TLDR

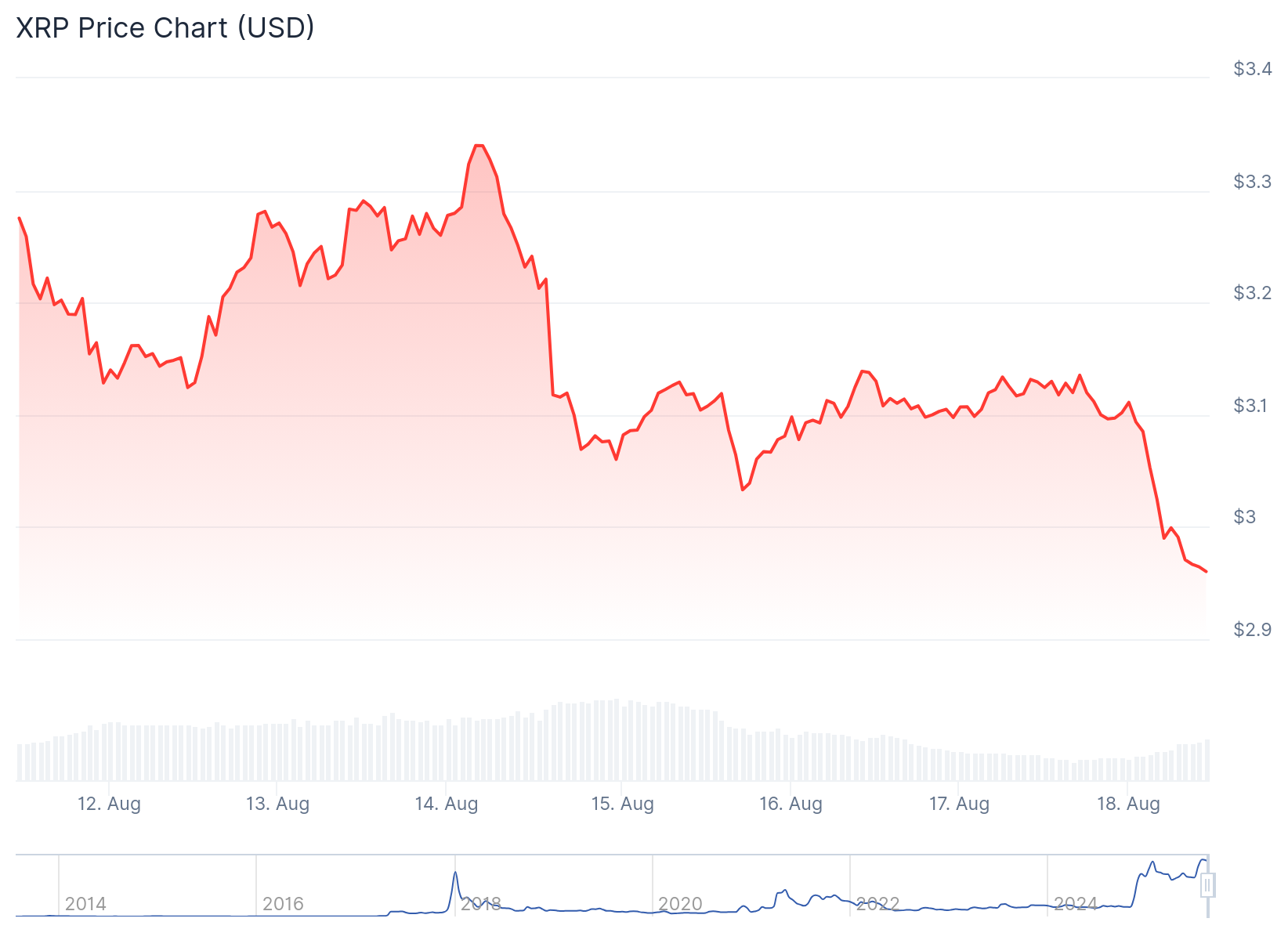

- XRP dropped 7% in 15 minutes on August 14, falling from $3.21 to $3.00 and triggering $420 million in crypto liquidations

- The price quickly recovered and held key support at $3.11, suggesting the drop may have been a liquidity hunt rather than fundamental weakness

- XRP is currently trading around $3.06 and struggling below the $3.15 resistance zone with bearish momentum building

- Technical indicators show bearish signals with MACD gaining pace in negative territory and RSI below 50

- Bulls need to clear $3.10-$3.15 resistance to prevent further decline toward $2.92 support, while long-term targets remain near $4.70

XRP price faced intense volatility this week following a dramatic price crash that wiped out hundreds of millions in leveraged positions. The cryptocurrency is now testing critical support levels as traders watch for the next directional move.

The chaos began on August 14 when XRP suddenly plunged over 7% within just 15 minutes. The sharp decline sent the price tumbling from $3.21 to exactly $3.00 in a matter of minutes.

This rapid selloff contributed to a massive $420 million in liquidations across the cryptocurrency market. The move caught many traders off guard and eliminated leveraged positions in seconds.

Despite the initial panic, XRP managed to hold the psychologically important $3.00 support level. The price quickly stabilized and began recovering, suggesting the drop may not have been driven by fundamental factors.

Market analysts noted that the sudden decline looked more like a liquidity hunt than a genuine trend reversal. XRP respected the 0.382 Fibonacci retracement level at $3.00 rather than breaking the macro 0.5 retracement at $2.76.

Current Technical Picture Shows Bearish Pressure

XRP is now trading around $3.06 after the recent volatility but faces mounting pressure from sellers. The price has fallen below the $3.15 resistance zone and is struggling to maintain momentum.

Technical indicators are flashing bearish signals across multiple timeframes. The hourly MACD is gaining pace in negative territory while the RSI has dropped below the 50 level.

XRP is currently trading below both the $3.12 level and the 100-hourly Simple Moving Average. A bearish trend line has formed with resistance at $3.06 on the hourly chart.

The price tested a low of $2.97 during the recent selloff before bouncing. This level represents the bottom of the current correction from the $3.35 swing high.

On the upside, XRP faces immediate resistance at $3.02 followed by stronger barriers at $3.05 and $3.06. A clear break above $3.06 could target the $3.12 resistance level.

XRP Price Prediction

If bulls fail to reclaim the $3.05 resistance zone, XRP could face additional declines. The first support level sits at $2.96 based on the recent low.

🚨 XRP drops 7% in Just 15min! $420M Liquidated Across Crypto! 🚨

The entire crypto market just experienced one of the wildest shakeouts. In a single 15-minute candle, $XRP dropped over 7%, and across the board, cryptocurrencies saw the same violent selloff. Within just 20… pic.twitter.com/ILQlWggIYt

— CasiTrades 🔥 (@CasiTrades) August 14, 2025

Below that, traders are watching the $2.92 level as major support. A break and close below $2.92 could open the door to further weakness toward $2.85.

The $2.80 zone represents the next major support area. A decline to these levels would likely trigger additional selling pressure and could lead to a larger correction.

However, the broader bullish structure remains intact as long as XRP holds above the $2.76 macro support level. This level represents the 0.5 Fibonacci retracement of the recent rally.

The $3.11 golden retracement level that XRP recovered to after the flash crash remains crucial for near-term direction. Trading above this level could trap short sellers and spark fresh buying interest.

Resistance levels are clearly defined at $3.21, $3.41, and the recent high area around $3.66. Breaking above these zones could set up XRP for a move toward the long-term target near $4.70.

The cryptocurrency is currently at a critical juncture with bears pushing lower while bulls attempt to maintain control near the $3.00 psychological support level.