TLDR

- XRP remains undervalued according to Bayberry Capital, which says the market misunderstands its role as financial infrastructure for global liquidity and settlement systems

- CryptoQuant data shows traders are rotating from Bitcoin and Ethereum into XRP, with open interest in BTC and ETH falling while XRP accumulation rises

- Ripple secured $500 million in funding at a $40 billion valuation and expanded partnerships with Mastercard, WebBank, and Gemini to enable stablecoin settlements

- The XRP network created 21,595 new wallets in 48 hours, the highest level in 8 months, suggesting new investors are entering during the recent price dip

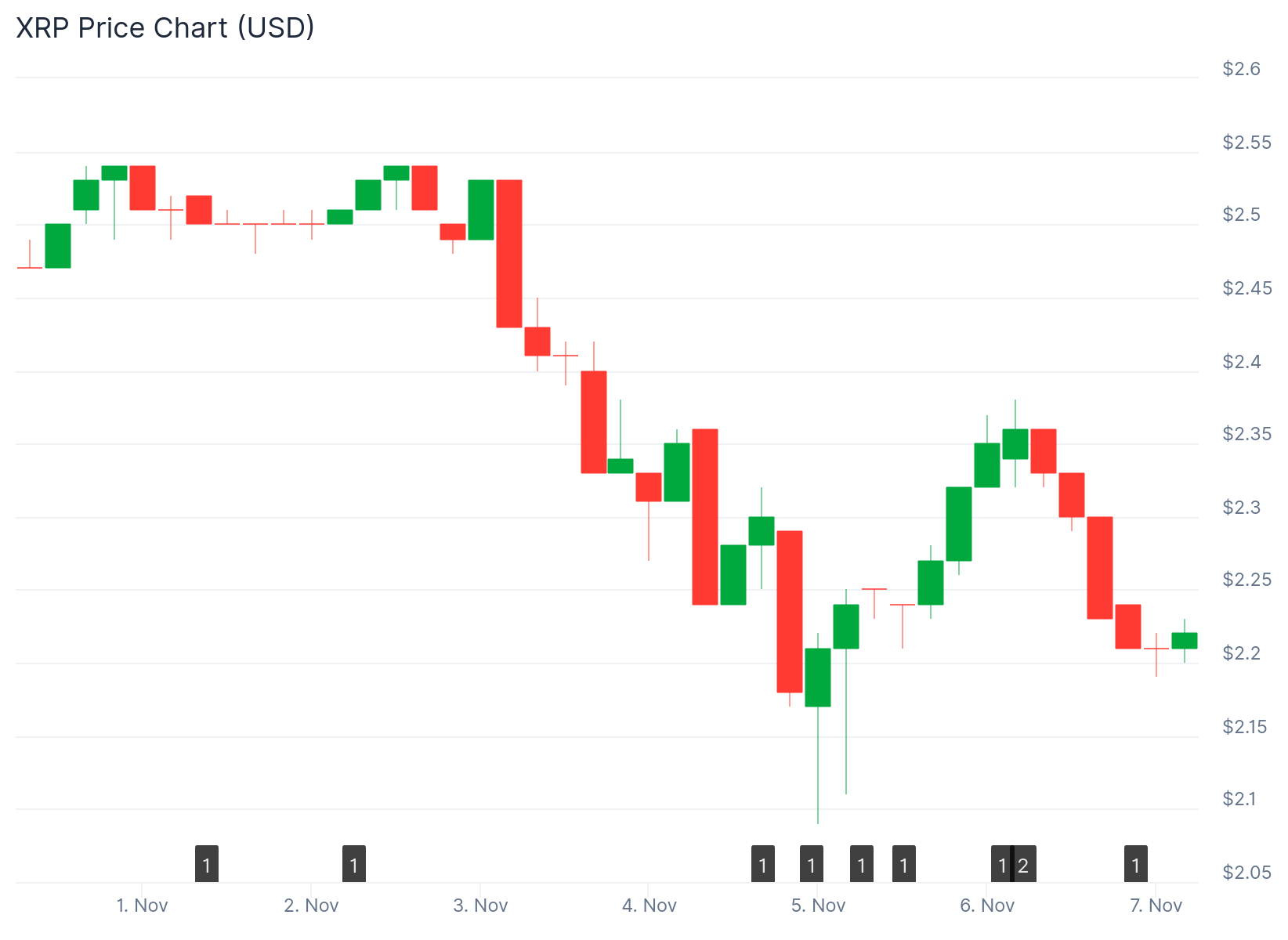

- XRP price dropped to $2 during the market crash but has rebounded to $2.3, with the $2 level serving as support within a year-long consolidation channel

XRP has seen a wave of new wallet creation and growing demand even as its price faces pressure. The token dropped to $2 during this week’s market crash before rebounding to $2.3.

On-chain data from Santiment shows the XRP network created 21,595 new addresses in a 48-hour period. This marks the highest level of network growth in eight months.

📈 XRP's price has bounced back, and users who bought the dip have enjoyed a nice +12% jump in the past 24 hours. Notably, XRP Ledger data indicates there were 21,595 new $XRP wallets created in a 48-hour span in the past couple days, the highest level of growth in 8 months. pic.twitter.com/vkGLwLJjrk

— Santiment (@santimentfeed) November 5, 2025

The spike in wallet creation happened alongside the price drop. This timing suggests new investors may be entering the market to buy the dip.

The last time XRP saw similar retail adoption was in July. Back then, the surge in new wallets happened at a price top. This time, the pattern is different with wallet growth occurring during a price decline.

CryptoQuant data reveals another shift in trader behavior. Open interest in Bitcoin and Ethereum positions has fallen over the last 72 hours. During the same period, XRP accumulation has increased.

Traders appear to be converting their BTC and ETH holdings into XRP. The data shows a rotation toward assets with specific utility rather than speculative positions.

Investment Firm Says Market Misprices XRP

Bayberry Capital released research stating that XRP remains undervalued. The private investment firm says the market treats XRP like a speculative token instead of financial infrastructure.

The company argues that XRP functions as plumbing for global value transfer. It says the token’s role in providing liquidity between disconnected financial systems is not reflected in its price.

Bayberry Capital compares the current moment to the early internet era. Networks and routers traded sideways while foundational infrastructure was being built beneath the surface.

The firm says XRP sits in a similar phase. Tokenized finance infrastructure is developing slowly through institutional adoption and compliance work.

This gradual development leads markets to underestimate what is being built. The firm believes XRP’s price stability reflects infrastructure growth rather than weak interest.

Ripple Expands Partnerships and Raises Funding

Ripple recently secured $500 million in funding at a $40 billion valuation. Major players including Citadel Securities and Fortress affiliates participated in the raise.

The company has expanded partnerships with Mastercard, WebBank, and Gemini. These collaborations enable credit card settlements on the XRP Ledger using stablecoins.

Ripple has been expanding the use of RLUSD, its stablecoin product. The partnerships allow settlement infrastructure to run on the XRP network.

CEO Brad Garlinghouse stated that XRP plays a central role across multiple settlement applications. The token serves as a bridge asset between different financial systems.

The private investment firm notes that this bridge function requires deep integrations that take time to develop. Institutional adoption and regulatory compliance move at a measured pace.

$XRP could find support at $2. pic.twitter.com/WKIqhITosA

— Ali (@ali_charts) October 31, 2025

The $2 price level served as support during the recent crash. Analyst Ali Martinez had identified this level as the lower boundary of a year-long consolidation channel. The token bounced from this support line and recovered to $2.3.