TLDR

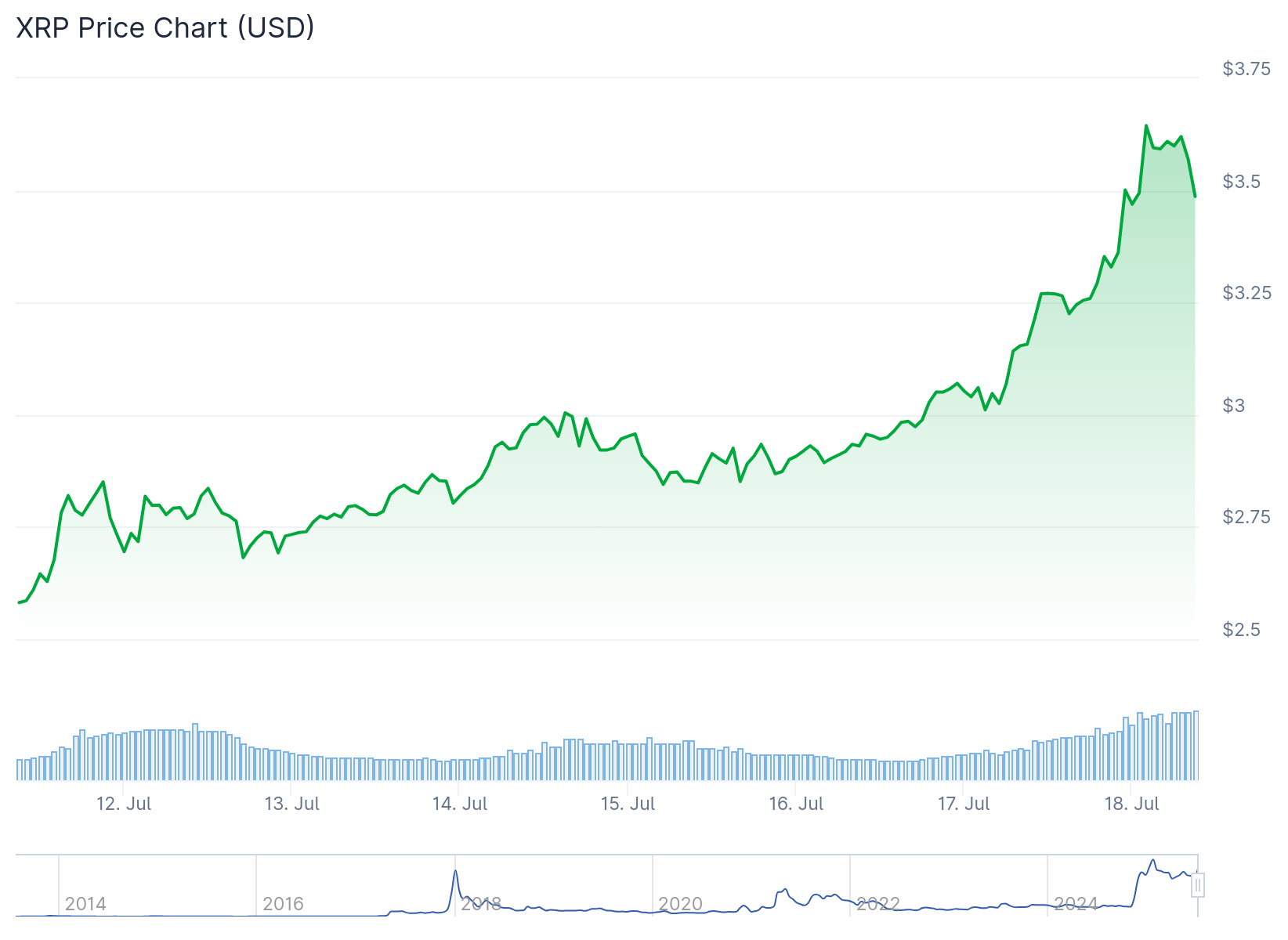

- XRP hit new all-time highs above $3.60 in July 2025, surpassing its 2018 record with over 20% gains in 24 hours

- ProShares Ultra XRP ETF received approval for NYSE listing under ticker UXRP, marking institutional acceptance milestone

- Ripple resolved legal issues with SEC by not pursuing cross-appeal, providing regulatory clarity for institutional investors

- XRP futures trading volume approached $4 billion driven by institutional platforms, with open interest topping $10 billion

- Technical analysts project potential price targets of $4.20-$10+ by 2030 if payment adoption continues growing

XRP just reached new all-time highs, climbing above $3.60 and breaking its previous record from 2018. The token gained over 20% in 24 hours, reaching $3.61 as its highest level in over six years.

#XRP ALL TIME HIGH!!!! 🎉🍾

8 YEARS LATER‼️ pic.twitter.com/P6in5RKO8T

— Cryptoes (@cryptoes_ta) July 17, 2025

The rally came with three massive volume surges at key trading windows. Over 200 million XRP changed hands during breakout periods at 05:00, 08:00, and 21:00 UTC according to CoinDesk Analytics.

Price volatility reached nearly 20% during the session. The $3.29-$3.30 zone served as a high-volume base throughout trading.

Bulls repeatedly absorbed sell pressure at this level. The token pushed past key resistance at $3.52-$3.53 during the breakout.

ETF Developments Drive Institutional Interest

ProShares Ultra XRP ETF received approval for listing on the New York Stock Exchange under ticker UXRP. This represents a major milestone for XRP’s institutional acceptance.

🚨 IT'S HAPPENING! 🚨

ProShares Ultra XRP ETF is now listed on the DTCC under the ticker $UXRP 🧨

📄 Official SEC filing confirms:

📅 Launch proposed for July 18, 2025This isn't speculation anymore it's in motion! 💥 $XRP pic.twitter.com/rakgBulx3P

— 𝕏aif🇮🇳|🇺🇸 (@Xaif_Crypto) July 13, 2025

Purpose XRP ETF also launched on the Toronto Stock Exchange. Additional ETF interest emerged in both the U.S. and Canada markets.

BlackRock reportedly showed interest in spot XRP ETFs. This development increases accessibility for traditional investors.

The moves indicate expanding institutional involvement in XRP trading. Traditional finance firms are gaining easier access to XRP exposure.

Legal Clarity Boosts Market Confidence

Ripple announced it will not pursue a cross-appeal in its long-running SEC case. This legal resolution provides regulatory clarity for institutional investors.

The decision paves the way for greater participation by institutional investors. It also facilitates approval of spot XRP ETFs in the U.S. market.

Ripple Labs applied for a U.S. national bank charter in early July. If approved, this would bring Ripple under federal and state regulation.

BNY Mellon was appointed as custodian for Ripple’s XRP dollar reserves. This enhances security and legitimacy of Ripple’s digital asset holdings.

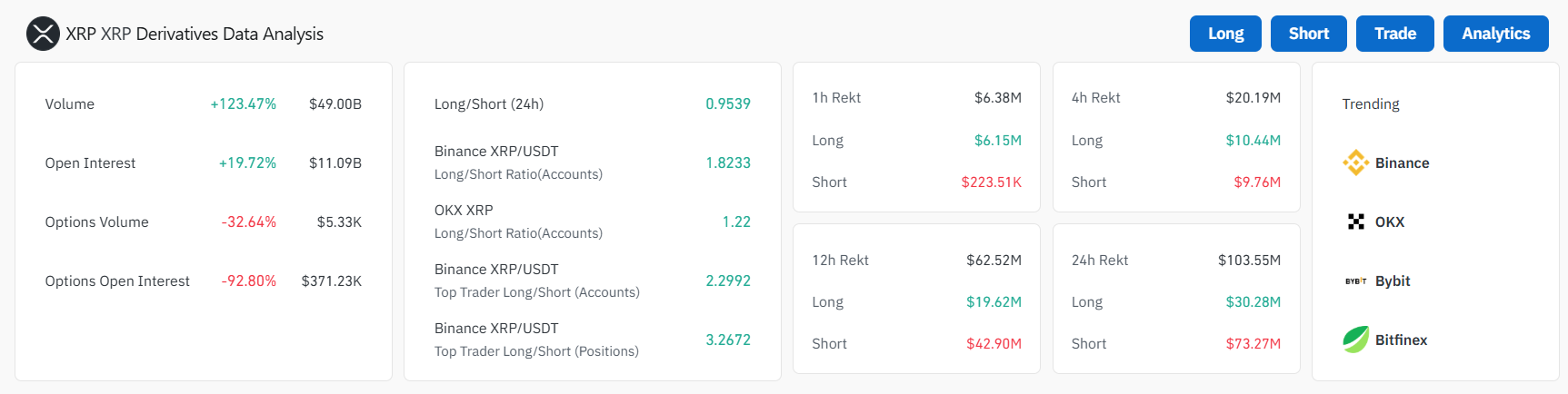

XRP futures trading volume approached $4 billion, largely driven by institutional trading platforms. Open interest in XRP derivatives topped $10 billion for the first time since 2021.

Large holders of XRP increased their positions during the rally. Wallets holding 1-10 million tokens now represent nearly 10% of total supply.

The rally liquidated over $68 million in short positions. This indicates an aggressive shift in market sentiment from bearish to bullish.

Funding rates across major exchanges flipped positive. This suggests aggressive long positioning by traders.

Ryan Lee, Chief Analyst at Bitget, provided price targets for XRP. Short-term targets range from $2.00-$2.17 on the downside to $2.65-$3.00 on the upside.

Long-term forecasts suggest $4.20-$10+ by 2030 if Ripple capitalizes on payment adoption. The medium-term trajectory could extend to $5.89, depending on ETF approvals and regulatory clarity.

Technical indicators remain mixed with neutral RSI and bearish MACD. These point to potential near-term consolidation despite the strong rally.

Ripple co-founder Chris Larsen sold $26 million worth of XRP during the recent price surge. On-chain data shows he has moved $344 million in total since 2020.

XRP has gained nearly 70% in the past 30 days, emerging as the strongest performer among major cryptocurrencies. The global crypto market capitalization topped $4 trillion, reflecting renewed strength in altcoins.