TLDR

- XRP trades near $1.40 after Ripple CEO Brad Garlinghouse was appointed to the CFTC Innovation Advisory Committee, marking a shift in regulatory relations.

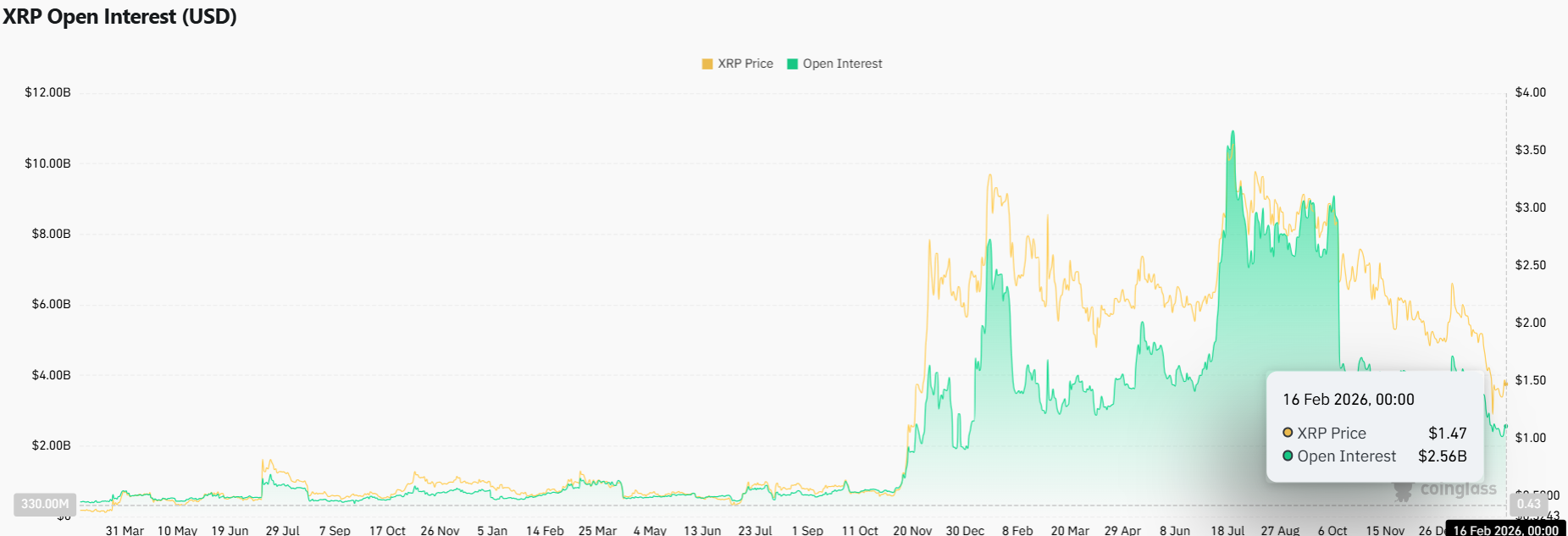

- Open interest rose 2.04% to $2.30 billion while options volume surged 338.80%, showing renewed trader activity despite recent price weakness.

- The token broke below its multi-month descending trendline and needs to reclaim $1.51 to invalidate the breakdown structure.

- XRP has dropped 25% year-to-date and faces continued pressure as investors rotate capital toward other assets during uncertain market conditions.

- Analysts project short-term support at $1.00 with medium-term targets of $2.50 if the Market Structure Bill advances in the Senate.

Ripple CEO Brad Garlinghouse announced his appointment to the Commodity Futures Trading Commission’s Innovation Advisory Committee. The CFTC revealed 35 members for the panel on February 12, including Coinbase CEO Brian Armstrong and Nasdaq Chair Adena Friedman.

As far as committees go…this is the Olympics crypto roster https://t.co/qYYNx8vviH

— Brad Garlinghouse (@bgarlinghouse) February 12, 2026

CFTC Chairman Michael Selig said the committee will help ensure regulatory decisions reflect market realities. The appointment represents a change from the regulatory environment that challenged Ripple for nearly five years.

The token has fallen 25% so far in 2026. XRP dropped from above $2.40 in early January to a low near $1.15 on February 11. This marks a 52% correction from its $3.56 all-time high.

Derivatives Data Shows Mixed Signals

According to Coinglass, XRP’s open interest increased 2.04% to $2.30 billion. Volume dropped 16.70% to $3.32 billion.

Options volume surged 338.80% to $6.25 million. Options open interest fell 5.34% to $51.04 million, indicating some positions were closed despite increased trading activity.

Long/short ratios remain elevated at 2.18 on Binance and 2.28 on OKX. Top trader positioning shows $219.18 million in longs versus $88.88 million in shorts on 12-hour timeframes.

XRP has broken below the descending trendline that guided price action since the July 2025 peak. The Supertrend indicator flipped bearish at $1.74.

The $1.40 psychological support level is under immediate pressure. Former support at $1.51 now acts as resistance.

Analysts say XRP must reclaim $1.51 to invalidate the breakdown. A daily close above this level would place the token back above recent support and shift momentum away from bears.

Losing the $1.40 level would expose $1.30 and potentially retest the $1.15 lows. The near-term structure remains bearish as long as price stays below $1.51.

Legislative Progress Could Shift Outlook

Reports suggest US Senate negotiations on stablecoin regulations are progressing. Coinbase CEO Brian Armstrong stated the crypto industry is making progress toward reaching an agreement between the White House, banks, and crypto representatives.

Two meetings at the White House aimed to find common ground on stablecoin rewards. The Market Structure Bill remains pending in the Senate after the House passed it in July 2025.

Progress on crypto legislation could provide regulatory clarity for XRP. However, market participants continue to focus on near-term technical levels while monitoring Washington developments.

The token recovered 22% from its February lows but remains inside a corrective phase. Range-bound trading dominates with resistance at $1.45 capping rally attempts.

If Bitcoin does drop to $40k – $30k then expect a sub $1 XRP. pic.twitter.com/OXAZhhbLQF

— Crypto Tony (@CryptoTony__) February 7, 2026

Price is forming higher lows from the $1.15 base. The RSI sits at 58.66, showing no strong directional bias. Buyers are defending the $1.35-$1.40 zone.

A breakout above $1.45 with volume would place $1.51 back in range. A breakdown below $1.35 would send price back to test $1.30 support.

Analysts project a short-term target of $1.00 if selling continues. Medium-term targets range from $2.50 to $3.00 if legislative progress materializes and technical structure improves.