Don’t Let the Markets Fool You: Bulls Run Amok

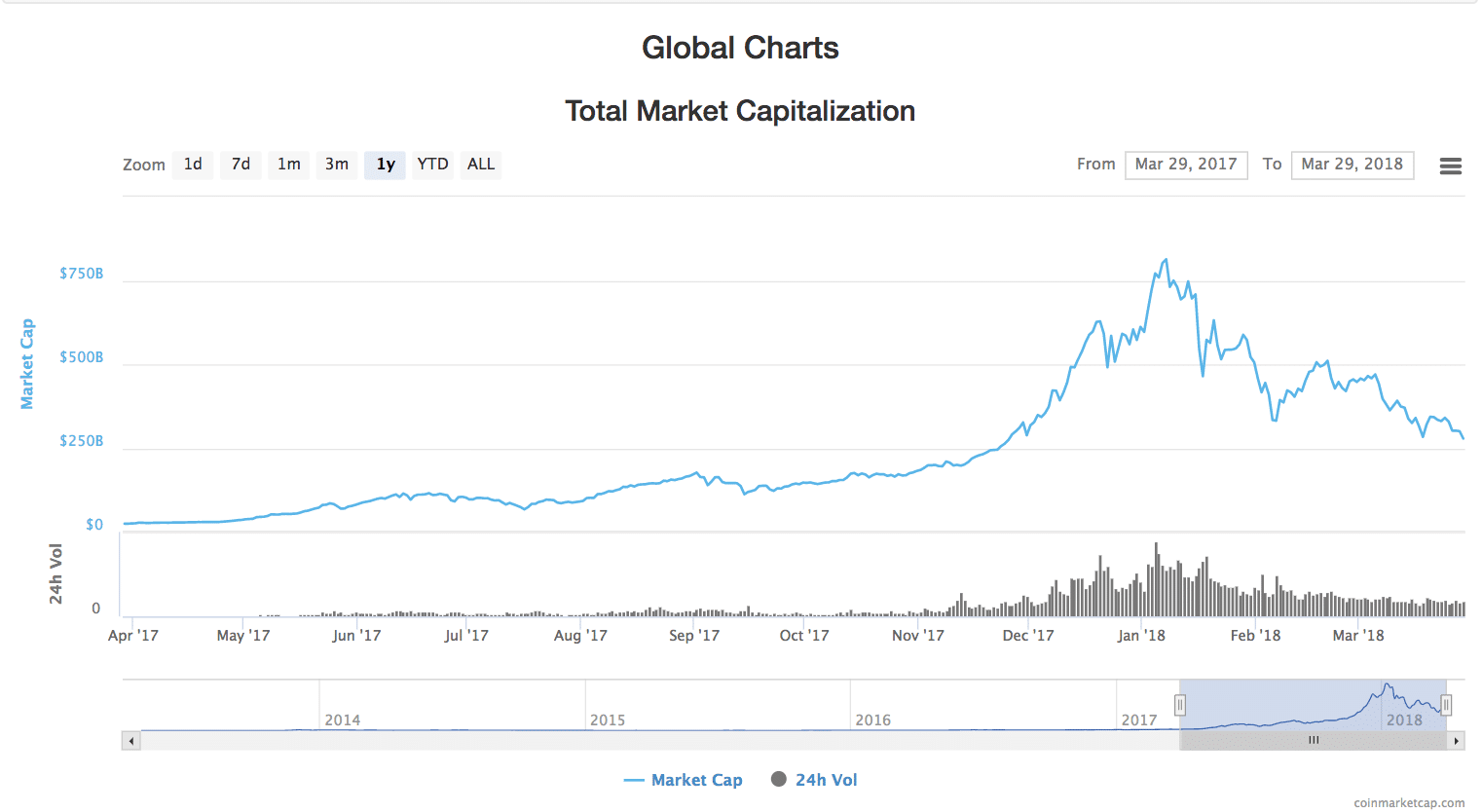

The cryptocurrency market in 2018 has seen a fairly sharp transition from the end or 2017. Most projects are at a mere fourth of their all-time high value in 2017, with the Bitcoin flagship down around 60% of its value.

Reddit communities and forum discussions that were previously elated and borderline manic took a turn into more muted, focused tones. Naturally, tokens making jumps of 10% and falls of 20% make for more somber discussions than those that skyrocket 200% per week.

If decreasing Google search trends are any indication, the attention of the general population seems to have also slightly diminished.

However, to look at the general movement of prices in the markets is a severely limited attempt at understanding innovation in the cryptocurrency industry.

While the decline of cryptocurrency prices does pose a problem to the budgets of teams that rely on their holdings of tokens to fund operating expenses, very few are actually strapped for cash to the point of insolvency.

2017 was the equivalent of a meteor striking the ground. The seemingly sudden explosion of cryptocurrency and blockchain projects onto the scene and into media outlets was a spectacle for all.

However, most steady investment hands and seasoned technology enthusiasts looked forward to 2018 to watch the smoke clear and see which projects are doing their due diligence to create meaningful strides towards reachings their goals.

Many blockchain projects that came out of 2017 well-funded and poised for success have been driving with the pedal to the metal regardless of market fluctuations. Teams are hiring developers and business development talent by the dozens, and savvy investors are taking note.

A few of the questions worth exploring to take a deeper dive than mere price analysis include:

- Which projects are reaching their milestones?

- What partnerships are these projects making to advance their goals?

- What changes in strategy (if any) are these projects taking?

- How many users/customers does the project currently have?

- How active is the development team, and how reliable are they in releasing updates?

The Cryptocurrency Investment World is Still Active

Don’t let the downward trend of today’s markets distract you from the still red-hot investment world. In 2017, venture capitalists and other investors put $1.06 billion into the industry. So far in 2018, these investments are already at upwards of $350 million.

There are still exciting projects coming to the forefront.

Take Fusion for example. Fusion, a public blockchain aiming to create an inclusive crypto financial platform for cross-chain, cross-organization, and cross-datasource smart contracts, raised over $50 million in under 24 hours during its token offering in February 2018.

Circle, a digital payments company, bought the cryptocurrency exchange Poloniex for a reported $400 million. Circle co-founder and CEO Jeremy Allaire noted, “These markets are still in their infancy but they hold enormous promise.Maybe the first $1 trillion company in the world will be created in this space.”

On March 15th, 2018, Lightning Labs released their first mainnet beta and announced a round of seed financing from the likes of Jack Dorsey (CEO of Twitter and Square, one of the largest P2P payment platforms), David Sacks (former PayPal COO), Vlad Tenev (co-founder Robinhood), Charlie Lee (creator of Litecoin).

Final Thoughts:

The overarching narrative for 2018 is setting the foundation and expectations for what a high-velocity blockchain project owes to its investors.

2017 was a time where you could literally plagiarize a whitepaper for a dubious concept and raise a few million dollars, but the bearish Q1 market of 2018 added another layer of investor skepticism that essentially pruned this awful, conniving approach (for any new projects, at least).

This is the year where many of the front-running innovators in the cryptocurrency and blockchain space need to step up and provide investors, spectators, and regulators a reason to keep believing.

That’s why so many people have their eyes on projects like Ethereum, NEO, STEEM, EOS, and Monero to name a few. Of course, the list is limited for the sake of brevity, but the point is that 2018 is the year that people want to see human beings and teams working together to further flesh out the functionality of these potentially revolutionizing projects.

2018 is the year that cryptocurrency investors will learn that an astronomical jump in token price is not a metric for potential project success. There’s strategy to spotting innovation, and the pre-requisite is an unscrupulous curiosity combined with a firm belief in the team behind the project.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.