awareness.

This pattern suggests smart money positioning for upside while controlling risk exposure. Traders remember July’s volatility and avoid overextending positions.

For immediate confirmation, analysts say XRP needs to break and hold above $3.31 resistance. Success at this level could quickly shift targets toward $3.50-$3.66 range.

Current market sentiment remains cautiously optimistic. XRP’s ongoing use cases in cross-border payments and DeFi integration support fundamental strength.

The asset’s resilience aligns with speculation around the Ripple vs SEC lawsuit. While recent court updates haven’t provided major surprises, legal developments continue influencing investor behavior.

XRP price currently trades at approximately $3.307, representing a 2.67% gain in the last 24 hours according to the XRP Liquid Index.