TLDR

- Veteran trader Peter Brandt warns XRP could drop 20% to $2.22 if the price closes below $2.68 support on the weekly chart

- Whale wallets holding 1-10 million XRP have sold roughly 440 million tokens over the past 30 days

- Over 320 million XRP moved to exchanges in the past week, pushing exchange reserves near nine-month highs

- XRP is forming a descending triangle pattern with lower highs converging on $2.68 support

- Bulls argue a breakout above $3.15 could send XRP toward $4.00-$4.50 range

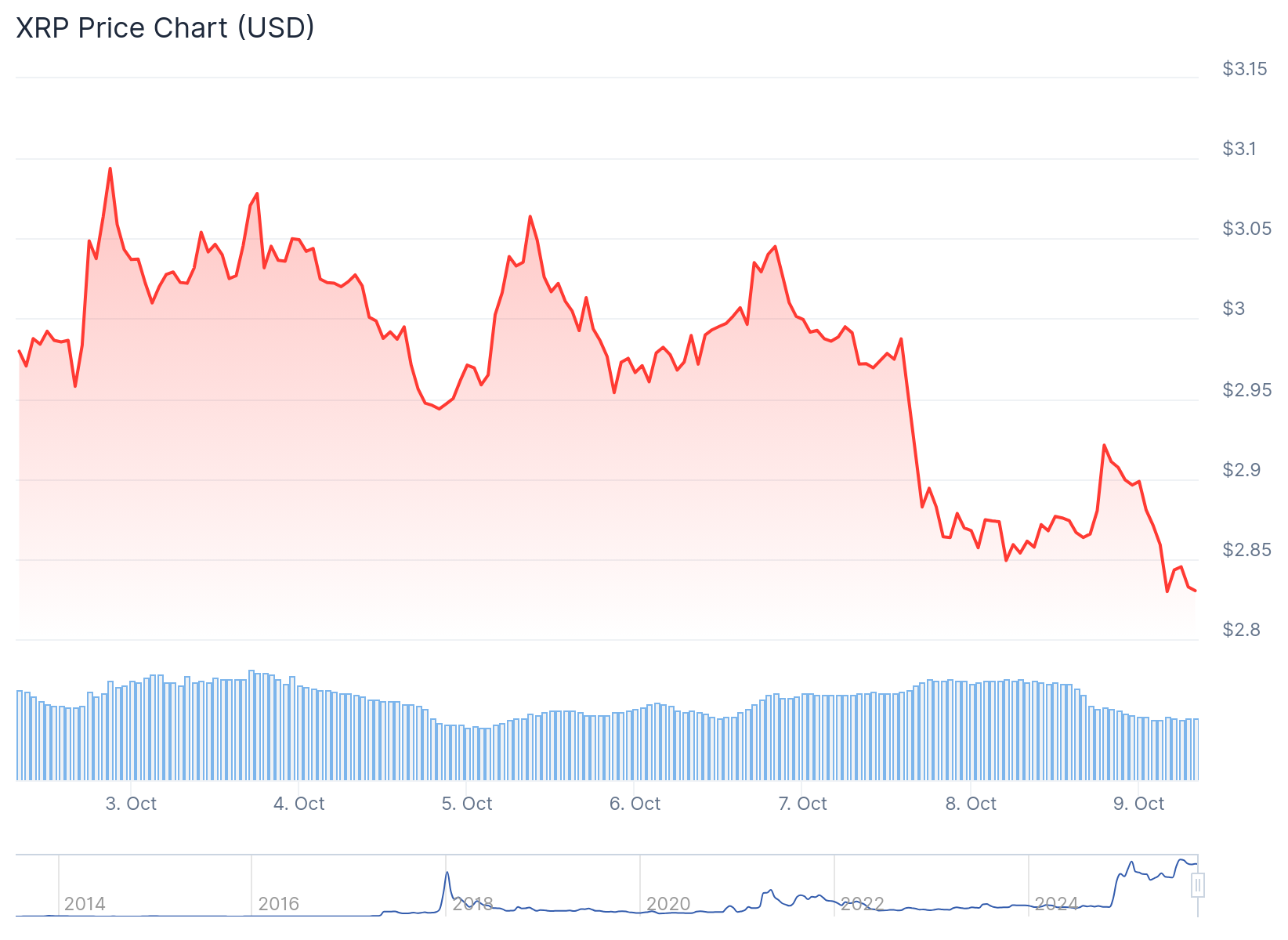

Veteran trader Peter Brandt has issued a bearish XRP price forecast that has caught the attention of crypto markets. He warns that a weekly close below $2.68743 would likely push the token down to $2.22163.

That target represents roughly a 20% decline from the current price of around $2.85. Brandt’s analysis centers on a descending triangle pattern forming on XRP’s chart, with lower highs converging on the $2.68 support level.

The trader also pointed to bearish RSI divergence on the weekly timeframe. This technical indicator suggests momentum is weakening even as price attempts to hold steady.

Brandt’s chart shows XRP creating a series of lower highs while support holds around $2.68. This classic descending triangle formation typically resolves with a break to the downside.

On the left is a classic descending triangle from Edwards and Magee, showing what descending triangles are supposed to do. On the right is a developing descending triangle. ONLY IF it closes below 2.68743 (then I'll be a hater), then it should drop to 2.22163. $XRP pic.twitter.com/3GI7nT1TaW

— Peter Brandt (@PeterLBrandt) October 7, 2025

If XRP closes below the $2.68743 level on a weekly basis, the pattern would be confirmed. The measured move from this formation points to the $2.22 price target.

At current levels near $2.85, this would mark an 18% drop. For traders watching technical patterns, this $2.68 level has become a critical line in the sand.

Exchange Flows Signal Selling Pressure

On-chain data supports the bearish technical setup. Glassnode data shows more than 320 million XRP moved to major exchanges over the past week.

These exchange inflows have pushed reserves toward nine-month highs. When tokens move to exchanges, it typically signals holders preparing to sell.

Data from analyst Ali shows an even broader picture of whale distribution. Wallets holding between 1 million and 10 million XRP have sold approximately 440 million tokens in 30 days.

440 million $XRP sold by whales in the last 30 days! pic.twitter.com/qIQ9I2fYML

— Ali (@ali_charts) October 8, 2025

Whale balances in this category dropped from roughly 6.9 billion XRP to around 6.5 billion over the month. This represents a decline of about 400 million tokens from the largest holders.

The timing of this selling pressure coincides with XRP’s struggle to break above the $2.85-$2.90 zone. When large holders reduce positions and retail buyers don’t absorb the supply, downward pressure typically follows.

Sentiment Reaches Extreme Levels

Santiment data reveals that XRP’s crowd FUD metric hit its highest level in six months. The fear, uncertainty, and doubt among market participants has reached extreme levels.

Historically, these sentiment extremes have sometimes acted as contrarian indicators. Past instances of peak FUD have occasionally marked local bottoms for the token.

However, sentiment alone doesn’t change the technical and flow picture. The combination of bearish chart patterns, exchange inflows, and whale selling creates a challenging environment.

XRP currently trades around $2.86 with a market cap of approximately $177 billion. This puts it just below BNB’s market cap of around $178 billion in the rankings.

Bulls Point to Alternative Scenarios

Not all analysts share the bearish outlook. Crypto trader CasiTrades notes that XRP has held near the $3.00 level for several days.

🚀XRP Testing Major $3 Fib Support! 🚀

XRP is starting the week with some very encouraging technicals. The strongest right now is XRP holding the $3 major Fib support and forming a consolidation pattern with this level as the apex. 🎯Price has respected this zone for a few days,… pic.twitter.com/NVVrfb2QBs

— CasiTrades 🔥 (@CasiTrades) October 6, 2025

She argues the token is forming a consolidation pattern. A confirmed breakout from this range could send XRP toward $4.00-$4.50 in her view.

Analyst Ali Martinez suggests a clean break above $3.15 could drive XRP toward $3.60. These bullish scenarios depend on the token holding above support and breaking key resistance.

The market now watches two critical levels. A break below $2.68 would validate the bearish triangle pattern and open the door to $2.22.

A move above $3.15 would invalidate the descending triangle and shift focus to higher targets. Trader CasiTrades notes the market “awaits a decisive move, either above $3.15 or below $2.68743.”

Several factors could explain the recent whale selling. Some holders may be taking profits after XRP’s earlier gains this year.

Regulatory uncertainty around XRP continues to create hesitation among large investors. Others may be rotating capital into different cryptocurrencies or Bitcoin.

If selling pressure continues, XRP risks dropping below $2.80. This could accelerate downside momentum toward the $2.68 support level.

For now, the $2.68 level serves as the critical pivot point. A weekly close below this support would likely cement the bearish price target at $2.22.