TLDR

- XRP price fell 8% below $3 as Trump’s tariff executive order sent shockwaves through crypto and stock markets

- Chris Larsen moved $175 million in XRP to exchanges, creating additional selling pressure during market-wide decline

- Trading volume dropped from $78 billion to $41 billion when XRP crossed new highs, showing reduced buying interest

- Trump’s tariffs hiked rates on Canada to 35% and imposed 19-39% rates on South Africa, Switzerland, Taiwan and Thailand

- Technical analysts see potential breakout between July-September 2025 with targets of $8-$27 or drops to $1.14

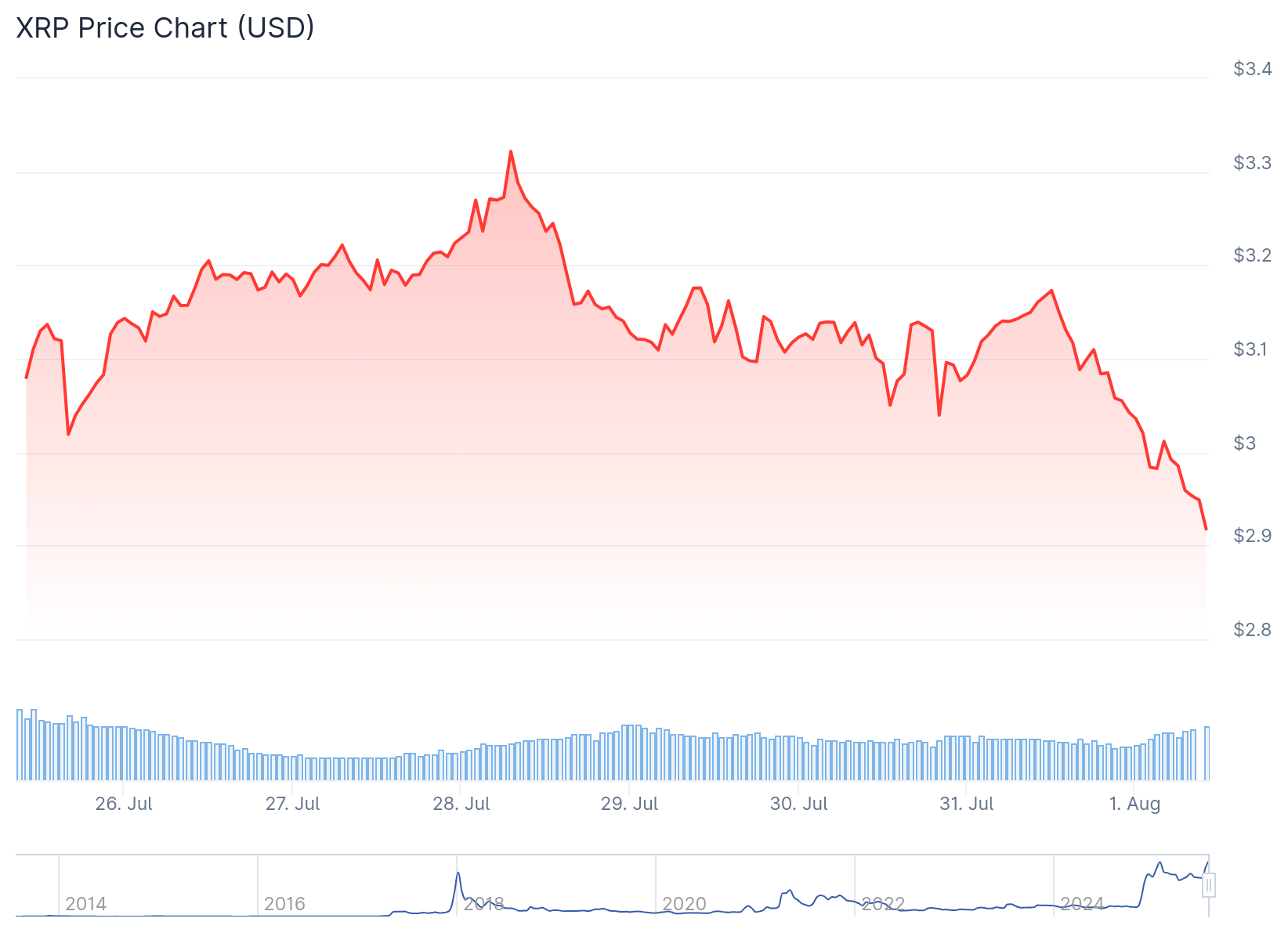

XRP price has declined more than 8% below $3 as President Donald Trump’s tariff executive order sent shockwaves through both cryptocurrency and stock markets. The digital asset is currently trading near $3 following the broader market selloff.

President Trump formalized his promised trade tariffs late Thursday through an executive order. The directive increased tariffs on Canada from 25% to 35%, catching markets off guard.

The tariff announcement triggered widespread selling across risk assets. Cryptocurrencies were particularly hard hit as investors moved away from volatile assets during the uncertainty.

🚨 US Futures Drop as Trump’s Trade Deadline Hits…

🔹 White House rolls out new tariffs after Trump’s trade deadline expires, hiking tariffs on Canada from 25% to 35%

🔹 S&P 500 $ES down over 2% from Thursday's highs

🔹 70+ countries hit with tariffs ranging from 15%-40%.

🔹… pic.twitter.com/wGxq3P5Ms8— Trader Edge (@Pro_Trader_Edge) August 1, 2025

Countries that failed to reach agreements with the Trump administration now face varying tariff rates. South Africa, Switzerland, Taiwan and Thailand will see tariffs between 19% and 39%.

The market reaction was swift and severe. XRP joined other major cryptocurrencies in declining as the tariff news dominated trading sessions.

Bitcoin’s struggle to reclaim all-time high levels added pressure on altcoins. XRP’s decline was particularly sharp given its recent strong performance to 7-year highs.

Additional Selling Pressure From Large Transfer

The crypto market selloff was compounded by Ripple co-founder Chris Larsen moving $175 million in XRP to exchanges. This large transfer raised concerns among investors during an already volatile period.

💥 BREAKING:

CHRIS LARSEN SOLD $200M IN #XRP OVER 8 DAYS.

SHOULD WE WORRY? pic.twitter.com/UnCff3mIy5

— STEPH IS CRYPTO (@Steph_iscrypto) July 30, 2025

The timing of Larsen’s transfer coincided with the broader market weakness. Combined with the tariff-induced selling, XRP faced pressure from multiple sources.

Trading volume had already shown warning signs during XRP’s recent rally. When XRP first crossed $3 in 2024, daily trading volume peaked above $78 billion.

However, during the recent highs above $3.6, the highest daily volume recorded was just above $41 billion. This decline in volume suggested reduced buying interest even before the tariff announcement.

The lower volume during new highs is often viewed as a warning sign by technical analysts. The tariff news appears to have confirmed these concerns about weakening momentum.

Despite the current weakness, some analysts see potential for recovery once the initial tariff shock subsides. The lack of aggressive selling from institutional holders could provide support for a bounce.

Technical Levels Remain Key Despite Market Shock

Crypto analyst Thecafetrader has identified several key price levels for XRP following the tariff-induced decline. The analyst notes that strong buyers drove the initial rally above 2024 highs but met resistance from sellers.

If buyers fail to step in during this market stress, XRP price could decline further from the current $2.95 level of interest. Initial downside targets are placed at $3.13, followed by $2.95 territory.

More severe declines could push XRP toward the $2.15-$2.30 range, which the analyst describes as a good entry price. The lowest target sits at $1.60-$1.93, marked as a potential buying opportunity.

On the upside, a recovery could target $4.64 if buying momentum returns after the tariff uncertainty settles. Technical analysts suggest XRP is positioning for a major breakout between July and mid-September 2025.

The tariff announcement adds another layer of complexity to XRP’s technical outlook. Market participants are now weighing both crypto-specific factors and broader economic policy impacts.

Institutional demand for XRP remains strong despite the recent price decline and tariff concerns. The ProShares Ultra XRP ETF has been approved for listing on the NYSE under the ticker UXRP.

Notable inflows into XRP exchange-traded products continue as institutional investors maintain interest in the asset. This institutional backing could provide support during the current market stress.

Ripple Labs has applied for a U.S. national banking license, raising speculation about new financial products. The legal saga between Ripple and the SEC appears to be winding down.

The resolution of regulatory uncertainty could clear the path for a possible spot XRP ETF in the United States. This development would likely increase institutional access to XRP once market conditions stabilize.

The cryptocurrency community is watching whether XRP can break through resistance levels between $2.14 and $2.40 following the tariff-induced selloff.