Nexus is a peer-to-peer network that improves on the speed, scalability, security, and accessibility of current blockchain protocols. The project mainly accomplishes this through the use of a quantum-resistant 3D blockchain in combination with communication satellites in space. With this, Nexus founder Colin Cantrell is aiming to “decentralize the decentralization”, by taking it out of reach of any government control or mining pool monopolies.

Hold on to your hats, folks. This is one of the more ambitious projects out there, so let’s get right into it.

In this Nexus guide, we’re going to go over:

- Three Dimensional Chain (3DC)

- Nexus Hardware

- Nexus Coin (NXS)

- Nexus Team & Progress

- Trading

- Where to Buy NXS

- Where to Store NXS

- Conclusion

- Additional Nexus Resources

Three Dimensional Chain (3DC)

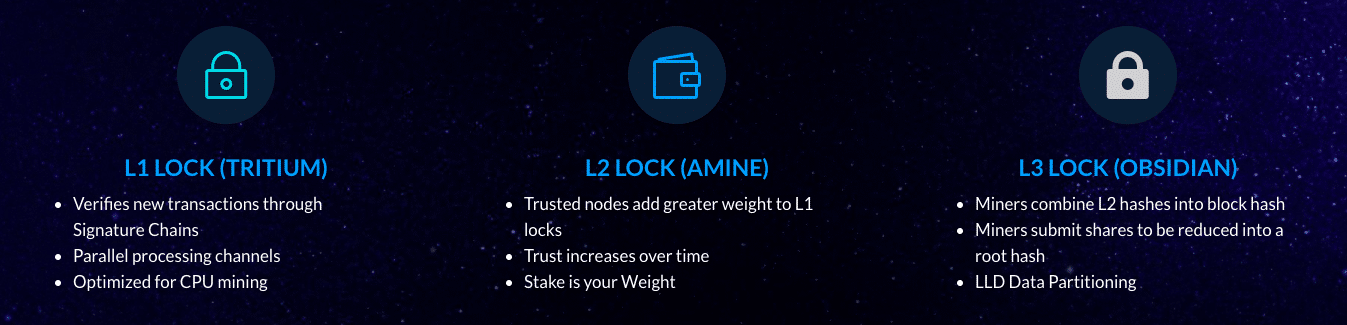

Nexus uses, not one, not two, but three consensus mechanisms to form a three-dimensional blockchain. The team argues that having three different mechanisms in place reduces miner centralization and enables more efficient on-chain scaling.

Prime Channel

The Prime Channel is a Proof-of-Work channel. In this channel, miners search for 308-digit dense prime clusters through trial-and-error. Dense prime cluster mining is more ASIC-resistant than traditional hash mining. Therefore, even if you have just a CPU, you can mine on this channel.

Outside of cryptocurrency, the mining on the Prime Channel produces data that can be further used in prime number research for quantum physics.

Hashing Channel

The Hashing Channel is also Proof-of-Work but uses Hashcash instead of dense prime clusters. This is similar to Bitcoin’s mining algorithm except that miners search for SHA-3 (with Skein) hashes while Bitcoin miners find SHA-256 ones. The Nexus block hashes are 4x the size of Bitcoin block hashes.

You should use a GPU when mining on this channel.

Proof-of-Holdings

The third and final channel uses Proof-of-Holdings to secure the network. This is essentially the same as the Proof-of-Stake consensus method used by coins like NEO. You earn newly minted Nexus coins (NXS) just by holding the ones you already have.

Four attributes determine what your return will be when you stake your coins:

- Interest Rate – An annual percentage of your balance, this is the rate at which you receive new coins. This starts at 0.5% annually and increases to a 3.0% annual maximum after 12 months.

- Trust Weight – This is an indicator of your node’s trust. It starts at 5% but quickly reaches its 100% maximum after just one month.

- Block Weight – This attribute resets to 0% each time you receive a staking transaction. It then slowly climbs to 100% over 24-hours. If your block weight ever reaches 100%, your Trust Key expires and all your attributes reset. The reset trigger ensures that you’re continually working to maintain the network.

- Stake Weight – The value of this is roughly determined by the average of your trust weight and block weight. The higher this is, the more likely you are to receive a transaction.

Nexus Hardware

Nexus has a three-pronged distributed telecommunications system to further decentralize the network.

Mesh Networks

Because the network provides three distinct mining opportunities, almost anyone around the world can run a node and participate in network security. All nodes in a mesh network work together to solve a block rather than compete against each other. This serves to distribute network data more so than other systems.

To take things further, Nexus may produce specialized antennas for you to purchase to operate locally based networks as well.

Cube Satellites

Nexus has partnered with Vector Space Systems (Vector) to create a Low Earth Orbit (LEO) Satellite Network of nodes. The satellites, in combination with the ground mesh network, will host the Nexus network as well as any decentralized apps (DApps) built on top of it. Even more outstanding, the satellite network will provide a worldwide decentralized Internet giving service to those previously unable to access their own.

Ground Stations

The Nexus ground stations connect the mesh networks on the ground to the satellite network in space. They run the uplink/downlink operations including address endpoint route defining and ground-based caching. They also run their own instance of Daemon, the software component of the Nexus system.

Nexus Coin (NXS)

The Nexus coin (NXS) is the currency of the network. There’s no cap on the amount of NXS that will be minted. Instead, the coin has a 10-year distribution period in which 78 million NXS will be distributed until September 23rd, 2024. After this time, the supply will inflate each year by a maximum of 3 percent through the holding channel and 1 percent through the prime and hashing channels.

Nodes create blocks, on average, every 50 seconds, and an NXS transaction requires 6 confirmations. Currently, most transactions cost 0.01 NXS. However, once the 3DC is built and 10-year distribution is complete, transaction fees will disappear. Instead, the system will absorb the fees through inflation.

Nexus didn’t hold an initial coin offering (ICO). Instead, the project has a Developer Fund that takes a small commission from mining rewards. This commission started at 1.5 percent and increases to 2.5 percent over 10 years. Additionally, 20 percent of the block rewards are slotted for marketing as well as the production and launch of the Nexus satellite network.

[thrive_leads id=’5219′]

Nexus Team & Progress

Colin Cantrell, also known as Videlicet, is the founder and lead developer of Nexus. He first named the project Coinshield (CSD) when starting in September 2014. The original code only contained the prime channel; the team added the hash channel in October 2014. In April 2015, the team rebranded to Nexus, and they added Proof-of-Holdings in July 2015.

Besides partnering with Vector on the satellite network, Nexus has also joined forces with SingularityNET to provide their 3DC architecture to the project’s decentralized AI network.

Moving forward, Nexus is releasing major updates following their TAO (Tritium, Amine, Obsidian) roadmap strategy. The releases include the 3DC, mobile wallets, quantum resistance, and the satellite network, among many other things.

The Nexus team is currently working on the Tritium phase of the roadmap. Beyond introducing Signature Chains and parallel processing channels, this phase also implements a Proof-of-Stake update, Tritium Trust. Tritium Trusts builds upon the current Nexus Proof-of-Stake system with the addition of a trust key and Trust Weight that determine your chances of staking success.

Nexus developers haven’t announced when Tritium will be complete, but they give updates showing consistent progress.

Competition

Nexus may be one of the most ambitious projects in the cryptocurrency space. First and foremost, the project is attempting to dethrone Bitcoin as the top peer-to-peer currency. With the decentralized internet produced from its space mesh network of satellites, Nexus is also competing with Substratum.

Trading

Like most of the crypto market, Nexus was relatively quiet until 2017. During that year, the price rose from $0.026 (~0.000027 BTC) to $3.34 (~0.00087 BTC) by September. Shortly after, the price fell back down to about $1 before skyrocketing up to an all-time high of $13.33 (~0.0008 BTC) in January 2018.

This significant rise in price can most likely be attributed to the Vector partnership announcement in combination with the success of the entire market at that time. Since then, the price has drastically fallen, sitting at about $0.30 (~0.000083 BTC) at the time of this writing. News of the SingularityNET partnership seems to have had no effect on the price.

The team hasn’t published a roadmap with exact dates, so it’s hard to make any price predictions for the immediate future. As with most cryptocurrency projects, though, important development releases should have a positive impact on the price. With the scope of this project, you should probably consider it a long-term hold.

Where to Buy NXS

You can purchase NXS on either Bittrex or Binance with BTC. If you don’t currently own any BTC, check out our guide on how to buy some.

As mentioned earlier, you can also earn NXS through mining. Check out the Nexus mining page to download the miner that fits best with your strategy. As a reminder, you should mine with the Prime Channel if you’re using a normal CPU, and you should check out the Hashing Channel if you plan to use a dedicated mining rig like an ASIC.

Once you hold at least 1,000 NXS, you can stake to earn additional coins as well. Technically, it is possible to stake with less than the minimum, although you’ll have a difficult time maintaining your Trust Weight.

Where to Store NXS

Nexus has an official wallet for Windows, Mac, and Linux desktops. All three operating systems have a command line interface (CLI) wallet version while only Windows and Mac have an easier-to-use graphical interface wallet.

Although you can keep your NXS on an exchange it’s highly recommended that you move them to a wallet. You’re only able to stake your coins if they’re in a Nexus wallet.

Conclusion

Nexus is building a new type of blockchain with three separate mechanisms for securing the network. On top of that, the team is sending node satellites into space to create a decentralized Internet and network outside the control of any one entity. The overall mission is to create an improved Bitcoin with faster transactions, lower fees, and less miner centralization.

Nexus is one of the few projects truly addressing quantum resistance and other potential future issues. If these problems become as large as the team believes they will, and they can accomplish their lofty mission, Nexus may just be one of the few projects still in action 20 years down the road.

Editor’s Note: This article was updated by Steven Buchko on 2.11.19 to reflect the recent changes of the project.

Additional Nexus Resources

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.