TLDR

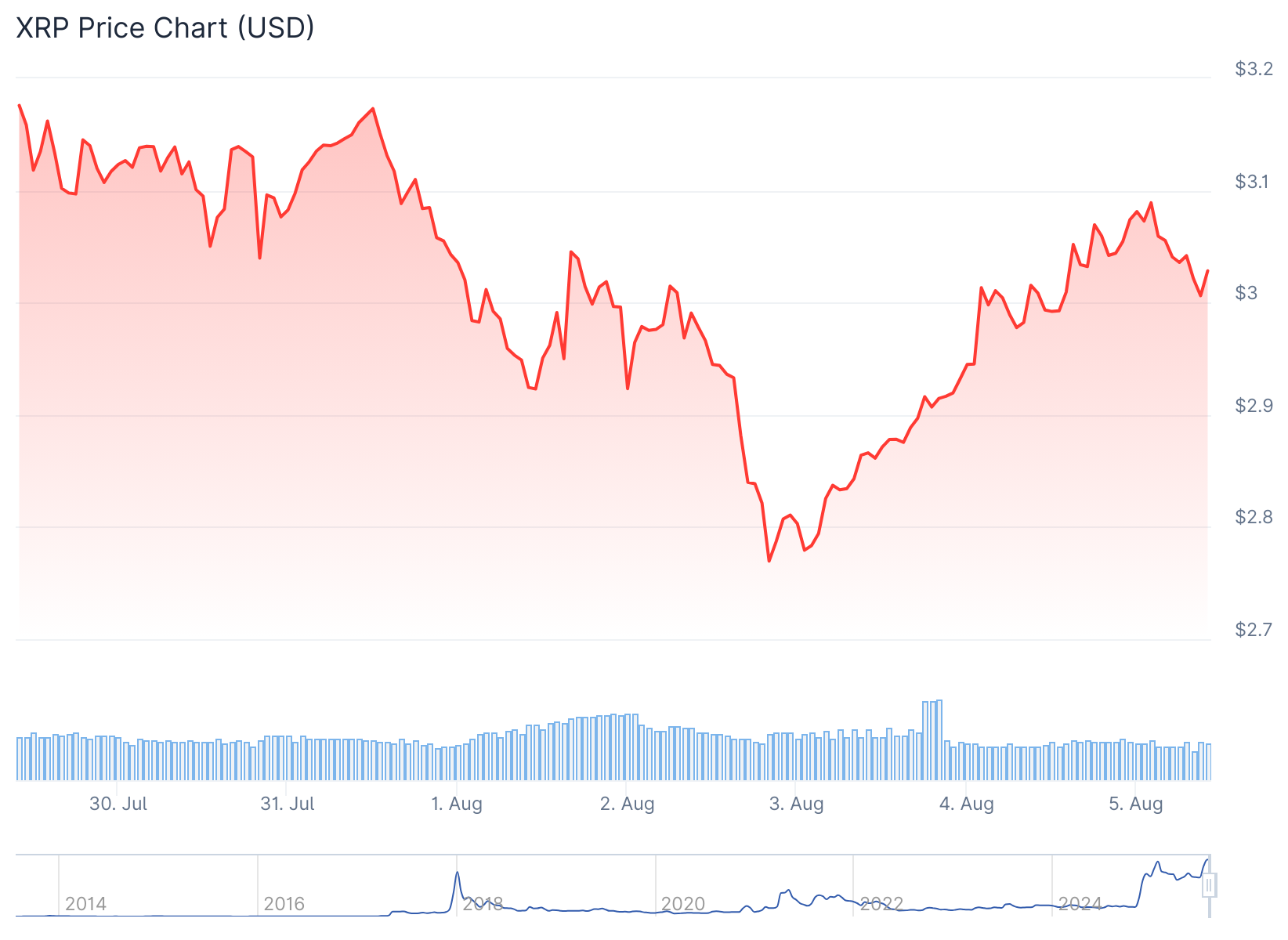

- XRP price traded near $2.90 after dropping to $2.75, showing resilience at key support levels

- Analysts identify $3.12 and $3.21 as critical resistance levels that could signal bullish continuation

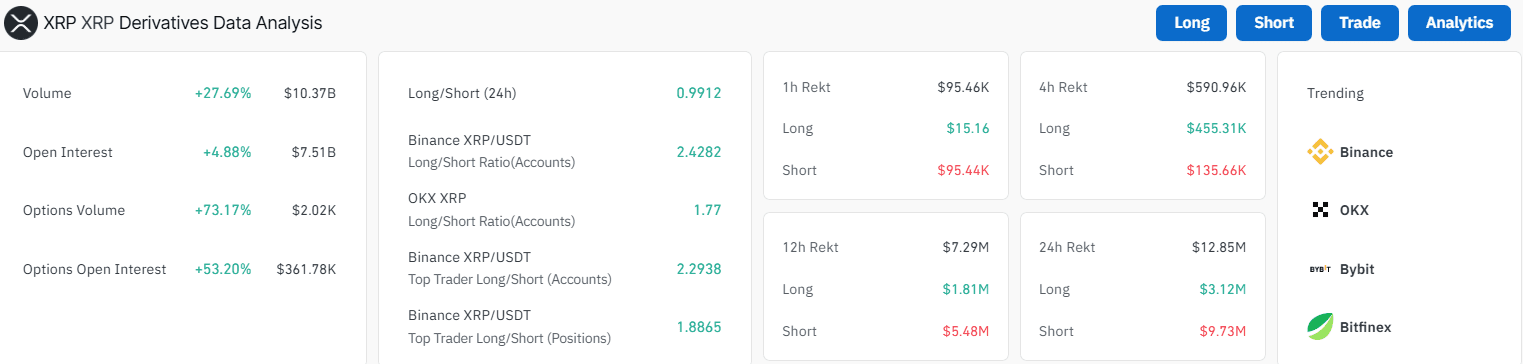

- Trading volume surged 27.69% to $10.37 billion, indicating increased market interest

- Support at $2.75-$2.85 range has held firm during recent price corrections

- Ripple CTO announced plans for personal XRPL server to support network testing and performance

XRP price has shown resilience after testing key support levels over the weekend. The cryptocurrency traded near $2.90 following a brief dip to $2.75 earlier in the session.

The recent price action has drawn attention from traders watching critical support and resistance zones. Support has held firm around the $2.75-$2.85 range, while resistance levels at $3.12 and $3.21 remain key barriers.

Analyst EGRAG CRYPTO noted that the sharp wick on XRP’s chart caused panic among newer traders. However, he suggested the price movement could be building one of the strongest candle structures in years.

#XRP – This Wick Made Many Shit Their Pants! 😱

In the near future, you will be remembered as the person who panicked over a tiny wick on the 2-month time frame, all while we’re forming the highest and most significant candle body structure in #XRP history! 📈🔥

Remember, Glory… pic.twitter.com/ZvSfsX145Q

— EGRAG CRYPTO (@egragcrypto) August 3, 2025

The analyst emphasized that closing above $3.12 would be crucial for XRP to regain upward momentum. Without breaking this level, he warned that another wick could appear and shake out more traders.

Technical Analysis Points to Key Levels

Market makers often use fear-based moves to their advantage, particularly targeting less experienced traders. The recent dip to $2.75 represented a 50% Fibonacci retracement level that proved critical for XRP’s future direction.

Dark Defender, another analyst following XRP, had predicted the $2.8558 level days earlier. He referred to this point as the fourth wave dip in the current price pattern.

The analyst reminded traders to be cautious with leverage, noting it can lead to losses and emotional reactions. He suggested that once XRP moves past $3 again, more people will understand the forming structure.

CasiTrades pointed out that XRP’s bullish setup may still be intact despite the short-term correction. The cryptocurrency was tested at the $3.00 level, which serves as a .382 Fibonacci retracement.

Initially, XRP showed good recovery when it hit $3.00, bouncing back to $3.31. However, the rally faded when the price failed to break through with consistency.

The rejection at $3.31 raised concerns that the rally was part of a larger corrective phase. The inability to break through resistance suggested the bull trend was not fully established.

Market Activity Shows Increased Interest

Trading volume has surged by 27.69% to $10.37 billion, according to Coinglass data. Open interest also rose 4.88% to $7.51 billion during the same period.

The increased market activity suggests growing interest in the asset. This volume increase could strengthen the potential for a bullish push in the coming sessions.

The 15-minute and 4-hour charts are forming bullish divergences. These indicators suggest the move toward $2.75 may have disrupted the corrective pattern.

Such technical signals provide hope that XRP’s price could soon change direction. The low at $2.75 remains above the prior wave 1 high at $2.65, maintaining the larger bullish trend.

Looking ahead, the next critical resistance point sits at $3.21. A convincing breakout above this level would signal the end of the correction phase.

If XRP successfully breaks $3.21, analysts are watching for price movement toward the $4.60-$4.80 range. The psychological $4.00 mark also remains another critical point for the cryptocurrency.

Meanwhile, Ripple’s Chief Technology Officer David Schwartz shared plans for a new XRP Ledger server. He announced he would set up a personal high-speed server in a New York data center to support the network.

The server would run independently from Ripple’s official operations. It would serve as a way to gather data and help test network performance while maintaining XRPL’s decentralized nature.