TLDR

- Chris Larsen, Ripple co-founder, has made $764 million in profit from selling XRP tokens since January 2018

- CryptoQuant analyst J.A. Maartunn identified a pattern where Larsen’s sales often happen near local price peaks

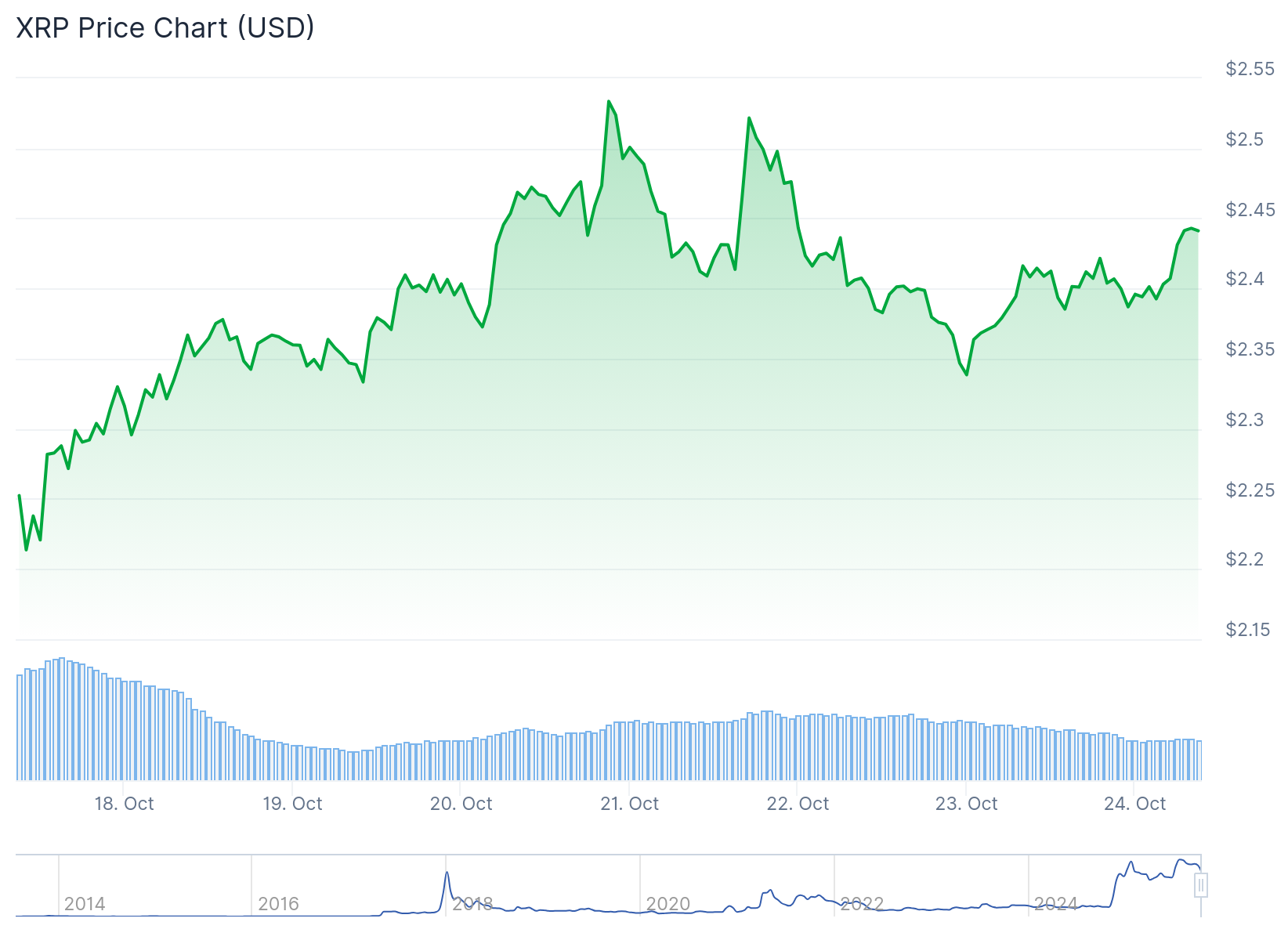

- XRP currently trades below $2.50 and needs to break above its 200-day moving average at $2.42 to show reversal signs

- Larsen still holds approximately $9 billion worth of XRP, which could mean continued selling pressure

- Technical indicators show a bullish divergence on the relative strength index, suggesting the recent decline may be losing momentum

Chris Larsen has sold XRP tokens worth $764 million since 2018. Larsen co-founded Ripple and remains one of the largest holders of the cryptocurrency.

The sales started in January 2018. J.A. Maartunn, an analyst at CryptoQuant, published the findings in a post on X.

Maartunn noted that Larsen tends to sell when XRP reaches local price highs. This pattern has raised questions among investors about the timing of these transactions.

😱 Chris Larsen (Ripple co-founder) has realized $764,209,610.42 (!!) in profits since January 2018.

Yes, the latest sale is tied to EvernorthXRP. But this isn’t an isolated event.

Larsen has a recurring habit of cashing out near local highs.

Zoom out. See the bigger picture. https://t.co/828ToHjC6T pic.twitter.com/53jW6hk92X

— Maartunn (@JA_Maartun) October 23, 2025

The latest sale connects to EvernorthXRP, which manages Ripple-linked holdings and distributions. Each time XRP rallies, selling activity from wallets tied to Ripple executives follows.

Some investors view this as smart profit-taking after long-term holding. Others question whether the timing affects price movements.

XRP currently trades below $2.50. The token has struggled to gain bullish momentum in recent weeks.

Trading volume has declined during this period. Market sentiment remains bearish as prices continue to drop.

Price Levels to Watch

For XRP to show a reversal, it needs to break above the 200-day simple moving average at $2.42. Breaking this level could open the path toward $3.00 in the near term.

TD Sequential flashes a buy signal on $XRP. Looks like the rebound is about to begin! pic.twitter.com/gSt6VyJDZl

— Ali (@ali_charts) October 23, 2025

The 50-day simple moving average sits at $2.38. The 100-day moving average is at $2.41. Crossing these levels could indicate a steadier climb ahead.

If XRP stays below these levels, selling pressure may continue. The technical setup shows some positive signs despite the current price struggles.

Technical Indicators

The relative strength index displays a bullish divergence. This suggests the recent price decline may be running out of momentum.

A bullish crossover in the moving average convergence divergence could provide additional support for an upward move. These indicators point to a possible upturn.

Larsen still holds roughly $9 billion worth of XRP. More sales from this holding could create ongoing pressure on the price.

The timing of Larsen’s sales happens when retail enthusiasm peaks. This adds uncertainty during fragile market conditions.

Altcoins remain in a delicate state across the market. Many tokens trade near long-term support zones.

Most altcoins sit well below their 200-day moving averages. Historically, altcoins regain strong momentum only after Bitcoin breaks above its all-time high.

Without confirmation from Bitcoin, capital stays conservative. Investors favor liquidity and safety over speculation during these periods.

The market is in a transitional phase. Bitcoin’s next move will determine whether confidence returns to the crypto landscape.

XRP faces muted inflows and persistent volatility until market conditions improve. The community market sentiment still projects a bullish phase for the coin.

Investors are watching key price levels and Bitcoin’s performance. These factors will shape XRP’s path in the coming weeks.