TLDR

- XRP reclaimed the $3 price level and now ranks as the 99th largest asset globally by market cap at over $180 billion

- Large holders accumulated 250 million XRP tokens worth $758 million in eight days during recent consolidation

- Key resistance zone sits between $3.26-$3.29 where over 1.05 billion XRP tokens were previously accumulated

- Federal Reserve rate cut signals and XRP lawsuit dismissal approval helped drive the recent price recovery

- Technical analysis shows potential upside targets at $3.43, $3.65, and $3.84 if resistance breaks

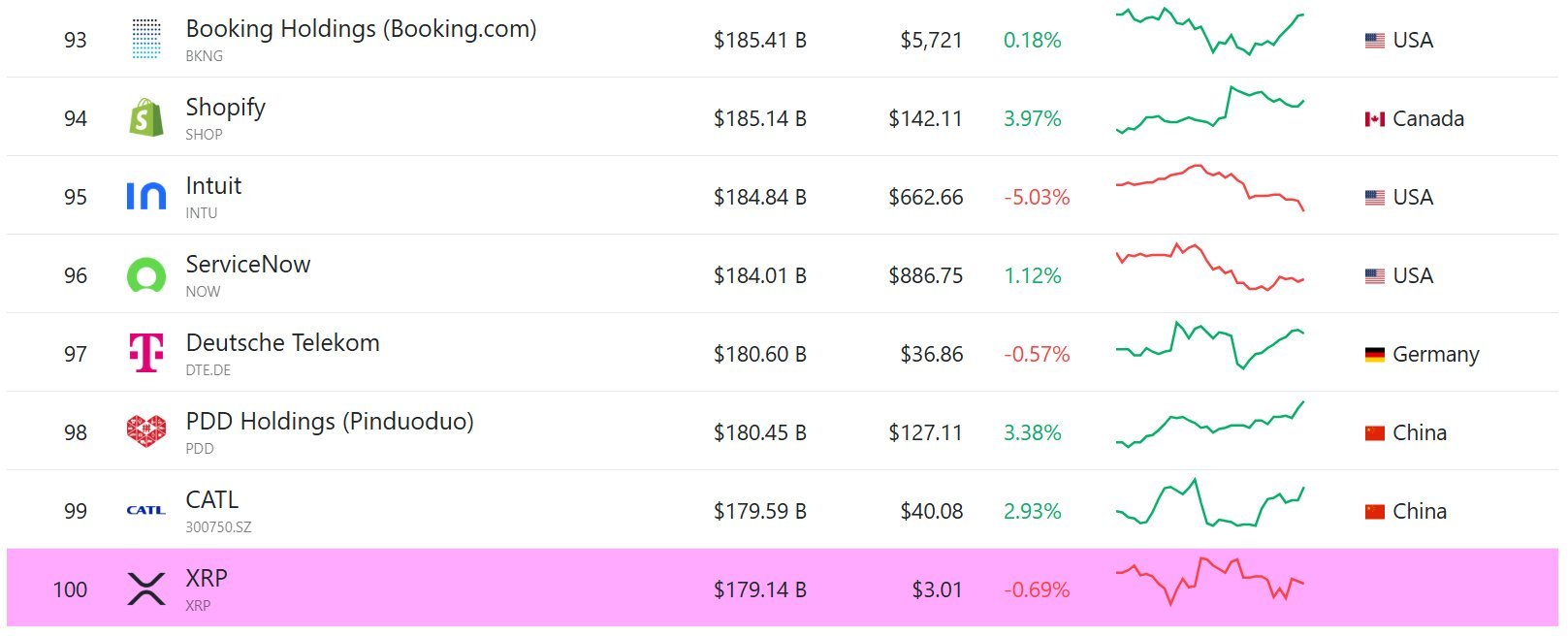

XRP has reclaimed its position among the world’s largest assets by market capitalization following its recent rally above the $3 price level. The altcoin now ranks 99th globally with a market cap exceeding $180 billion.

The token currently trades at $3.03, representing a slight decline of 0.7% over the past 24 hours. Weekly performance shows a 2.6% drop, while one-month returns remain negative at 1.4%.

Despite short-term volatility, three-month gains still reach nearly 30%. XRP joins Bitcoin and Ethereum as the only three cryptocurrencies currently featured in the top 100 global assets ranking.

The recent price recovery above $3 came after Federal Reserve Chair Jerome Powell’s Jackson Hole speech. Powell suggested the Fed could implement rate cuts at the September meeting.

Legal developments also supported the rally. The U.S. Appeals Court approved dismissal of the XRP lawsuit following a joint motion from Ripple and the SEC.

Whale Activity Shows Strong Accumulation

On-chain data reveals substantial accumulation by large holders during the recent consolidation period. Addresses holding between 10 million and 100 million XRP increased their positions steadily.

These whale wallets controlled approximately 7.51 billion XRP on August 16. By August 24, holdings had grown to 7.76 billion XRP.

This accumulation represents roughly $758 million worth of tokens added in just eight days at current prices. Such buying activity typically indicates confidence among institutional holders.

The whale accumulation has helped absorb selling pressure during the sideways trading range. However, it has not provided enough momentum to break through the strongest resistance zone.

🚀XRP Dips Below Consolidation, But Buyers Step In. Next Stop $3.21 🚀

Overnight $XRP dipped below the consolidation pattern. I was almost certain we’d see $2.77 tested, but momentum came across the market almost instantly! ⚡ Even with this new low, bullish divergences remained… pic.twitter.com/aeEBlof2Hl

— CasiTrades 🔥 (@CasiTrades) August 22, 2025

XRP Price Prediction

Cost Basis Distribution data identifies the most challenging price barrier ahead. The heaviest resistance cluster sits between $3.26 and $3.29.

More than 1.05 billion XRP tokens were previously accumulated within this narrow range. This concentration represents the price levels where the largest volumes last changed hands.

The zone has successfully capped every upside attempt since early August. Brief rallies have consistently failed to establish closes above this level.

Trend-based Fibonacci analysis supports the importance of this resistance. The 0.786 retracement line aligns almost perfectly with the $3.29 level.

A decisive breakout above this zone could trigger immediate upside targets. Technical projections point to $3.43 as the first major level.

Further gains could extend toward the previous all-time high of $3.65. A stronger rally might reach as high as $3.84.

XRP/BTC is about to smash through its 8-yr downtrend.

6+ spot XRP ETF approvals coming.

Partnerships with Japan's SBI holdings.

The Ripple-SEC case has officially ended.

XRPL massive upgrades coming.If there's one large cap which is about to pump hard, it's gonna be $XRP. pic.twitter.com/Q9k9H1S40H

— Gordon (@AltcoinGordon) August 23, 2025

Recent price action shows renewed bullish momentum emerging. XRP bulls have taken control for the first time in nine days.

Similar patterns in early August led to rapid gains from $2.90 to $3.33 within several trading sessions. A comparable reaction could develop if buying pressure increases.

Downside support remains anchored near $2.78 if whale accumulation fails to sustain current levels. A break below this level would invalidate the current bullish outlook.

XRP now ranks above CATL in market capitalization and sits just behind Pinduoduo and Deutsche Telekom. The positioning reflects growing institutional recognition of the asset’s market value.