- Zcash vs Ethereum at a Glance:

- What is Zcash?

- Truly private transactions?

- Market Outlook:

- Ethereum- A sleeping Giant

- Ethereum vs Bitcoin

- Market Outlook:

- Verdict

As the cryptocurrency economy develops and begins to engulf the world of alternative investments, the community continues to discuss the best new applications of blockchain technology and how these projects can not only develop on their own but come together to bring a decentralized solution to the internet.

Two applications of blockchain technology that will soon have real-world uses involving conducting completely private transactions via the blockchain and the use of smart contracts through decentralized applications (DAPPS).

Zcash, a protocol that provides a privacy-preserving version of Bitcoin, aims to help users pay one another directly via payment transactions that reveal neither the origin, destination or amount of payment. On the other hand, Ethereum provides a decentralized virtual machine which can execute smart contracts, store data and facilitate services currently centralized by the global economy.

Although similar in decentralized scope, Zcash and Ethereum are structured differently and aim to accomplish different goals within the blockchain community. As you will see below, despite their inherent differences, these two platforms aim to work together to change the future of the internet and the future of decentralized protocols.

Zcash vs Ethereum at a Glance:

| Cryptocurrency | ||

|---|---|---|

| Launch Date | October 28th, 2016 | July 30th, 2015 |

| Creator | Zooko Wilcox | Vitalik Buterin |

| Algorithm | Zerocoin | Ethash |

| Average Block Time | 2.5 Minutes | 15 Seconds |

| Block Halving | Every 840,000 Blocks | Constant Generation Every Year |

| Max Total Coins | 21,000,000 | No Max (Max Growth of 18m per year with 72m originally) |

What is Zcash?

Zcash is based on the Zerocash protocol which aims to fix Bitcoin’s privacy issues wherein every user’s payment history is in public view on the blockchain. Anonymity (one of pure cash transactions’ biggest advantages) is a crucial step to allow cryptocurrencies to become everyday payments, and Zcash makes strong strides in this direction. The Zcash team decided to fork a copy of the bitcoin blockchain and kept the design relatively the same aside from a few differences. These differences included:

-Changing the block interval target from 10 minutes to 2.5 Minutes.

-Increasing the block size limit to 2MB.

-Introducing a confidential value transfer scheme.

-Implementing a 20% reward to the Zcash team for each block rewarded for the first four years (or until the first halving occurs).

Truly private transactions?

Currently, the Bitcoin blockchain has a major limitation—the blockchain is public, and the history of all payment transactions is available to anyone. To compare, when making payments with a bank, you only disclose your finances to the bank and the related parties. With Bitcoin, you disclose them to the whole world.

Zcash guarantees users privacy by providing Zerocash payment transactions that do not reveal the origin, destination, or amount of any transaction. If you were to look at the ledger you would see a random-looking string that provides no information beyond the fact that the transaction was valid, and it occurred.

To implement this policy with an extra focus on anonymity, users create Basecoins which are non-anonymous in nature and can convert those to Zerocash coins or Zcash coins. When these coins are converted, they can be sent to other users in any way that the user sees fit.

The underlying zK-Snark proof that enables Zcash to be functional will allow for the enforcement of a wide range of policies. For example, imagine a situation where users can prove that they paid their taxes on all transactions without revealing their private information and keeping it out of centralized servers that are prone to hacking and data breaches.

Market Outlook:

Coming up on its one year anniversary, Zcash has had a great year with a price hitting over $400 in June 2017. Many in the community have taken great pride in endorsing the Zcash platform as they understand the importance of anonymous transactions in the future of cryptocurrency payments. That is not to say there is no controversy—many users have rebelled against the way mining rewards are allocated until the first block halving occurs. The rewards have a 20% kickback to the Zcash team which has the backing of multiple venture capital investors. Additionally, many have flocked to competitor coin Monero who some believe have a more secure way of conducting transactions.

Ethereum- A sleeping Giant

With a market cap eclipsing $27 Billion (the second largest behind Bitcoin), it’s hard to call Ethereum a sleeping giant, but regardless it doesn’t take the savviest investor to see all the potential uses for smart contracts in today’s economy.

Building blockchain applications used to require a complex background in coding, cryptography, mathematics as well as a large network of peers to assist when issues arise, as they inevitably do. Ethereum is a platform that enables developers to build and deploy decentralized applications (DAPPS) in the most streamlined and efficient way. With an extra focus on community and ease of use, developers are currently building thousands of different applications that are going to shape the future of the web3.0.

These applications will utilize smart contracts which are essentially self-executing code that will perform certain functions when conditions are met. These decisions can be enforced and monitored by the blockchain which provides opportunities for government compliance and audit opportunities.

Although we are in the early phases of smart-contract development, these apps have the ability to be corruption & tamper proof and provide assurance there will be zero downtime. Think about an internet where developers didn’t have to take a piece of the profit and kick it back to Apple for listing it in the app store. Think about what unique problems would be solved if every application didn’t need to pass Apple’s terms of service standard. From finance to real estate to insurance the future is full of unimagined possibilities that Ethereum will permit to develop on its platform.

Ethereum vs Bitcoin

In order to understand what Ethereum does well, it’s important to understand what Bitcoin does and how that compares to the benefits of Ethereum. What Bitcoin does for distributed data storage, Ethereum aims to do, plus computations. These computations are smart contracts which are possible due to the creation of the Ethereum Virtual Machine (EVM). When comparing the two projects, Bitcoin’s block time is around 10 minutes, while Ethereum’s aims to be close to 12 seconds. Another major difference is that Ethereum uses its own turning complete internal code, allowing developers to create an endless number of apps on the platform.

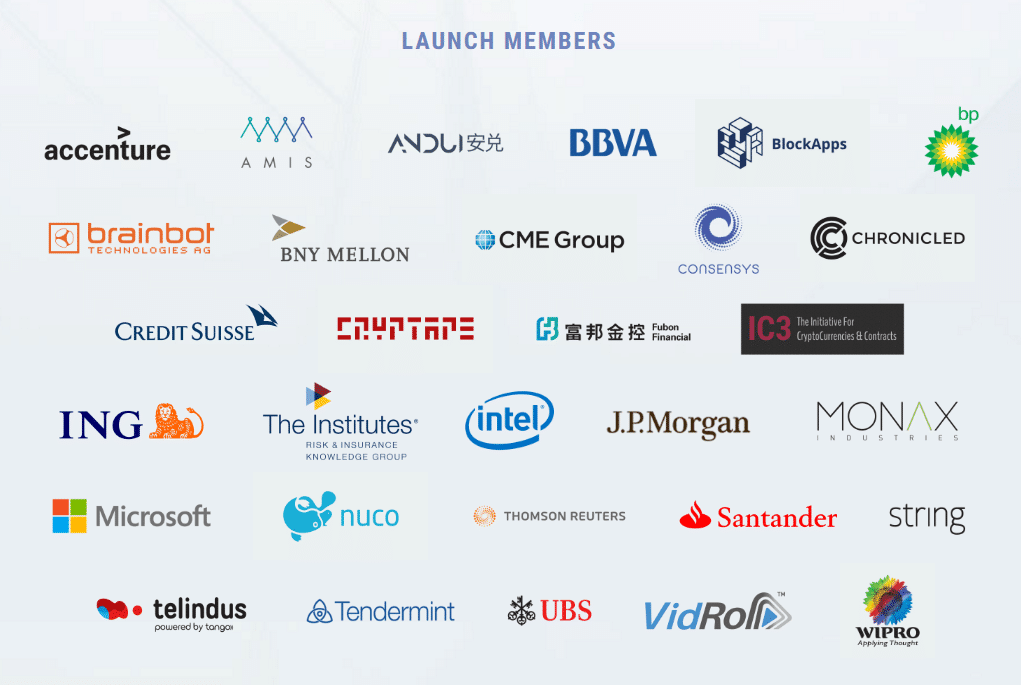

But the thing that takes the Ethereum platform to the next level is its community involvement and partnerships with top companies around the world. The Enterprise Ethereum Alliance is the connection of Fortune 500 companies, startups, and technology vendors working together to build real-world applications utilizing the Ethereum blockchain. Its members include the following:

Market Outlook:

Ethereum was founded by an online sale of ETH tokens in 2014, rising to become the platform many believe will eventually overtake Bitcoin for the number one position in all cryptocurrency. With an extremely strong developer community, a long list of fortune 500 companies working to hire and educate talent to develop on the Ethereum blockchain, and a jammed packed roadmap which aims to allow for the efficient throughput of a visa level number of transactions, it is no surprise that optimism is high. In Q4 of 2017, the Ethereum Foundation will be releasing Metropolis, a hard fork that many consider a major stepping stone towards the usability of the platform.

Zcash + Ethereum = ❤

While there are bright spots, the blockchain community can seem uncollaborative and critical at times. Many have a personal interest in the future of specific coins, and thus personal and professional attacks are common.

Zcash and Ethereum are an example of how two platforms are working together to benefit not only themselves but the users of the platform and public blockchains. Zcash and Ethereum have had at least three publicly known, semiofficial projects leading to Vitalik Buterin becoming an official advisor to the Zcash platform. Their goal is to find out how Zcash’s zK-Snark proofs can be implemented on the Ethereum blockchain.

Although there is still work to be done, the beginning of the integration allowing for Zcash transactions on the Ethereum blockchain has started to come to light with the first iteration of the Metropolis hard fork. During the first part of the hard fork (named Byzantium), new precompiles will be released which will allow for private transactions to occur. If all goes right, all Ethereum contracts will be able to send and receive Zcash.

You can learn more about the integration between the two platforms by listening to the presentation by Zcash CEO Zooko Wilcox during Devcon2.

Verdict

2017 has been a fantastic year for the cryptocurrency community. Besides the obvious jump of crypto platform valuations, it really seems like the world is starting to recognize the potential that distributed ledger technology can have on the internet and the global economy. Within this community, two of the biggest platforms, Zcash and Ethereum, are working to increase adoption and scale efficiently.

Zcash, with its focus on privacy, is utilizing a zero-knowledge proof and wants to allow users of any kind to have the ability to send public and private transactions in a public blockchain. Ethereum, on the other hand, wants to develop the ecosystem for decentralized application adoption Their goal is to build a community of developers and enterprises working together to cut costs while getting rid of inefficient intermediaries.

Together, Zcash and Ethereum aim to work together to allow Zcash level privacy on the Ethereum blockchain. If this can be implemented without any issues, this would be a major milestone that would bring excitement to the cryptocurrency community. The sky’s the limit for these two platforms, and it will be fascinating to see how they compete against the number of emerging competitors while navigating the unknown frontier of cryptocurrency regulation.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.