Ripple has struggled to break above the key $3 level, a price that’s become both a technical ceiling and a psychological hurdle for traders. Even with brief spikes in trading volume, momentum has faded, and with the RSI hovering near neutral, XRP remains stuck in a consolidation phase.

Digitap ($TAP), on the other hand, is showing the opposite trend. Its presale continues to gain momentum, with prices climbing from $0.0194 to $0.0268. The app is already live on iOS and Android, onboarding thousands of users—a feat few presale projects ever achieve.

Analysts see Digitap’s strong fundamentals and active development as signs that it could rise toward $14. Is $TAP the altcoin to watch now?

XRP Holds Steady Below $3 While Traders Wait for a Break

XRP’s chart paints a picture of stagnation. After climbing past $3.40 earlier this year, XRP has slipped back and settled in the $2.50–$2.70 range, struggling to build a clear upward trend.

The RSI hovering near 46 suggests a neutral market approach with traders unsure which way to lean next. For now, support sits near $2.00, while the $3.00–$3.20 zone remains a tough ceiling that XRP must break to reignite any real bullish momentum.

XRP’s long stretch of sideways trading might be a sign that money is starting to move elsewhere. When big coins lose momentum and get stuck below key price levels, investors often look for newer projects with more room to grow. That’s starting to happen here.

With XRP stuck under $3, attention is shifting toward projects that actually show progress and usefulness, and Digitap is one of them. As interest builds, more capital is likely to flow from slow-moving assets into platforms, driving the next wave of innovation in crypto.

Digitap Explained: Turning Crypto Into Everyday Money

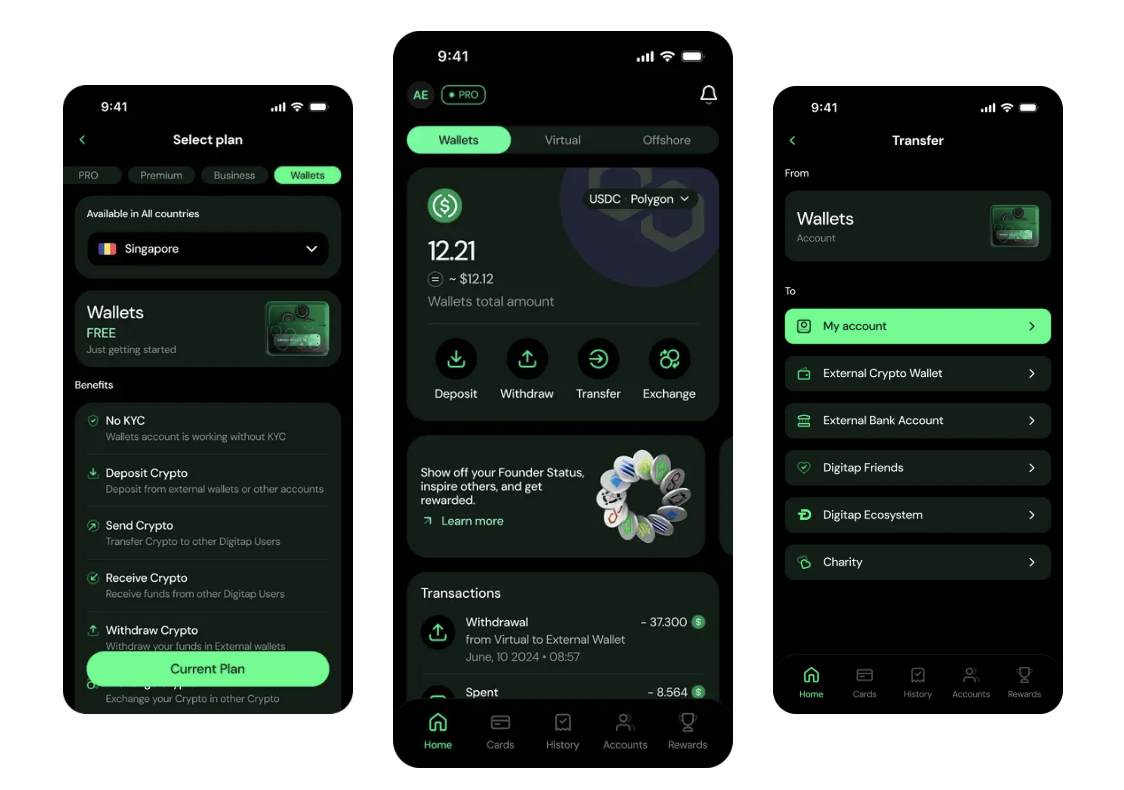

Digitap is a next-generation digital banking platform that blends traditional finance with crypto functionality. Users can hold both fiat and digital assets, send cross-border payments, and spend crypto anywhere using the Visa card through a single app.

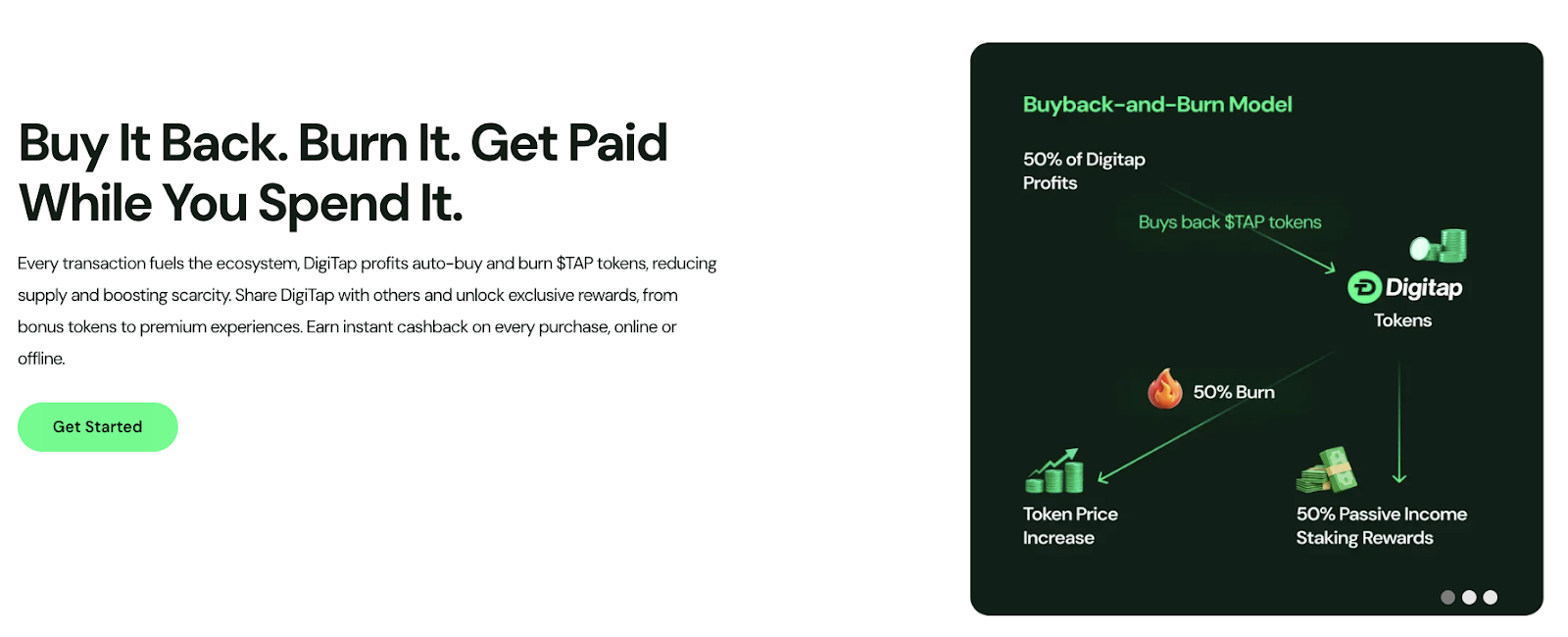

Digitap features built-in AI smart routing, which finds the best exchange rates across payment networks, and a deflationary token model in which 50% of platform profits are used to buy back and burn $TAP.

With a live app already available on iOS and Android, Digitap aims to become a true bridge between everyday banking and DeFi, offering practical utility beyond speculation.

How Digitap’s Banking Model Can Support a $14 Target

Digitap’s presale has recently advanced from $0.0194 to $0.0268, with a launch price of $0.14 locked in. That’s around a 5x increase before it even lists. The real question is how the app’s financial engine can support further growth once it’s live.

Digitap earns revenue through its banking and payments services, and half of those profits are automatically used to buy and burn $TAP tokens. It’s a built-in feedback loop that rewards adoption with scarcity.

To put it in perspective, Crypto.com hit more than 10 million users in 2021 and earned around $400 million in revenue, giving it a market value of over $20 billion at its peak.

If Digitap captures just a small slice of that scale, about 250,000 to 300,000 active users, and processes several billion dollars a year in payments and transfers, it could generate between $30 million and $50 million in annual revenue. Not to mention, Digitap targets a much larger market with cross-border payments seeing trillions in volume annually.

With half of that going into buybacks, $15–25 million in yearly liquidity would be flowing directly back into the token. That kind of sustained demand, paired with limited supply, could support a market cap near $1–1.5 billion, which translates to a $10–14 price range in the mid-term.

Add in exchange listings, user rewards, and real-world utility through the Visa card, and the case strengthens.

Three Market Scenarios for XRP and Digitap’s Next Move

Bull Case

If Bitcoin rallies past $150K and liquidity returns to altcoins, XRP could finally break above $3.20. Digitap launches successfully, gains about 400,000 users, and processes over $5B annually. With buybacks removing tens of millions of tokens, $TAP could climb into the $10–14 range by late 2026, supported by listings and strong adoption.

Base Case

Bitcoin trades between $100K–$120K while XRP stays capped near $3. Digitap grows steadily, reaches 150K–200K users, and generates around $25M in yearly revenue. Regular token burns help tighten the supply, keeping $TAP hovering in the $4–6 range as the platform matures.

Bear Case

If markets cool and Bitcoin slips below $80K, XRP may fall toward $2. Digitap’s user growth slows and liquidity thins, keeping $TAP around $1–2 until confidence returns. Still, the live app and deflationary design give it a base to recover when sentiment improves.

$TAP’s Momentum Grows as XRP Struggles Below $3

XRP’s price remains locked below $3, struggling to find fresh catalysts. Meanwhile, Digitap continues to accelerate: its presale has advanced from $0.0194 to $0.0268 in a week, the app is fully functional, and the ecosystem is expanding.

For investors seeking the best crypto coin to buy now, $TAP presents a rare asymmetric bet, with a live product, surging presale metrics, and a bold path toward $14 price targets in the next market cycle.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale: https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app