TLDR

- XRP whales accumulated $3.8 billion worth of tokens in four days, showing strong institutional confidence

- Technical analyst projects XRP could reach $34 this bull cycle based on double-bottom breakout pattern

- Over 95% of XRP supply is currently in profit, historically indicating potential market tops

- XRP trades at $3.13, down 16.8% from its all-time high of $3.66

- Market cap to TVL ratio shows potential overvaluation concerns compared to other cryptocurrencies

XRP price has experienced a dramatic rally of over 550% since November, reaching above $3 on Tuesday. The cryptocurrency’s recent performance has caught the attention of both technical analysts and large-scale investors.

Technical analyst Gert van Lagen believes XRP could climb toward $34 during this bull cycle. His analysis is based on XRP breaking out of a seven-year double-bottom structure after rising above its neckline near $1.80.

$XRP [2W] – Ripple is ready to rip.

The 7-year double bottom has broken out at ❌

The neckline was successfully retested at 🔵ATH cleared — first target near ~$34, at 2.00 fib. extension of double bottom.

–> Compare with 2014-2017 setup pic.twitter.com/aVk0lxp03O

— Gert van Lagen (@GertvanLagen) August 11, 2025

The cryptocurrency pulled back to test this neckline, which then acted as support. This retest pattern often indicates strong breakout confidence among traders.

Using the 2.00 Fibonacci extension of the pattern, Van Lagen’s measured-move projection points to a $34 target by mid-2026. This setup mirrors XRP’s 2014-2017 price action, when a similar multi-year base led to a parabolic rally.

XRP has demonstrated the ability to produce outsized moves in recent years. The token gained 1,072% since the 2022 lows and soared over 1,625% during 2020-2021.

XRP Price Prediction

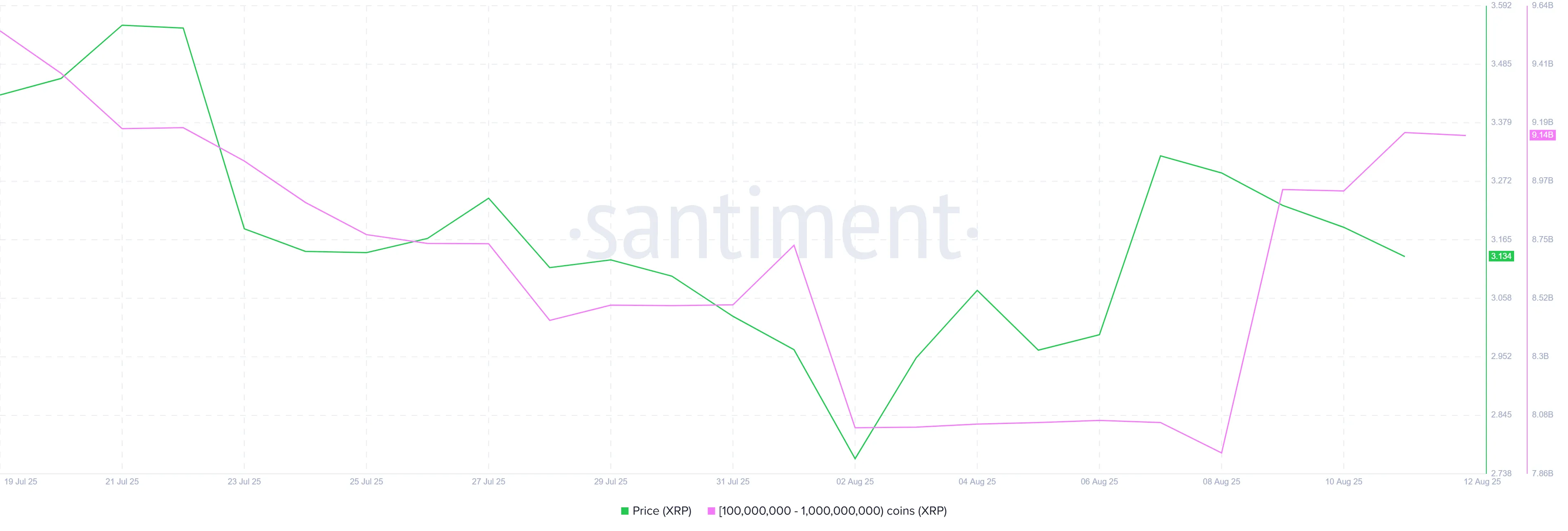

Recent whale activity has provided strong support for XRP’s price action. In the last four days, addresses holding between 100 million and 1 billion XRP accumulated over 1.2 billion tokens worth nearly $3.8 billion.

This accumulation occurred despite signs of a potential market top. Over 95% of XRP’s circulating supply is currently in profit, a threshold that historically precedes sharp price corrections.

Large investors appear confident in XRP’s future potential and are positioning themselves for further gains. The recent price dip likely triggered fear of missing out among these institutional holders.

XRP’s 2022-2025 gains were primarily fueled by progress in the Ripple lawsuit, growing legal clarity, exchange relistings and ETF optimism. The ETF narrative continues to guide bulls in 2025 with 95% odds of spot ETF approval.

Forecasts suggest the token could rally toward $27 if regulatory approval comes through. This target aligns closely with Van Lagen’s technical projection.

Fundamental Metrics Raise Questions

The growth of XRP Ledger lags behind other major layer-1 blockchains according to DefiLlama data. The network’s $190 billion market cap is roughly 2,200 times larger than its $85 million total-value-locked.

This ratio contrasts sharply with Ethereum’s ratio of about 5.6, despite XRP’s valuation being nearly 40% of Ethereum’s market cap. Such disparity has led to concerns over extreme overvaluation relative to onchain activity.

XRP price currently trades at $3.13, having faced a slight decline over the last four days. The altcoin remains 16.8% below its all-time high of $3.66.

If whale accumulation continues to support prices, XRP could rise to $3.41. Breaking this level could open the path toward the all-time high of $3.66.

However, bearish pressure from the broader market or retail selling could push the price down to $2.95 or lower. This would challenge the bullish thesis and raise questions about trend sustainability.

The cryptocurrency has shown resilience during previous market tops, maintaining upward momentum without experiencing major declines. This characteristic suggests XRP may defy typical market behavior patterns.