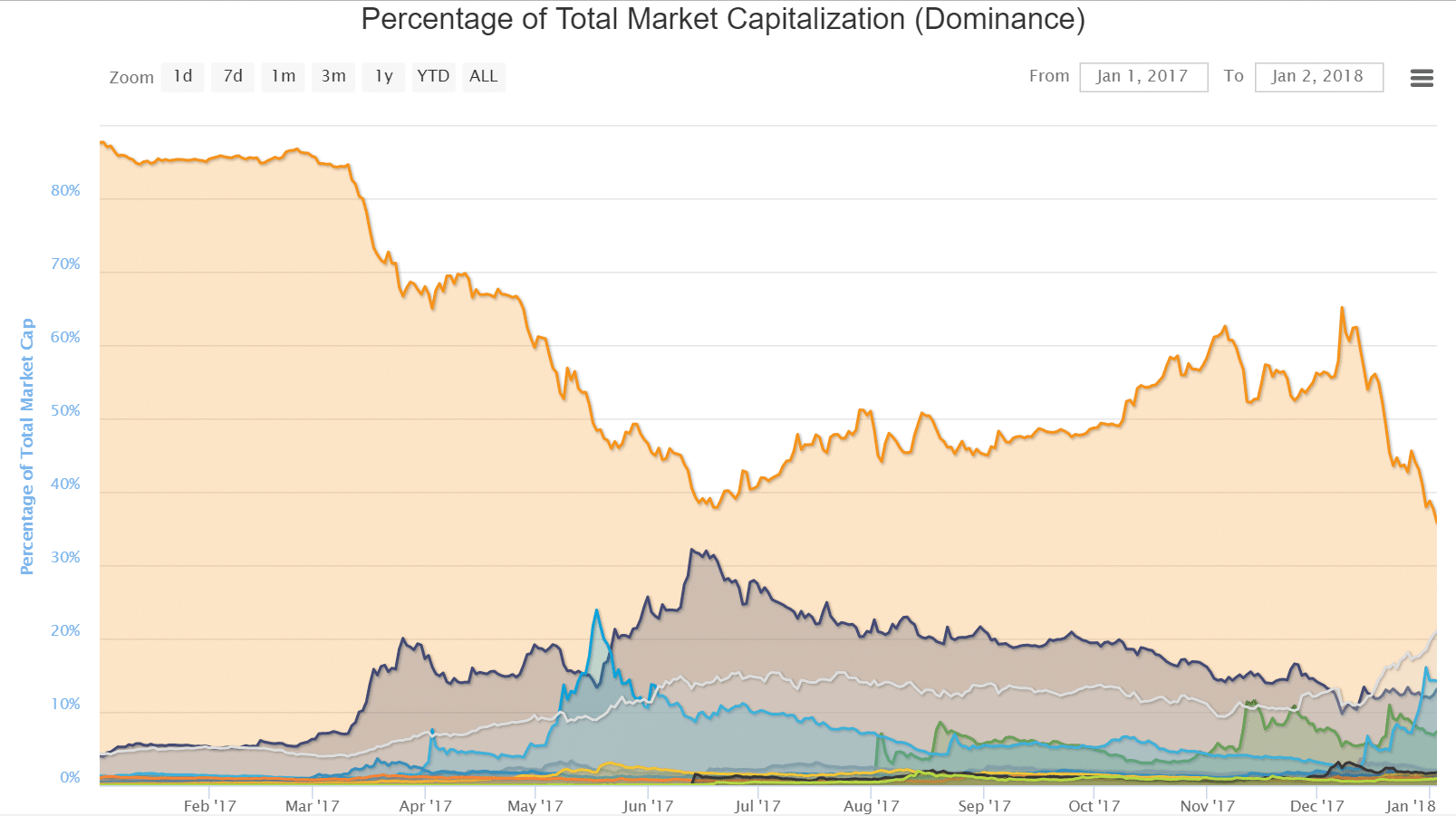

It’s 2018, and it’s already looking promising for cryptocurrency’s alternative players. Since the Christmas correction of December 22nd, altcoins have steadily recovered while Bitcoin has struggled to re-achieve both its pre-correction price and a majority of the market’s total capitalization.

Two days into 2018, Bitcoin’s market dominance slouched to a historic low of 35.7%. To put this into perspective, Bitcoin entered 2017 with about an 85% share of cryptocurrency’s total market cap. The lowest we’ve seen it until now was 37.6% in June, a time when altcoins like Ethereum and Litecoin were surging in value.

And they’re surging yet again. As Bitcoin treads water, we’ve seen investor jump ship to other crypto assets. Ripple, for example, has picked up some of Bitcoin’s investment slack. Recently outpacing Ethereum for the #2 spot on Coin Market Cap, the banking-focused crypto rose to an all-time high of $2.80 on December 30th. At the beginning of December, it only accounts for a little over 3% of crypto’s market share. Now, it accounts for 14.19%.

Even with Ripple replacing it as the market’s runner-up, Ethereum is also capitalizing off of Bitcoin’s receding dominance. At press time, the blockchain platform reached a new all-time high over $900. Its own market share rests at around 13%.

Investing is a zero-sum game, and with Ripple and Ethereum sporting market caps of $94bln and $88bln, respectively, they’ve taken chunks out of Bitcoin’s own. Down to a $238bln market cap, Bitcoin has lost 28% of its value from a net worth’s high of $333bln on December 17th. By comparison, Ripple’s total capitalization is up 68% from the same day, while Ethereum is up 20%.

It’s too early to say that 2018 will be a year for alternative currencies to dominate market attention in Bitcoin’s stead. But with Bitcoin’s dominance slipping below a threshold of 36%, the rest of the market is in a breakneck sprint while king crypto is still tying his shoes.

If the current climate is any indication of what the new year will bring, we may see a market less dependent on Bitcoin’s fluctuations going forward.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.