TLDR

- XRP reached its highest-ever quarterly close of $2.846 in September 2025.

-

XRP’s Q3 performance shows a 27.16% gain, its best quarter of 2025.

-

October’s SEC ETF decisions could fuel XRP’s price surge toward $3.66.

-

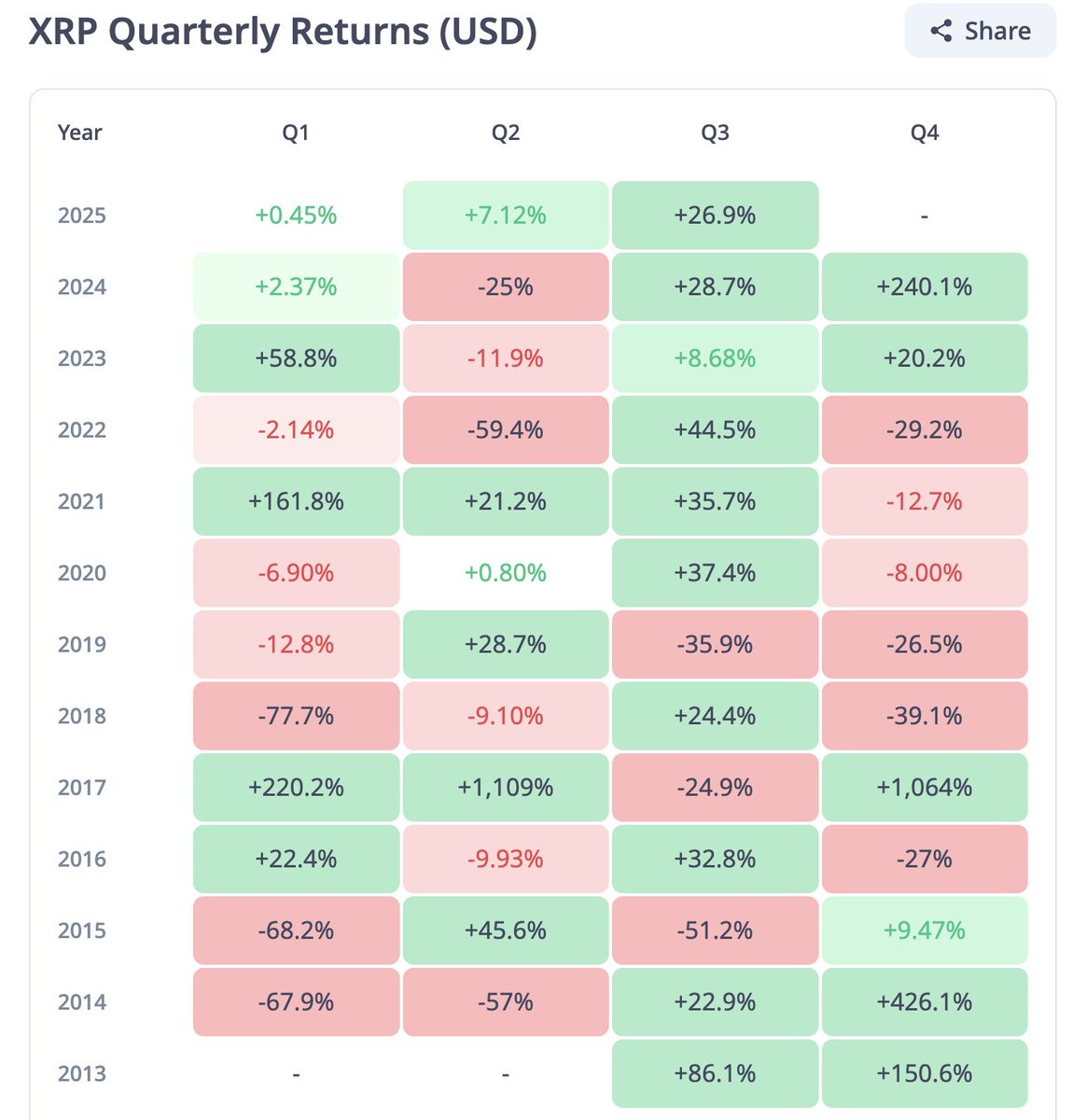

XRP’s average Q4 increase is 140%, setting expectations for a strong finish.

XRP has posted its highest-ever quarterly close, marking a milestone in its price action. At the end of September 2025, XRP closed at $2.846, representing a 2.55% increase for the month and a 27.16% gain over the quarter. This strong performance is especially notable as it follows a challenging August where the price dropped by 8.15%. Despite bearish sentiment in the market, XRP’s price continues to show resilience.

The Q3 close marks the highest quarterly closing price in XRP’s history, surpassing the previous record of $2.23 in Q2 2025. This achievement suggests that XRP has established a solid support level at $2.80, setting the stage for potential future growth. The recent price action indicates that XRP is well-positioned for the remainder of the year, with significant bullish momentum building as the market moves into Q4.

Q4 Expectations: Could XRP See a 140% Surge?

Historically, Q4 has been a strong period for XRP, with the coin often seeing explosive price movements. Notably, in Q4 2024, XRP surged by 240%, pushing above the $2 mark. XRP’s average Q4 increase is around 140%, making it the best-performing quarter for the asset.

Market analysts are hopeful that XRP could see another significant surge in the last quarter of 2025, with some speculating that it could reach a price of $6.81, assuming the typical Q4 gain.

Given the pattern of rapid price movements in previous years, many are forecasting a breakout. If XRP follows the historical trend and sees a 140% increase in Q4, it would hit an all-time high. This would represent a year-to-date increase of 228% and set the stage for continued bullish momentum as the year comes to a close.

Technical Indicators Support a Potential XRP Breakout

XRP is currently trading within a descending triangle pattern, a formation often associated with explosive price movements.

This pattern indicates that XRP may be preparing for a decisive breakout. Support at $2.80 has proven resilient, with buyers consistently defending this level, and a breakout above the descending trendline could lead to further gains.

The next major resistance level for XRP is at the 0.618 Fibonacci retracement level, which is around $3. A strong push above this level could trigger a rally toward $3.40 and potentially even $3.66. If this breakout is accompanied by high trading volume, XRP could see a significant increase in price, building on the momentum generated from its recent quarterly close.

SEC’s XRP ETF Approval Could Add Fuel to the Rally

The approval of spot XRP ETFs by the US Securities and Exchange Commission (SEC) could provide an additional catalyst for price action in October 2025. The SEC is expected to decide on six spot XRP ETF applications, including Grayscale’s, with deadlines approaching in mid-October.

The approval of these ETFs could unlock billions of dollars in institutional capital, which would boost XRP’s liquidity and adoption.

The potential approval of spot XRP ETFs has already had a positive impact on market sentiment, with XRP showing a 5% increase in price in the 24 hours leading up to the SEC decision. Even partial approvals would likely drive bullish sentiment, providing a tailwind for XRP’s price to continue rising in the coming weeks.