TLDR

- XRP futures open interest dropped $2.4 billion after price fell 19% from $3.66 peak on July 18

- Monthly futures remain at neutral 6-8% premium despite price decline, showing stable sentiment

- Technical analysts see XRP mimicking Bitcoin’s breakout pattern with potential targets of $4-$10

- XRP Ledger shows low DeFi adoption with only $134 million in tokenized assets

- Ripple unlocks 1 billion XRP monthly from escrow with most returned, limiting supply impact

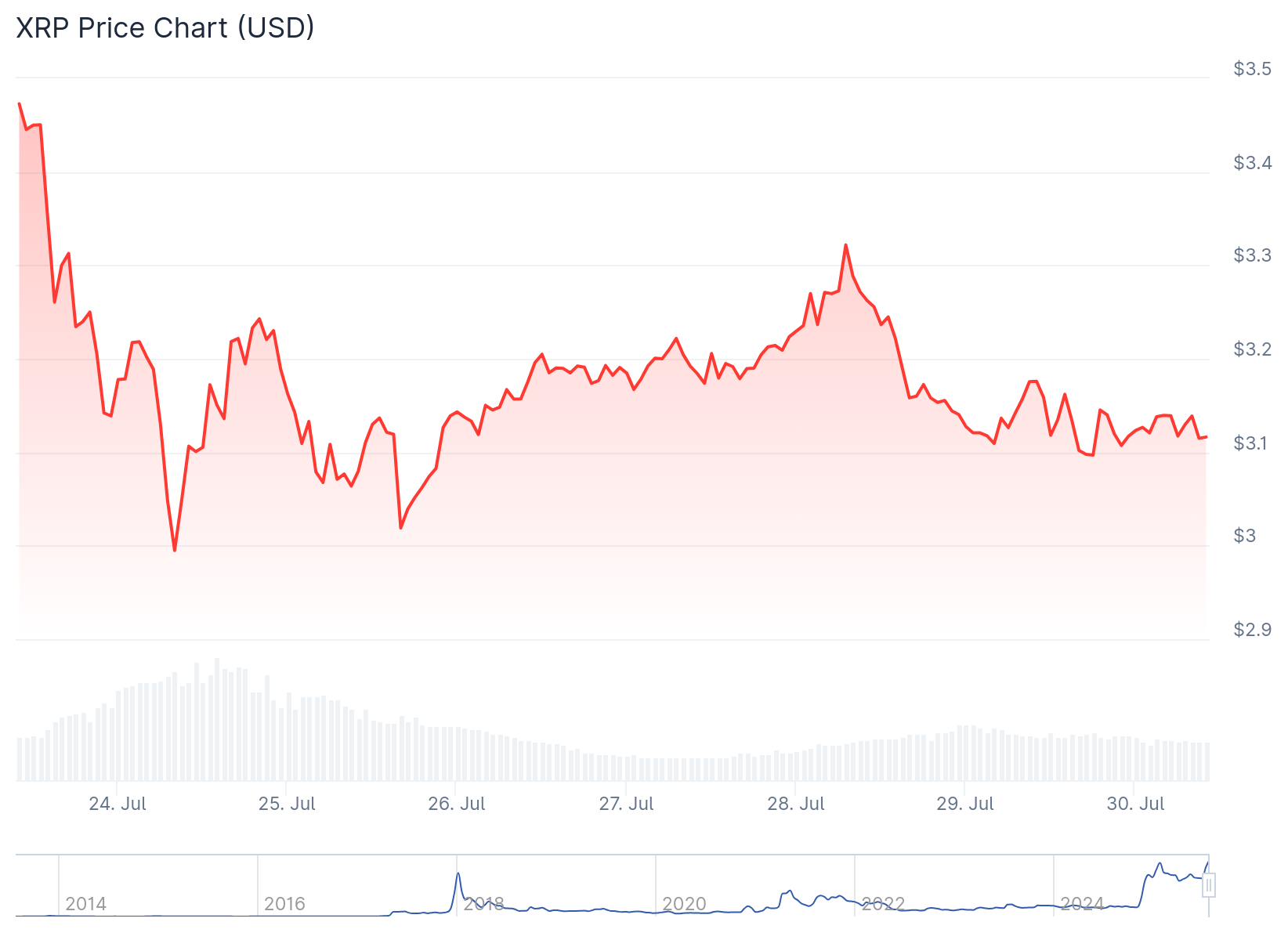

XRP price has fallen 19% since reaching $3.66 on July 18, dropping to current levels around $3.11. The decline came with a $2.4 billion decrease in futures open interest, raising questions about the altcoin’s next move.

The recent price action followed a strong 68.7% rally between July 1 and July 18. During this period, XRP climbed from $2.17 to its peak of $3.66.

Aggregate XRP futures open interest reached an all-time high of $11.2 billion on July 18. It has since fallen to $8.8 billion, representing a 21% drop in dollar terms.

Even measured in XRP units, current contracts of 2.82 billion represent a 12% decrease from the peak. Liquidations totaled $325 million during the two weeks ending July 25.

Open interest remains 48% higher than one month ago in XRP terms. This elevated level keeps traders cautious about potential further volatility.

Futures Markets Show Neutral Sentiment

Monthly XRP futures have consistently traded at a 6% to 8% premium over the past week. This falls within the normal 5% to 10% range that indicates neutral market conditions.

The premium did not surge even when XRP briefly rose above $3.60. This suggests reduced risk of cascading liquidations under normal market swings.

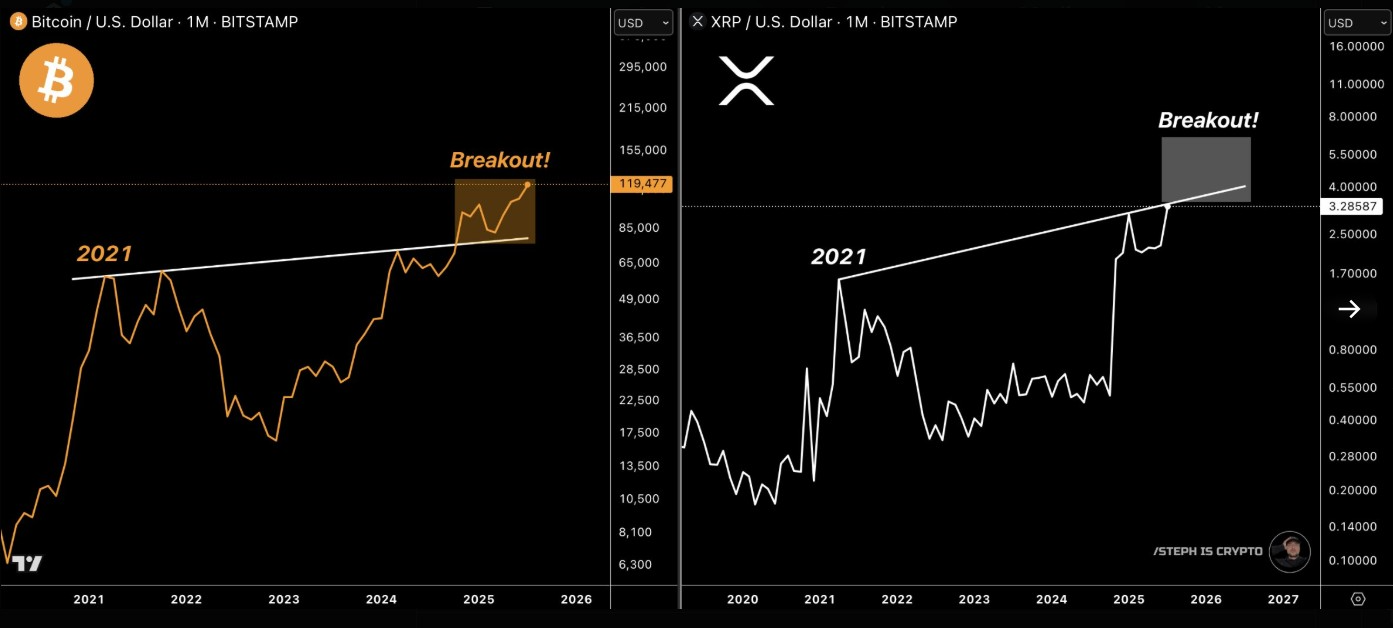

Market analyst Steph Is Crypto highlighted similarities between XRP’s chart pattern and Bitcoin’s recent breakout. Bitcoin broke above its 2021 resistance level and reached $119,000 before settling around $117,000.

XRP sits just below comparable resistance from its 2021 cycle high. The comparative analysis suggests XRP could follow a similar breakout pattern.

Technical Targets Range from $4 to $10

Analyst Zach Rector noted that XRP price closed above $3.24, a key Fibonacci resistance level. This move signals that downside pressure may have diminished.

The analyst predicted a move to the $4-$5 range before August 12. Extended projections reach $7 to $15 by September 7 based on Elliott Wave Theory and Fibonacci extensions.

These targets derive from cycle timing tools and historical wave analysis. The broader cycle may continue into November or December according to the forecast.

Limited On-Chain Activity Raises Questions

Despite price gains, the XRP Ledger shows limited decentralized finance adoption. Only $134 million in tokenized assets exist on the network according to RWA.xyz data.

This falls well short of top-10 rankings and trails Avalanche’s $190 million. Decentralized exchange activity on XRP Ledger does not place it among the top 50 blockchains.

The Sui blockchain processed $13.3 billion in 30-day DEX volumes for comparison. Sei handled $1.43 billion over the same period.

Regulatory and Institutional Developments

Part of XRP’s recent optimism stems from ETF speculation. Ether products have surpassed $18 billion in assets under management, raising hopes for other altcoin ETFs.

The GENIUS Act mandates strategic evaluation of digital assets. XRP appears in federal documents related to crypto reserve infrastructure feasibility studies.

PayPal recently launched a crypto payment service supporting over 100 cryptocurrencies including XRP. The service reduces international transaction fees by up to 90%.

Monthly Token Unlocks Continue

Ripple unlocks 1 billion XRP from escrow monthly as part of its regular schedule. Between 700 million and 800 million tokens typically return to escrow.

The remaining 200-300 million sell through over-the-counter transactions with institutional partners. This structure avoids exchange-based selling that could pressure prices.

XRP has maintained steady institutional demand since Q3 2019. The controlled distribution mechanism provides structural support for price stability during large volume sales.