TLDR

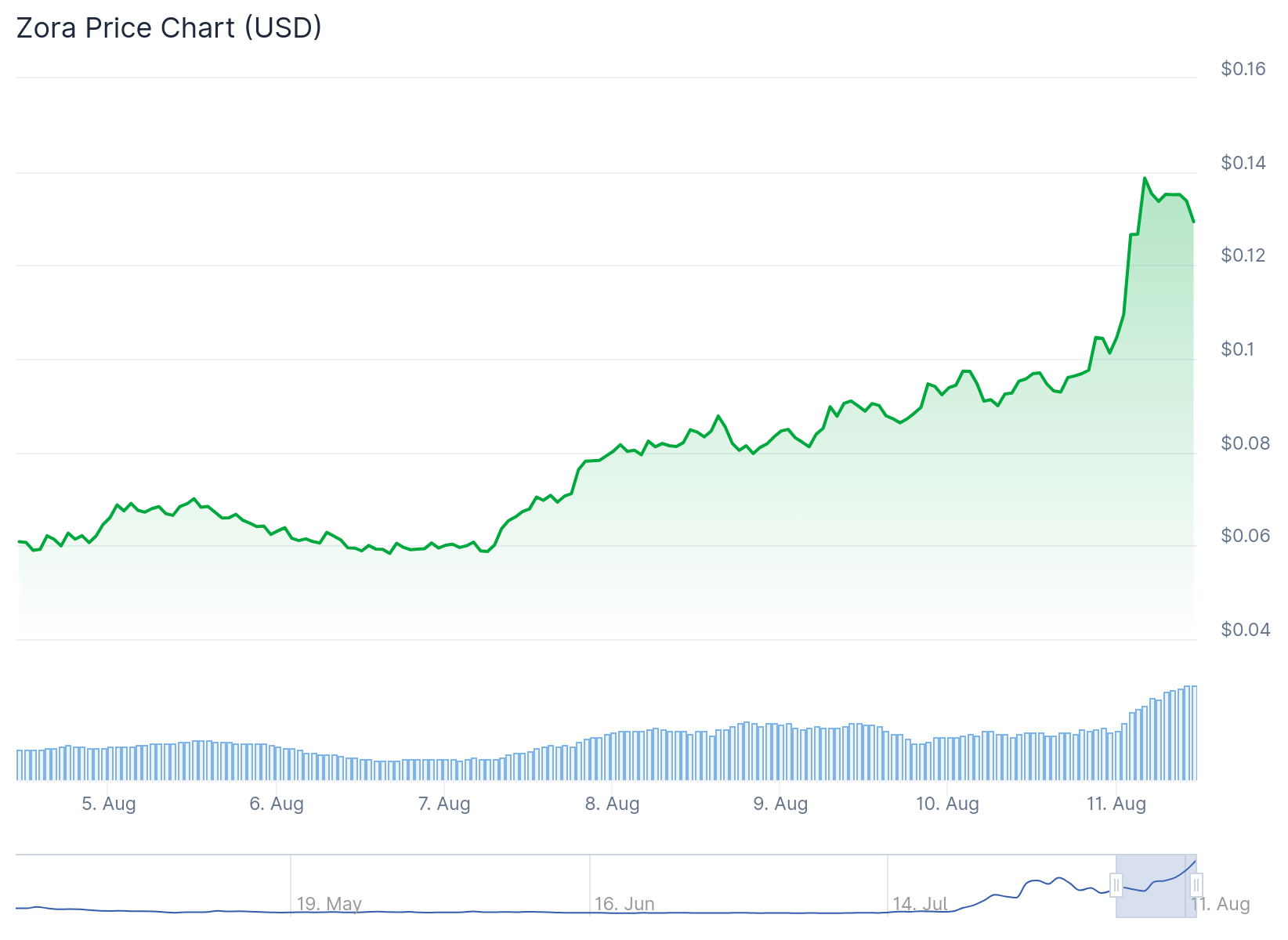

- ZORA price surged 50% in 24 hours to over $0.13, extending weekly gains to 118%

- Trading volume jumped to $284 million as major exchanges added perpetual contracts

- Market cap reached $450 million with no immediate news catalyst driving the rally

- RSI at 77 indicates overbought conditions while MACD shows continued bullish momentum

- Coin creation activity spiked with 47,000 token issuances from 21,000 creators on Sunday

Zora token experienced a dramatic price surge over the weekend, climbing nearly 50% in 24 hours to reach over $0.13. The rally extended a week-long upward trend that has seen the token gain more than 118% in seven days.

The price movement pushed ZORA’s market capitalization to $450 million. Trading volume increased sharply to $284 million on Sunday from under $160 million the previous day, reflecting heightened investor interest.

No immediate catalyst or news event appeared to drive the demand surge. Market analysts suggest the rapid price movement indicates a large purchase by a wealthy investor anticipating future volatility.

The rally coincided with increased activity on the Zora network. On-chain data shows 47,000 token issuances from 21,000 creators on Sunday, marking the highest figures since July 31.

Zora operates as an OP Stack Layer 2 blockchain designed for creators and media minting. The platform was added to the Base App discovery flow in mid-July, improving retail access and boosting creator activity.

Exchange Listings Fuel Trading Activity

Major derivatives exchanges, including Binance, introduced ZORA perpetual contracts during the rally. These contracts offer leverage up to 50x, widening access for directional trading and attracting speculative capital.

The perpetual contract listings likely compressed trading spreads and deepened market liquidity. This development facilitated both spot and leveraged positioning in the Base ecosystem token.

ZORA launched in April through a retroactive airdrop to early platform users. This distribution method left a relatively tight free float in circulation.

ZORA Price Prediction

Current technical indicators present a mixed outlook for ZORA’s price action. The Relative Strength Index sits at 77.08, indicating overbought conditions that could trigger a short-term pullback.

However, the MACD indicator remains bullish with the MACD line above the signal line. The positive histogram suggests continued upward momentum in the near term.

Open interest data from CoinGlass shows market activity increasing by 67.27% to $927.75 million. Open interest itself rose 43.49% to $155.36 million during the rally period.

The OI-Weighted Funding Rate stands at -0.0030%, suggesting some traders are taking short positions. This introduces caution regarding overall market sentiment despite the strong price performance.

🔥 Price is up 10x in under a month!

Massive congrats to early holders.$ZORA – Price Analysis [Request]Trend check:

Uptrend and bull pressure looking super solid! 📈We could see another 20–30% pump towards the next big psychological level.

My Tip:

Watch the… pic.twitter.com/AgjQuYqv0O— 🧙 Crypto_Jobs🧙♂️ TA & FA 🎯 (@CryptoJobs3) August 10, 2025

Analysts project ZORA could see additional gains of 20-30% if it breaks above current resistance levels. The token needs to hold above $0.08800 to maintain its bullish trajectory.

Current trading data shows ZORA at $0.1323 with sustained high volume supporting the price level.