- What is Yield Farming?

- How Yield Farming Works

- The Best DeFi Aggregators

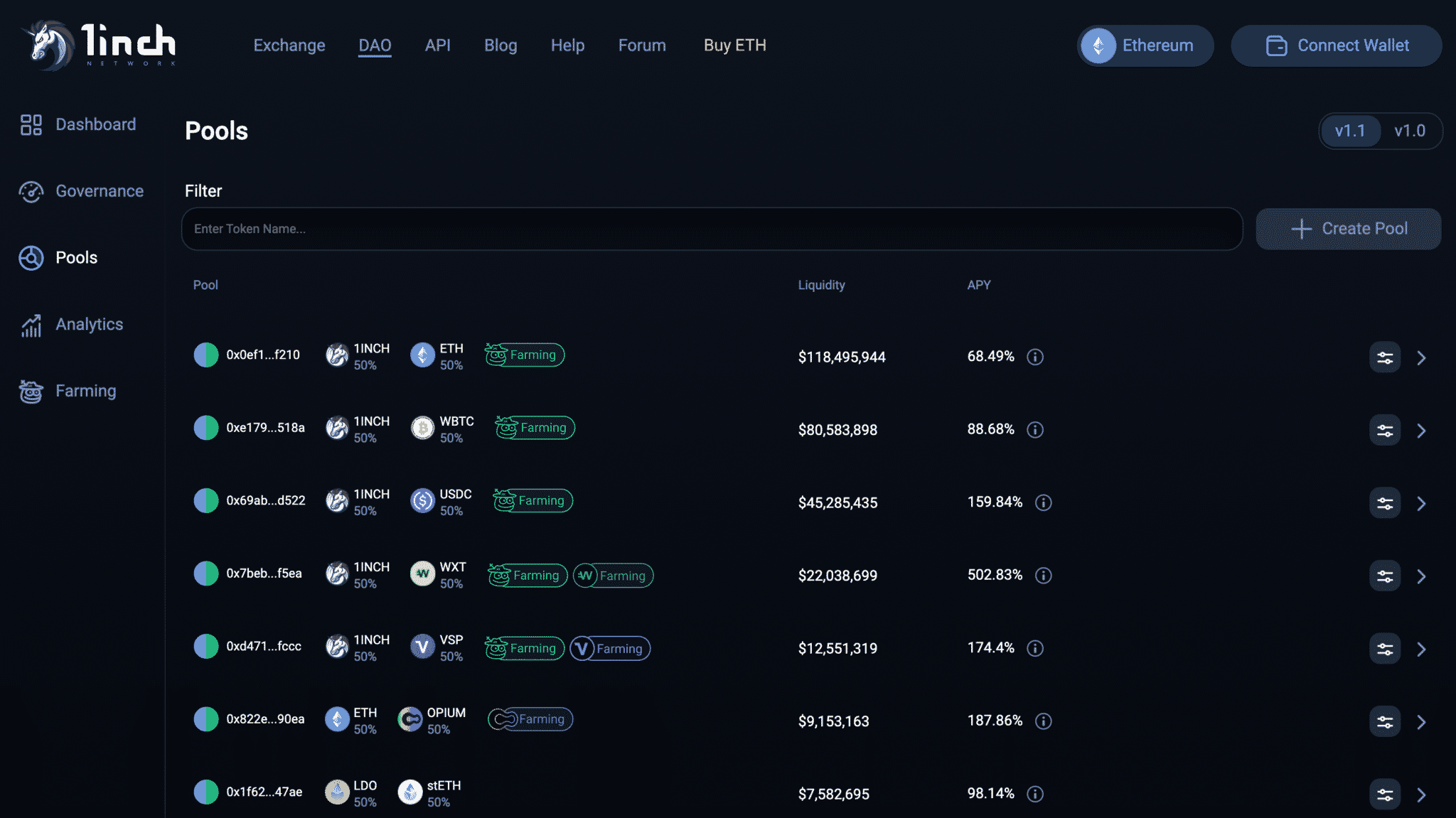

- 1inch

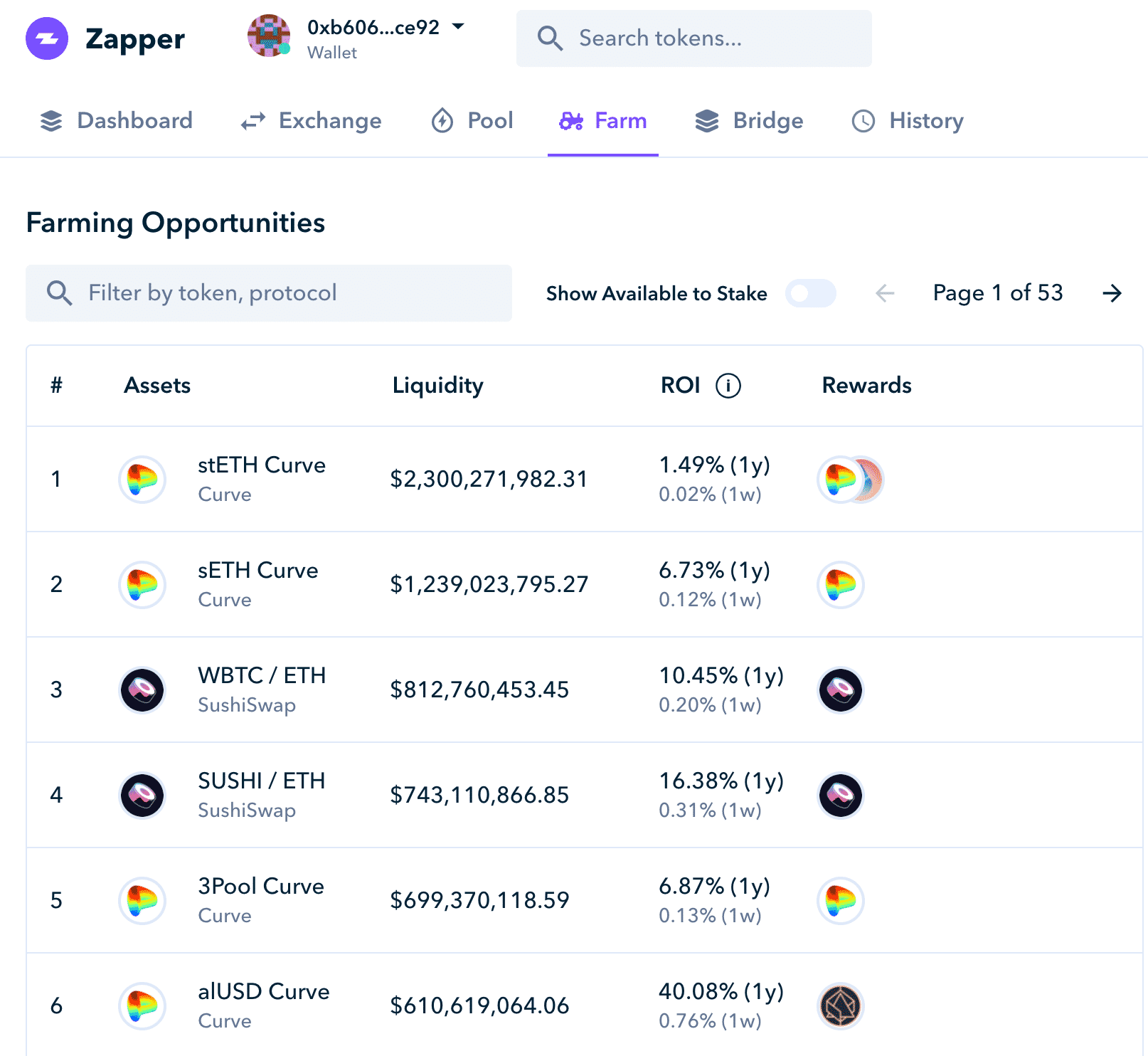

- Zapper

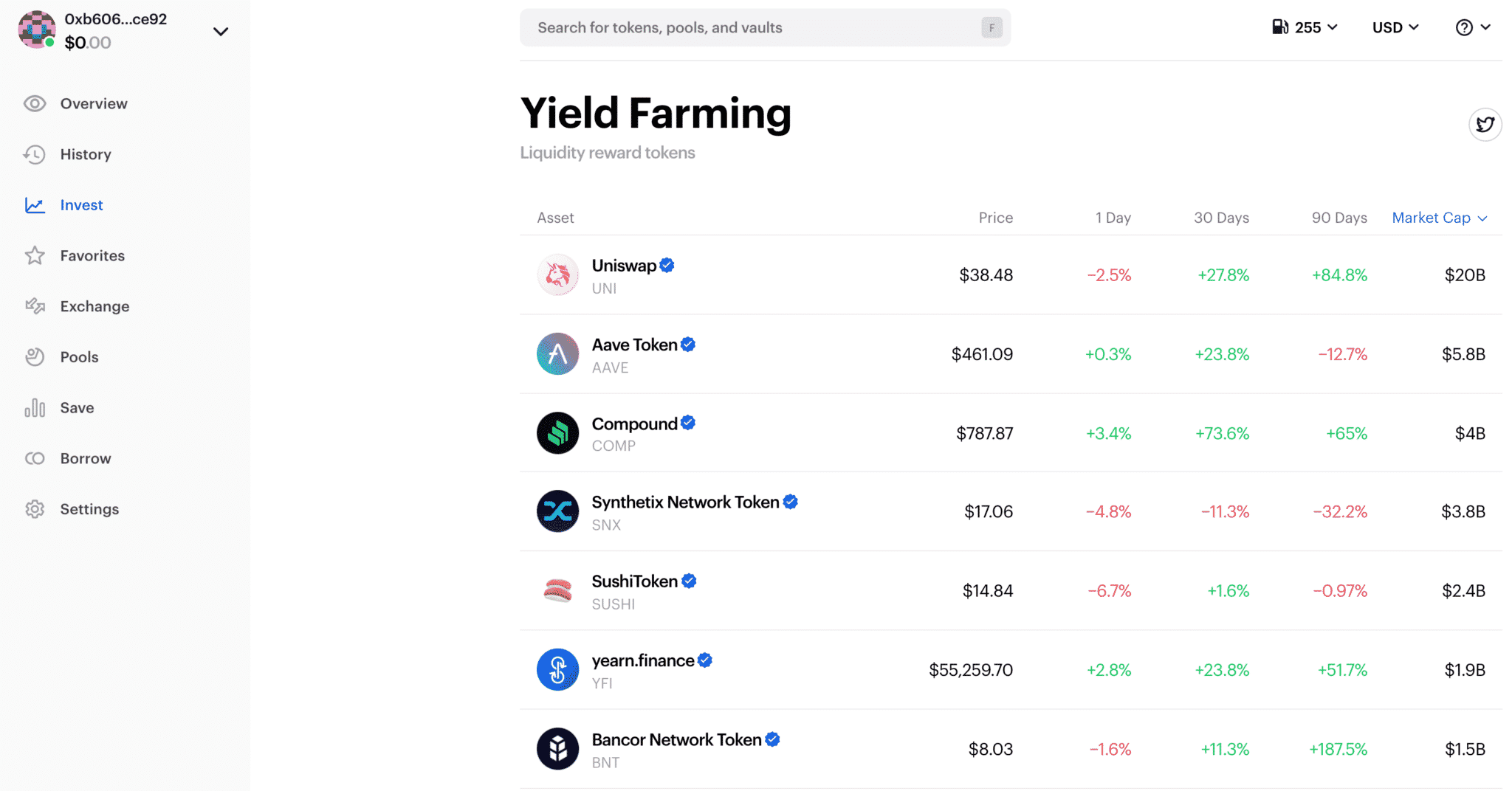

- Zerion

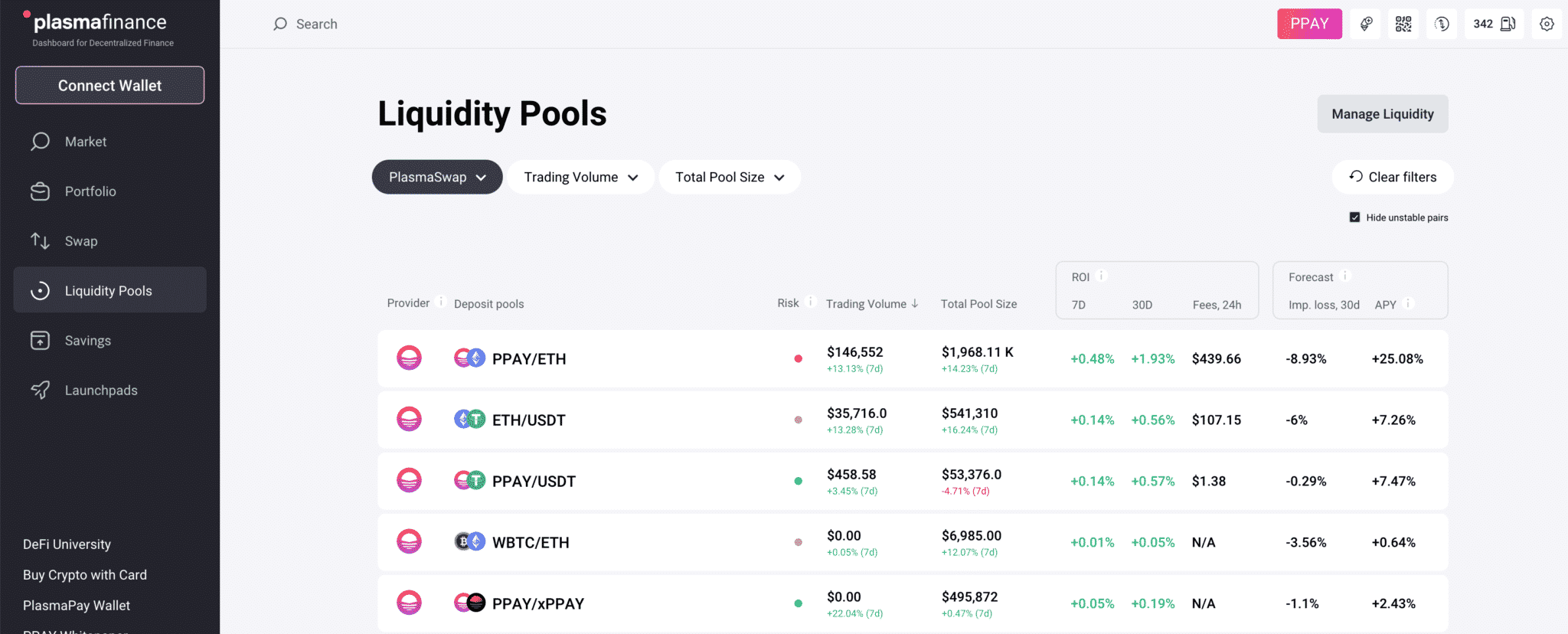

- Plasma.Finance

- Matcha

- How to Use DeFi for Free

- Final Thoughts: The Evolving DEX Aggregator Role

A DeFi aggregator is a platform that leverages multiple different DEX and implements various buying and selling strategies to help users maximize profits, as well as mitigate high gas fees and DEX trading commissions.

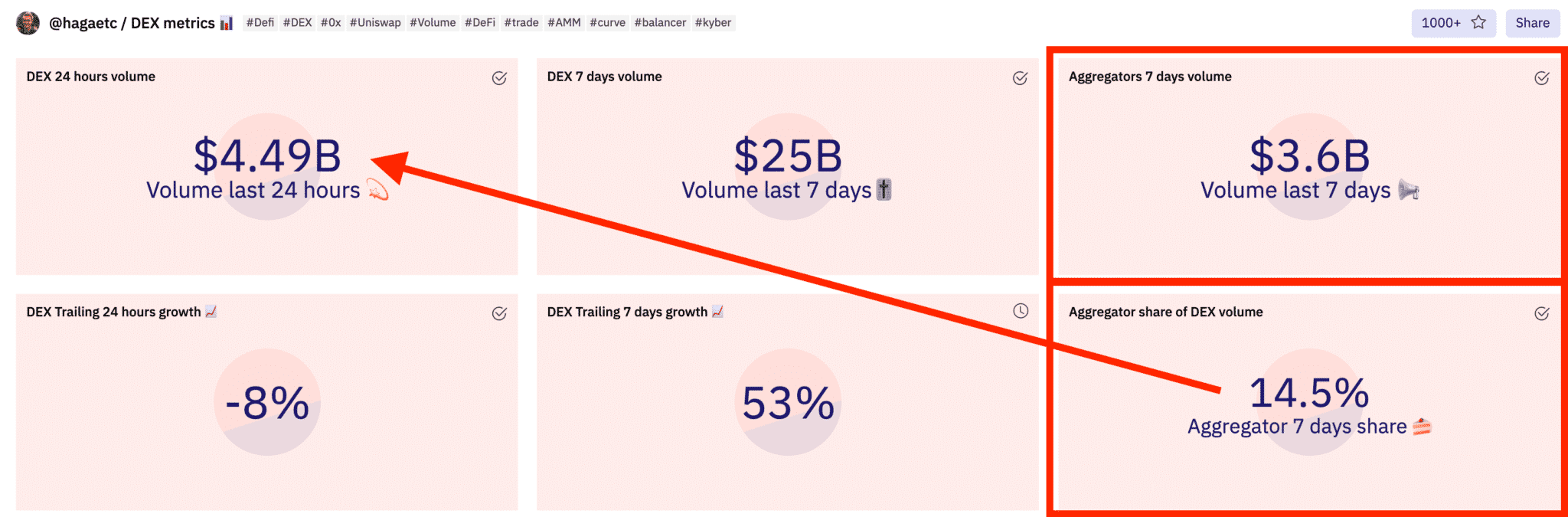

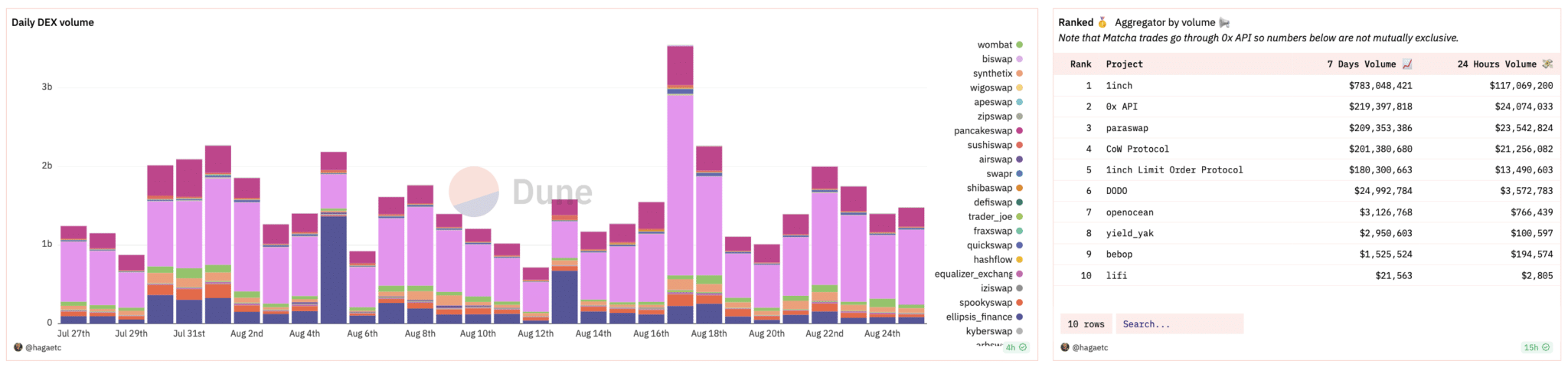

Popular DeFi aggregators 1inch, 0x, and Paraswap facilitate about $1.2 billion of volume weekly.

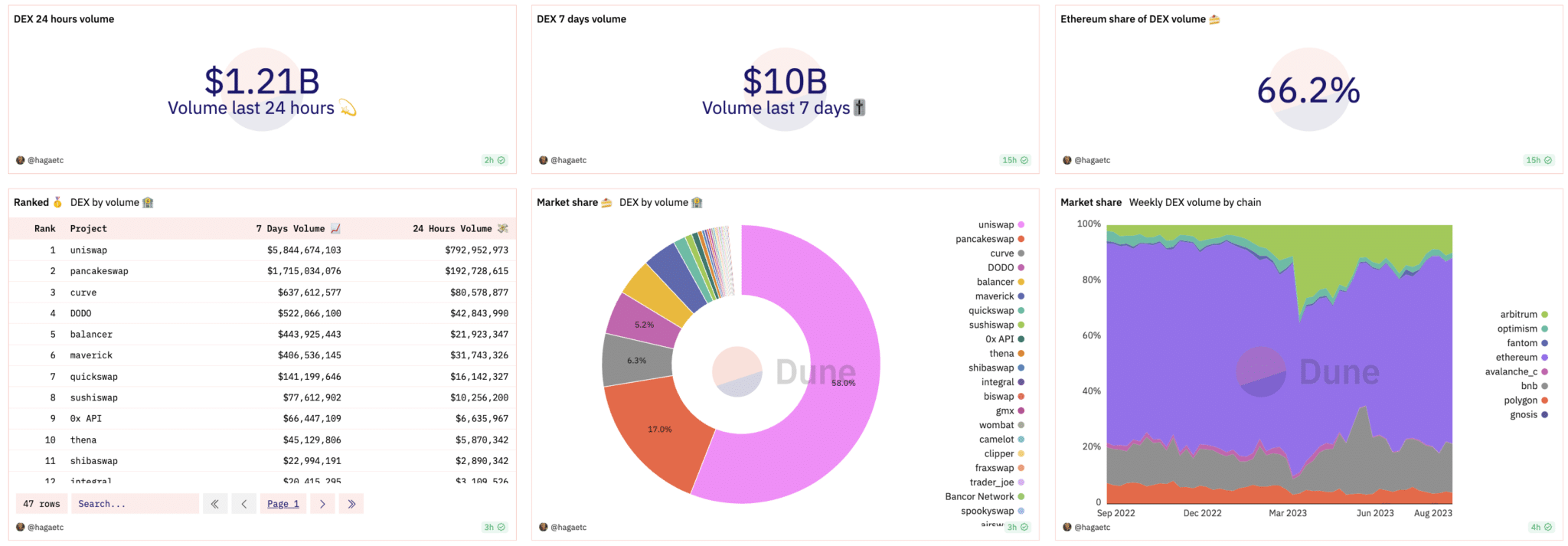

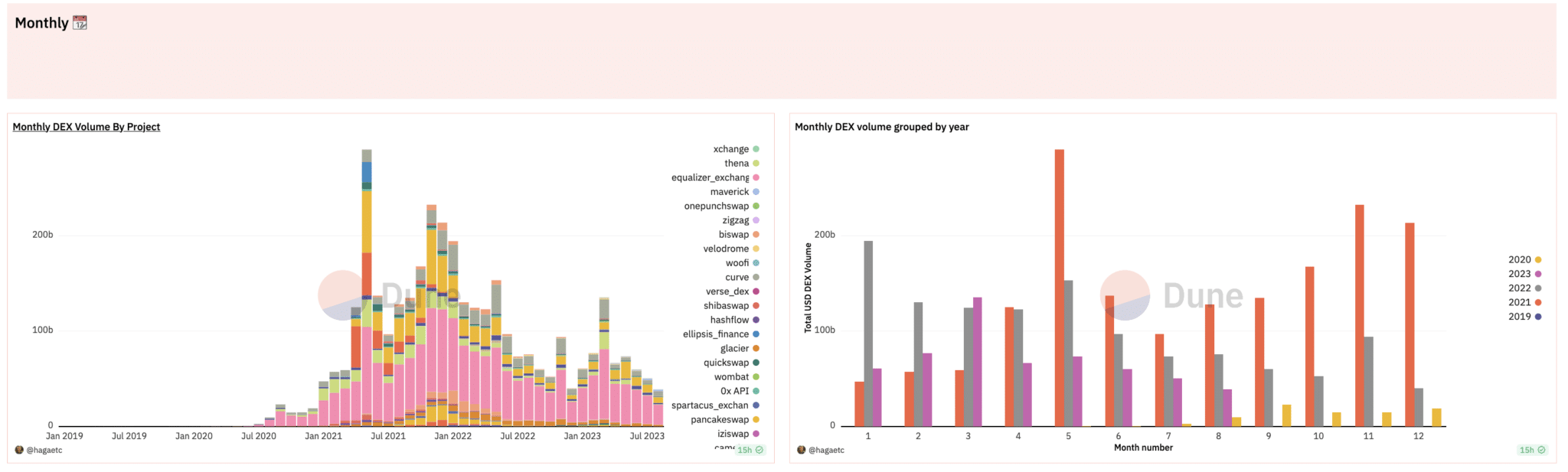

According to Dune Analytics Data, the number of new users, daily transactions, and daily volumes have surged in 2023, doing about $10 billion in volume weekly, dominated by Ethereum-based DEX aggregators.

What is Yield Farming?

To better understand the utility of a DeFi aggregator, it’s helpful to gloss over the concept of Yield Farming.

Yield farming (noun): a methodical approach to lending and staking cryptocurrency assets at the places that yield the highest returns and rewards. Yield farming requires a cryptocurrency holder to lock up their funds in a smart contract, which specifies how much and how often a lender receives their rewards.

Without a DeFi aggregator, a yield farmer would click around multiple different lending pools and decentralized exchanges such as Aave and Compound, manually comparing the best rates, and cryptocurrency token options available, and migrating the funds themselves.

Where do DeFi yields come from? In theory, the other side of the decentralized finance equation has a borrower taking out a loan using their own cryptocurrency as collateral. Most of the time these borrowers need funds for liquidity on decentralized exchanges.

These rewards tend to be much greater on average than more traditional investments but have much higher risks associated.

How Yield Farming Works

Most yield farming is typically done by lending ETH or an ERC-20 token on a decentralized, non-custodial money market protocol.

Yield farming and the tokens they generate can be a risky endeavor, here’s how it works:

Step 1: Add funds to a liquidity pool. These are smart contracts that contain the funds themselves, and the pools power a marketplace where users have the ability to exchange, borrow or lend tokens.

Step 2: Once you have added your funds to a pool, you become a “liquidity provider” and begin to start generating interest through fees.

Step 3: Next you’ll have the option to close a leveraged yield farming position. To do this, connect to your wallet, and ensure that your network is set to the chain in question. You will see your active positions in the “Your Positions” section, and you will need to select a position that you would like to close and click on “Close Position”. Wait for the transaction to be processed, and you should be able to see the tokens back in your wallet.

The Best DeFi Aggregators

DeFi aggregator definition: Rather than having to manually sift through multiple pools, DeFi users can use a DeFi aggregator to access a wide range of decentralized exchanges and trading pools on a single dashboard, which pulls information from a wide variety of exchanges and automated market makers.

1inch

1inch is a well-known DEX aggregator that specializes in working out the best crypto prices when compared to different decentralized exchanges. The platform launched with its own governance token known as 1INCH, and the main way through which you as a user can earn 1INCH tokens is through providing liquidity to the liquidity platform.

The token is Ethereum-based, and the aggregator works by sourcing liquidity from different DExs, which means that you can get better token swap rates than you would fin on an individual DEX.

1inch was founded by Sergej Kunz.

1inch can be accessed on https://app.1inch.io/.

Zapper

Zapper allows you to manage DeFi assets and liabilities through a simple interface, and it’s generally regarded as one of the most intuitive DeFi aggregators– users can deploy different DeFi positions with a single click.

Users can enter and exit DeFi positions through functions called Zapping In and Zapping Out.

Zapper integrates with multiple DeFi platforms, such as 1inch, Aave, Alchemix, Alpha, and more, and allows for portfolio rebalancing through shifting capital to other platforms. Portfolio rebalancing offers advantages when compared to simply holding crypto, and the strategy implemented by Zapper will help you minimize risk through rebalancing your portfolio throughout certain periods.

Zapper even includes a multi-pooling feature that allows for diversification when it comes to asset distribution.

Zapper was founded by Seb Audet and Nodar Janashia.

Zapper can be accessed at Zapper.Fi

Zerion

Zerion allows traders to discover the potential of every asset on the market and trade at the best rates from a single dashboard.

The app tracks over 50 protocols, making it easy to find less popular tokens.

It also sources liquidity from major decentralized exchanges, and this gives users single-transaction access to liquidity pools and even automated strategies. This means that they can exchange assets, and send them to another wallet within a single transaction.

Zerion was founded by Vadim Koleoshkin, Alexey Bashlykov, and Evgeny Yartaev.

Zerio can be accessed on https://app.zerion.io/.

Plasma.Finance

With Plasma.Finance, you can manage your portfolio, Fiat on/off ramp, liquidity pools, DEX and SWAP aggregator, lending and borrowing as well as cross-chain asset swap from a single interface.

It is one of the easiest ways to buy as well as sell tokens because it allows for credit card or bank integrations. This is done through a partnership with plasmapay, ramp, and simplex.

Plasma.Finance was founded by Ilia Maskimenka.

Plasma.Finance can be accessed by visiting Plasma.Finance.

Matcha

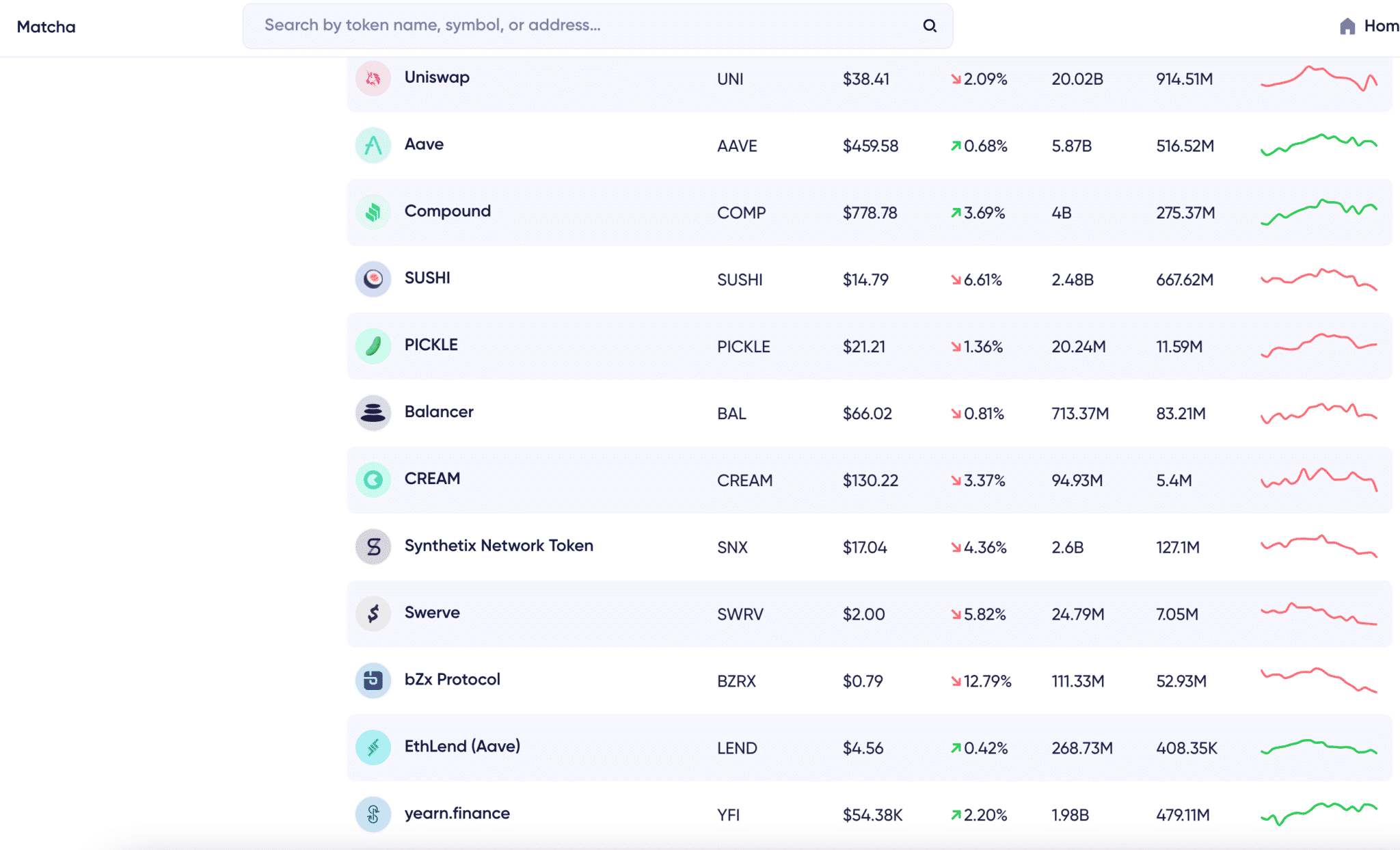

Matcha is a DeFi platform that intends to get crypto traders the best rates on any cryptocurrency exchange through the usage of a proprietary 0x API technology that checks 23 decentralized exchanges (DEXs) at the same time.

It works with 0x, Uniswap, SushiSwap, Curve, Kyber, Balancer, Mooniswap, Bancor, mStable, and a few other coins. Users can search 23 exchanges simultaneously, and intelligently route their orders to trade safely without hidden fees.

No account is required, and there are no trading limits, deposit requirements, or withdrawal fees.

Matcha was created by Will Warren.

Matcha can be accessed on https://matcha.xyz/

How to Use DeFi for Free

You may notice that even just experimenting with DeFi protocols and aggregators gets expensive fast due to the Ethereum network gas fees.

Some aggregators offer DeFi simulators, meaning that you can play around with the dashboard with fake Ethereum or other tokens generated by the mock simulation.

The Defiant has a great explainer video on using the DeFi simulator feature on another DeFi aggregator called InstaDapp :

Final Thoughts: The Evolving DEX Aggregator Role

An aggregator pulls the best prices from across different DEX so you don’t have to manually check anything.

As such, you get the chance to make an educated decision on what to farm next much faster. DeFi aggregators are a beloved innovation that have greatly simplified the DeFi landscape for beginners and experts alike.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.