Read our Advertising Guidelines Here

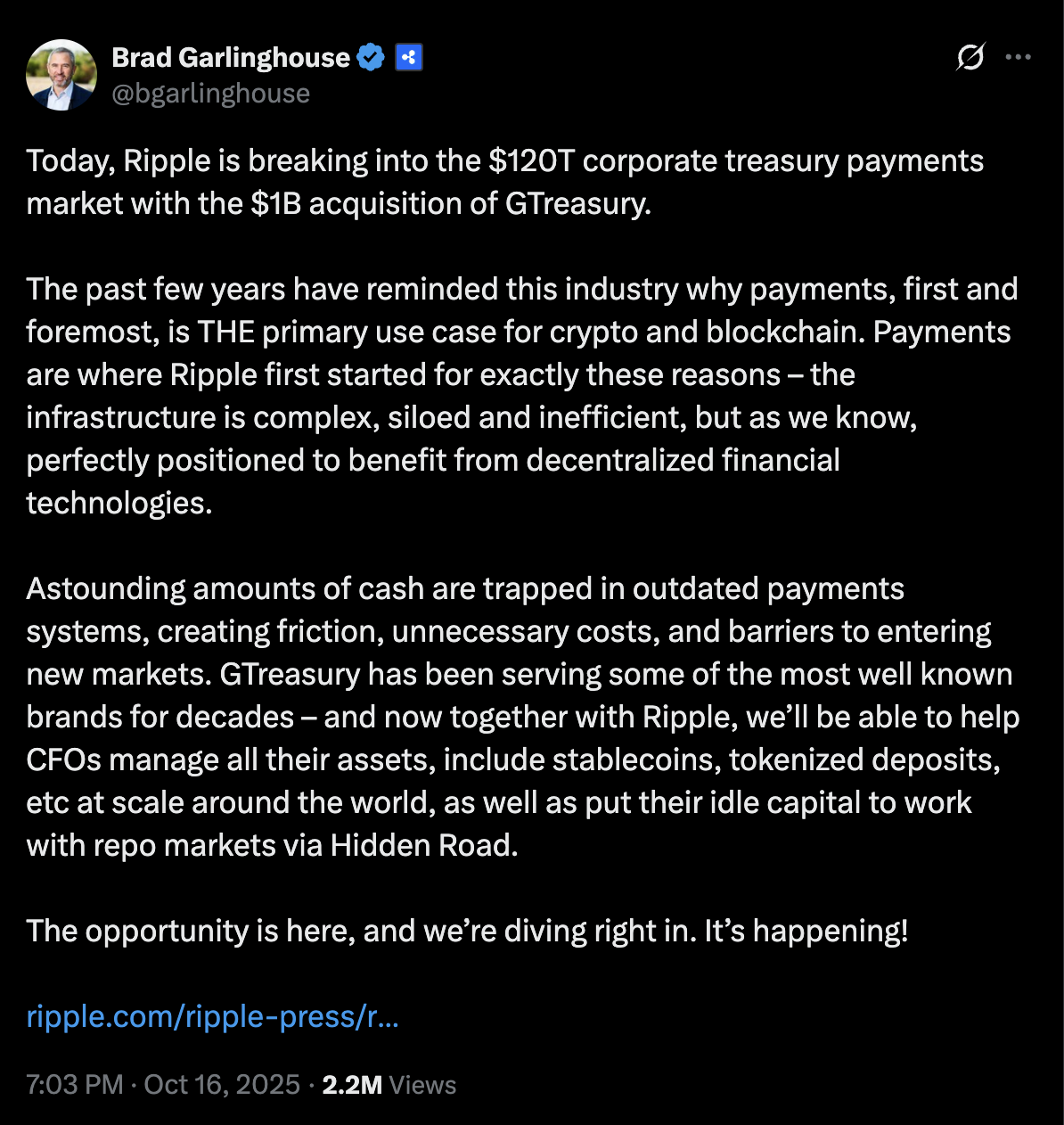

Ripple has just acquired GTreasury in a $1 billion deal, marking its biggest move yet to replace SWIFT and take control of global treasury infrastructure.

With this acquisition, Ripple gains the tools to let corporations move money 24/7 using blockchain rails. It’s Ripple’s third major buyout this year, and it cements its ambition to rebuild institutional finance on-chain.

But even with such a big move, XRP’s price forecast remains muted. The same goes for BNB, despite its Coinbase listing and recent surge.

That’s why many investors are now turning to DeepSnitch AI, a presale gem with real utility and the upside potential these blue chips can no longer offer.

Ripple buys GTreasury for $1B as it races to replace SWIFT

Ripple has acquired GTreasury, a leading corporate treasury management firm, in a $1 billion deal aimed at bringing blockchain speed and flexibility to traditional finance. The move gives Ripple direct infrastructure to help corporate treasuries manage digital assets, including stablecoins and tokenized deposits.

With GTreasury’s tools and Ripple’s blockchain rails, clients can now move funds 24/7 with near-instant settlement, streamlining cross-border transactions. CEO Brad Garlinghouse said the deal targets the inefficiencies of legacy systems: “Money has been stuck in outdated infrastructure for too long.”

This is Ripple’s third major acquisition in 2025, following Hidden Road and Rail, as the company deepens its push into institutional finance.

Ripple isn’t just expanding, it’s going after SWIFT’s role in global banking. Recent partnerships with BBVA, Franklin Templeton, DBS, and Bahrain Fintech Bay point to a broader strategy: combine stablecoins, tokenized funds, and custody services to rebuild global finance on-chain.

With each deal, Ripple positions itself not just as a payments firm, but as a serious challenger to the legacy financial system.

Can DeepSnitch AI offer better returns than XRP and BNB?

DeepSnitch AI

The 100x era of crypto isn’t dead, investors just need to stop betting on random meme coins and start focusing on projects with real utility and massive reach. That’s what serious finance looks for: use case + market size. And that’s exactly what DeepSnitch AI delivers.

Now in its presale phase, DeepSnitch AI offers a rare opportunity. At just $0.01915 per token, a $100 investment could realistically turn into $10,000 once the token hits exchanges. All it would take is DSNT reaching $1 post-launch, a target well within reach for a project of this caliber.

Built for over 100M active crypto traders, DeepSnitch helps eliminate emotion from trading. It offers AI-powered tools that let users track whales, avoid scams, and act on real data instead of panic. It’s why many believe DeepSnitch could soon be as essential as TradingView or MetaMask.

Even better, DeepSnitch AI is perfectly positioned to ride the explosive growth of the AI sector, which analysts say will 25x by 2033. That momentum is already here, with over $430K raised in the presale.

XRP price prediction: Can it surge past $3 in the coming weeks?

The XRP price is sitting around $2.44, caught between support at $2.10 and resistance at $2.80. Price action has slowed after a week of whale sell-offs, liquidations, and ETF rumors. Despite $5.8 billion in daily volume, momentum is still lacking for the XRP price prediction.

Glassnode data shows whales grabbed 1.65 billion XRP near $2.10, forming a strong demand zone. But $2.80 poses a challenge, with nearly 4% of supply bought there, likely to trigger selling pressure if the price climbs.

Institutional selling on Oct. 14-15 sparked a 6% drop, cutting open interest in half and flipping funding rates negative. Retail hasn’t stepped in yet to move the XRP price prediction forward.

BNB has dropped close to $1,000, but momentum is still here

BNB has dropped 22% to $1,069 after hitting an all-time high near $1,370 just days earlier. The sharp move wiped out over $16 billion in market cap, while trading volume slipped 13% to $3.7 billion.

The chart now confirms a double top pattern, with the neckline at $1,103 broken and price testing key support at the 50-day SMA near $1,017. If this level fails, BNB could fall toward $904 or even $829.

Momentum is fading fast. The MACD has flipped bearish. RSI is sliding. Futures open interest is down 14%. The long/short ratio is just 0.88, showing traders are leaning bearish.

Macro pressures and weak demand for BNB-linked memecoins add fuel to the drop. Still, some bulls point to structural support holding firm, for now. A push back above the trendline could revive momentum, with $1,350 as the next big target.

Closing thoughts

In today’s crypto market, hype alone doesn’t cut it, and neither does utility without momentum.

The projects that explode are the ones that combine both. DeepSnitch AI is one of the few that checks every box: strong utility, viral potential, and perfect timing.

Its presale is live right now, targeting the most undervalued sector in crypto: AI. And with the AI sector expected to grow 25x in the next few years, this may be your last shot to enter before the big money does.

Check out the website for more information.

FAQs

What’s the XRP forecast for 2025?

Analysts remain divided. Some see XRP hitting $5–$10 if Ripple’s treasury and banking partnerships keep building up momentum. The Ripple price prediction for 2025 depends on adoption and whether it can fully replace SWIFT’s outdated infrastructure.

How much has DeepSnitch AI raised so far?

Over $430,000 has been raised during its presale, with early buyers already seeing a 26% increase in token value. The project is building momentum fast as more traders realize its 100x potential.

How high can DeepSnitch AI go after launch?

If the token reaches $1, that’s a 52x gain from the current presale price. But if it follows the same trajectory as top AI tokens like Bittensor or Fetch.AI, a 100x pump isn’t unrealistic.

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above. Read our Advertising Guidelines Here.