September has historically been a tough month for the cryptocurrency market, but in keeping with 2025’s trend-breaking momentum, history is being proven wrong.

Prices across the board are soaring; Bitcoin is nearing its all-time high (ATH), Ethereum is at levels last seen over three years ago, and the altcoin market is scorching hot.

As such, traders are searching for the best cryptocurrencies to buy now. Momentum is growing, and if the Ethereum rally keeps up, then the next Altcoin Season could be moments away. It’s during altcoin seasons that well-placed $1,000 investments can turn huge sums.

So, with that in mind, let’s explore three of the most promising tokens on the market. We’ll look at factors such as momentum, narrative alignment, community strength, and use cases to identify projects with the biggest upside potential.

Lido DAO

Lido is the largest Ethereum liquid staking token. It provides staking pool services that enable $ETH holders to delegate their coins to validators and earn passive rewards. Additionally, they receive a synthetic $ETH while their tokens are pooled, allowing them to generate extra yield through other DeFi activities.

The project is benefiting this week after the SEC issued guidelines indicating that receipt tokens (synthetic $ETH) are not securities. This change is seen as a major shift in the agency’s regulation of the crypto industry, and is also a primary driver in Ethereum’s recent strength.

There are also several staked Ethereum ETF applications pending SEC approval, with some deadlines as early as October 2025. This could normalize staking among institutions and corporations, potentially leading to significant capital inflows to Lido in the coming months.

All of this creates a highly bullish setup for the project, and that has caused a 15% price rally today, making it the biggest gainer today among the top 100 cryptos by market cap.

Pump.fun

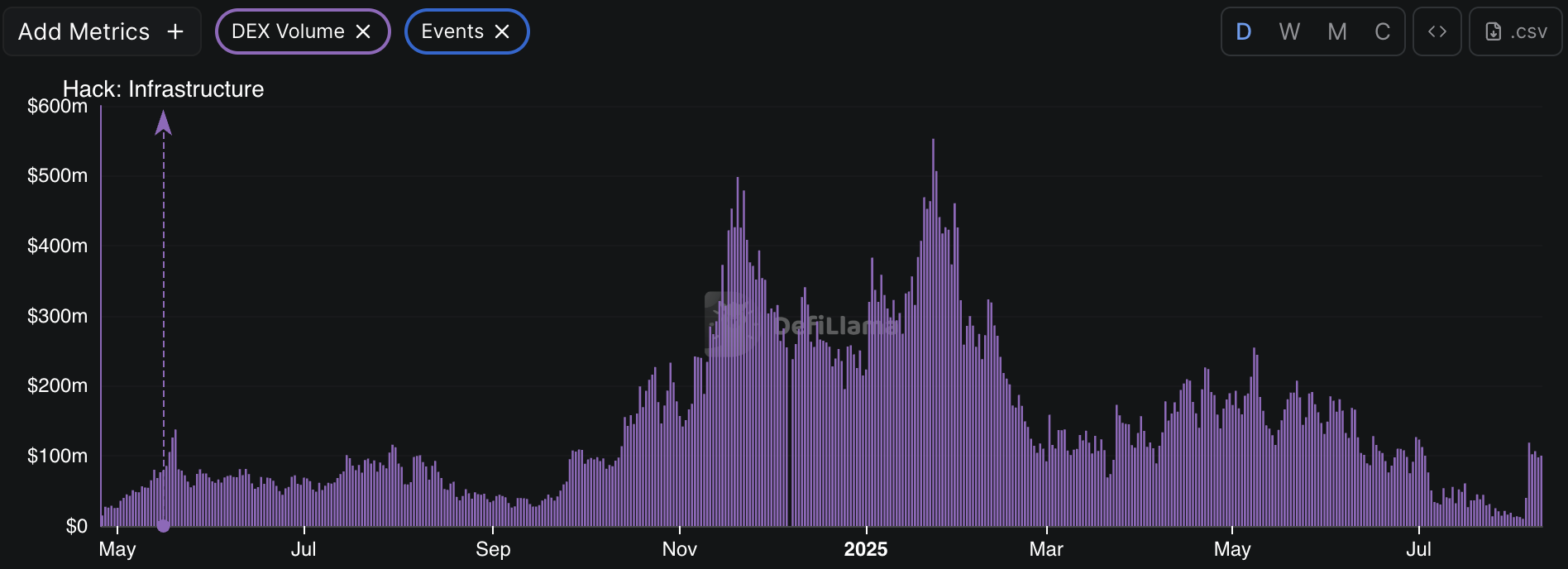

Pump.fun is a meme coin launchpad built on the Solana blockchain. Typically, meme coins perform well during euphoric phases, indicating that the Pump.fun platform could see a surge in usage soon.

The project generated around $700 million in revenue in about nine months through 2024 and early 2025, signifying that it has massive potential as the next euphoric phase commences.

Should Pump.fun return to peak revenue-generating levels, $PUMP could rapidly reprice. This is because the Pump.fun team will utilize revenue to purchase $PUMP from the open market, thereby generating token demand that aligns with platform usage.

Should Pump.fun return to peak revenue-generating levels, $PUMP could rapidly reprice. This is because the Pump.fun team will utilize revenue to purchase $PUMP from the open market, thereby generating token demand that aligns with platform usage.

It’s also worth noting that the $PUMP market cap is currently $1.3 billion. If the platform regains its earlier levels of usage, investors might see this market cap as highly undervalued, leading to increased demand and price gains.

The Pump.fun token is the biggest gainer among the top 200 cryptos today with a 15.9% price increase.

Snorter

Snorter is another meme coin infrastructure project with huge potential. It’s a meme coin trading bot designed to help users discover promising new projects and get in early.

It’s built using private RPC infrastructure, which means trade execution occurs within milliseconds. The bot also features innovative tools, including copy trading, automated token sniping, and rug pull detection. All these features are supported by the lowest fees on the market at just 0.85%.

And the best part is that Snorter is currently in presale, allowing investors to buy in early and maximize their potential gains.

The $SNORT presale has already raised an impressive $3 million, showing plenty of investor confidence, and momentum has been increasing rapidly in recent days.

With a strong use case, growing momentum, and the meme coin market possibly approaching its next big breakout, everything seems set for $SNORT to explode. Visit Snorter.

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.