- Nexo – Still Standing Strong (CeFi)

- Lido – Non-Custodial Staking, High Interest Rates & KYC Security (DeFi)

- Gemini Earn – A Leading Exchange In Crypto Security (CeFi)

- Uphold – Innovative Debit Card Feature (CeFi)

- Crypto.com – Best For Non-US Altcoin Investors (CeFi)

- Crypto.com Key Information

- Final Thoughts: Which Celsius Alternative Is Best For you?

Celsius Network was a leading cryptocurrency lending platform and interest account where users could earn interest on their digital assets and take out cryptocurrency loans. With over 1.7 million users and over $8 billion in loans, the platform was the first place many crypto enthusiasts went to earn a yield on their digital assets or take out cryptocurrency loans. Now investors are looking for Celsius alternatives.

Until June 13th, 2022, Celsius offered high annual percentage yields (APYs), sometimes up to 17% on some assets.

However, the platform suddenly halted all withdrawals, swaps, and transfers– leaving many of its users’ funds locked on the platform; you can find the official announcement on the Celsius blog.

The company that once advocated for the decentralized ethos and power of cryptocurrency suddenly transformed into a villain overnight; Celsius Network currently finds itself in Chapter 11 bankruptcy proceedings and a $1.2 billion gap on its balance sheet, with thousands of extremely unhappy users hoping to get their money back.

However, the cryptocurrency interest account model is still valid despite Celsius’ lack of disclosures and poor risk management.

This begs the question: Who will fill the void that companies like Celsius Network (and fellow recently departed crypto interest account offerings by BlockFi, Voyager, and Hodlnaut) for those users that still want to earn a yield on their crypto?

Are there any providers where a cryptocurrency holder can park their idle assets and earn a yield– while sleeping soundly at night without worry withdrawals will suddenly be paused? This article will cover the five best Celsius alternatives and their various features. The list currently includes:

- Nexo

- Lido

- Gemini Earn

- Uphold

- Crypto.com

Top Crypto Interest Account List Criteria: Celsius Alternatives

2022 was a hurricane of a year for cryptocurrency interest accounts. The top two contenders, BlockFi and Celsius, both shuttered their crypto interest account offering– BlockFi for regulatory reasons, whereas Celsius cited bear market conditions.

To clarify, Celsius was seeking yield through various incredibly risky strategies, pigeonholing itself into very illiquid positions as asset prices were falling. Celsius representatives publicly mentioned nothing beyond simply facilitating a cryptocurrency lending market and its global risk management team “working around the clock” to keep assets safe.

Well, we saw how that panned out. Celsius was widely trusted, and in the blink of an eye, millions of dollars of customer assets were left in purgatory to be decided in Chapter 11 bankruptcy proceedings.

The collapse of Celsius reminds us of the importance of asset custody. We predict the crypto interest account niche will grow to be dominated by non-custodial yield-generating projects.

However, for now, the top Celsius alternatives are still centralized companies. This is largely because one of the primary mechanisms for yield, the lending of assets, is more complicated and less profitable through non-custodial DeFi means. Non-custodial DeFi projects tend to generate yield on staking-enabled assets.

If the goal is to generate yield, minimizing the custodial risk by going with a DeFi means like Lido is a solid choice.

However, we’re optimistic that the remaining CeFi crypto interest accounts can help set the standard for a more trustworthy cryptocurrency interest account space.

Nexo – Still Standing Strong (CeFi)

Nexo was founded in 2018 by Credissimo, a Fintech group that has operated throughout Europe for over ten years. It’s led by Antoni Trenchev and provides users with blockchain-based overdrafts in the form of instant crypto loans.

The project uses BitGo as its custodian and provides NEXO token holders with a 30% share of the company’s profits. On the site, users can take advantage of an “Earn in Nexo” option which lets them take advantage of a 2% boost per asset. Nexo also offers an XRP interest account.

The APY on the platform is around 10%, and 78% of its traffic is generated from recurring customers, suggesting Nexo is building a loyal audience.

Nexo Key Information

| Site Type | Cryptocurrency Lending Platform |

| Beginner Friendly | No |

| Mobile App | Yes |

| Company Location | London, UK |

| Company Launch | 2018 |

| Buy Methods | Bank Transfers, Cryptocurrency, Credit Cards |

| Sell Methods | Bank Transfers & Wires |

| Available Cryptocurrencies | 35 cryptocurrencies including XRP, Cardano, Bitcoin, Ethereum |

| Community Trust | Great |

| Security | Great |

| Fees | Very Low |

| Customer Support | Good |

| Site | Visit Nexo |

Lido – Non-Custodial Staking, High Interest Rates & KYC Security (DeFi)

Lido is a liquid staking solution with a DAO. It uses ETH 2.0’s Beacon Chain to lock out assets while Lido liquifies them so they can be used for other protocols. These assets are known as ‘staked’ assets and will have “st” at the start of their name; for example, stETH.

The Lido DAO was founded in December 2020 and is governed by its community, with key members including P2P Capital, KR1, and Semantic Ventures. Though a relatively new project, it’s already one of the largest platforms for liquid staking, with over $13 billion in assets staked in 2021 and $6.5 billion in 2022.

Lido offers high APYs of up to 16.5% on assets such as Polkadot and 13.9% on Kusama, with APRs of around 6% for most other assets.

Lido Key Information

| Site Type | Liquid Staking Solution |

| Beginner Friendly | No |

| Mobile App | No |

| Company Location | London, UK |

| Company Launch | 2020 |

| Buy Methods | Cryptocurrency |

| Sell Methods | Cryptocurrency |

| Available Cryptocurrencies | 5 |

| Community Trust | Great |

| Security | Great |

| Fees | Very Low |

| Customer Support | Good |

| Site | Visit LIDO |

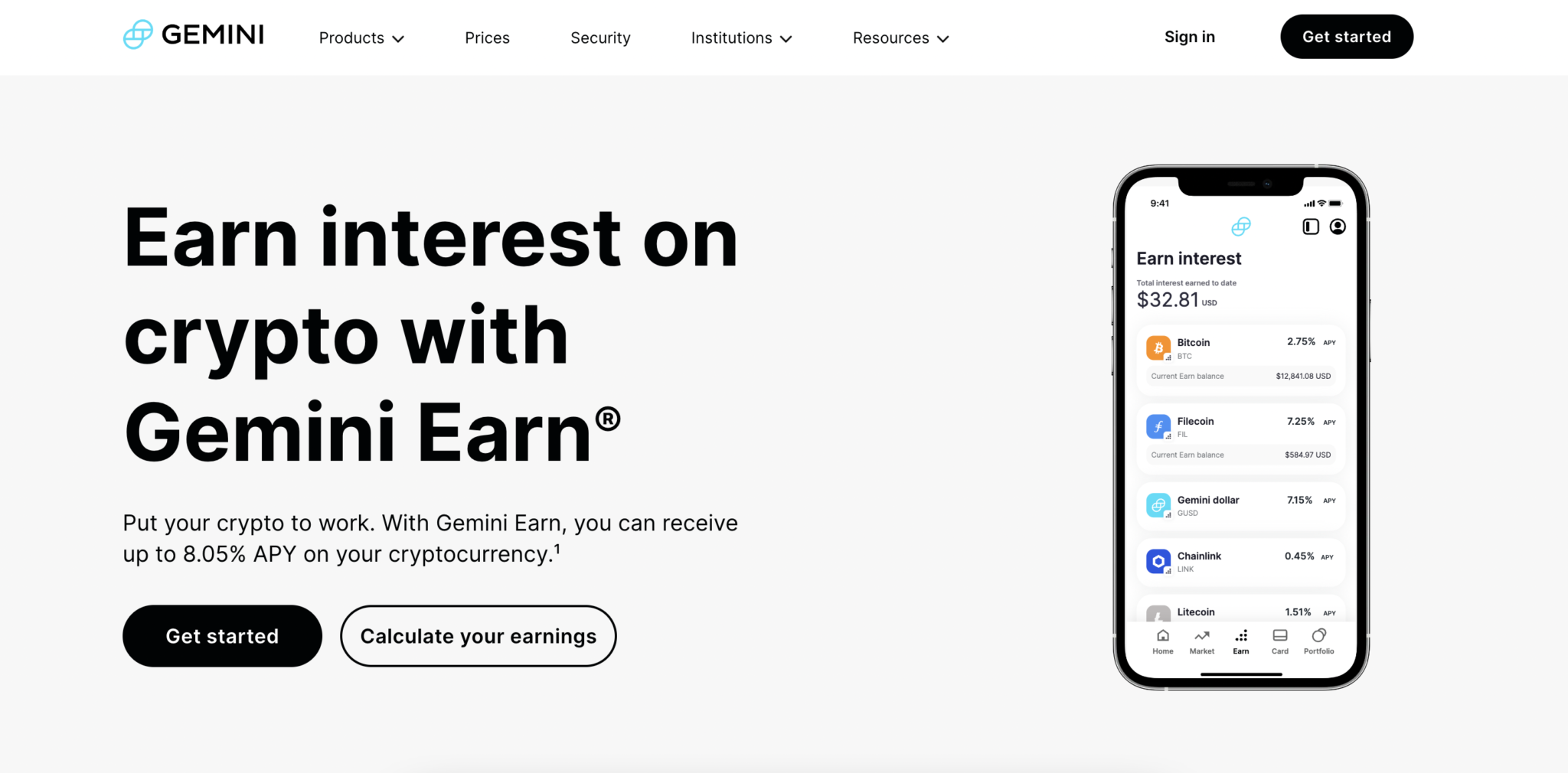

Gemini Earn – A Leading Exchange In Crypto Security (CeFi)

Gemini Earn is an extension of the Gemini platform and lets users earn interest on their cryptocurrency and choose the institution they want to lend their crypto to.

The platform has partnered with several third-party borrowers, such as Genesis, to reduce risk. It is the world’s first SOC 1 Type 2 and SOC 2 Type 2 certified crypto exchange and custodian, making it by far one of the safest Celsius alternatives.

Interest rates go up to 8% on assets such as Curve, Inch, and Filecoin, with traditional crypto assets such as Bitcoin earning an APY of around 2%.

The interface is easy to use, and customers can view their total trading balance, their earned balance, and their total interest as a whole or for each asset. Interest is paid daily at 4 p.m. ET.

Gemini Earn Key Information

| Site Type | Cryptocurrency Interest Account And Exchange |

| Beginner Friendly | Yes |

| Mobile App | Yes |

| Company Location | New York, USA |

| Company Launch | 2014 |

| Buy Methods | Debit Card, Bank Transfers, Wire Transfer |

| Sell Methods | Bank Transfers, Wire Transfer |

| Available Cryptocurrencies | 50+ cryptocurrencies, including Bitcoin and Ether |

| Community Trust | Great |

| Security | Great |

| Fees | Average |

| Customer Support | Good |

| Site | Visit Gemini |

Uphold – Innovative Debit Card Feature (CeFi)

Uphold is a cryptocurrency exchange with over 10 million users, 160 cryptocurrencies, and availability in over 160 countries. On the site, users can stake cryptocurrencies such as:

- ETH

- ADA

- SOL

- XTZ

- ADA

Staking rewards are weekly; you can earn up to 19.5% on staked crypto assets. However, a 15% commission is charged on all staking rewards, which significantly reduces the APY you make.

Unlike most other exchanges, Uphold lets users create their own debit card accounts. This account lets you see your Uphold balance with physical and virtual cards, bridging the gap between traditional and decentralized finance.

Uphold Key Information

| Site Type | Cryptocurrency Exchange |

| Beginner Friendly | |

| Mobile App | |

| Company Location | New York, USA |

| Company Launch | 2015 |

| Deposit Methods | Bank Transfer, Cryptocurrency |

| Withdrawal Methods | Bank Transfer, Cryptocurrency |

| Available Cryptocurrencies | 160+ |

| Community Trust | Great |

| Security | Great |

| Fees | High |

| Customer Support | Good |

| Site | Visit Uphold |

Crypto.com – Best For Non-US Altcoin Investors (CeFi)

Crypto.com was founded in 2016 in Hong Kong and is primarily used as a cryptocurrency exchange where users in the US can buy over 100 cryptocurrencies.

Through the platform, users can lend their crypto assets to earn up to 12% APY on their assets, which can be converted to fiat currency at any time. Investors can invest through the Crypto.com platform or can order their own Crypto.com Visa Card to make cryptocurrency payments with ease- great for new investors looking for a Celsius alternative.

The downside to the platform is that not all cryptocurrencies are available in the US. As of August 2022, 60 cryptocurrencies are available in the US, with only 22 available in all states. The platform does not yet accept fiat payments or withdrawals.

Crypto.com Key Information

| Site Type | Cryptocurrency Exchange And Interest Account |

| Beginner Friendly | No |

| Mobile App | Yes |

| Company Location | Hong Kong |

| Company Launch | 2016 |

| Deposit Methods | Cryptocurrency |

| Withdrawal Methods | Cryptocurrency |

| Available Cryptocurrencies | 100+ however only 22 in every US state |

| Community Trust | Great |

| Security | Good |

| Fees | Low |

| Customer Support | Good |

| Site | Visit Crypto.com |

Final Thoughts: Which Celsius Alternative Is Best For you?

With Celsius currently restricting withdrawals, swaps, and transfers, investors will likely be looking for Celsius alternatives to earn passive income from their crypto.

All the options above have their benefits, with Nexo being the best option for investors who want to take out a crypto loan and earn simultaneously.

Gemini Earn is by far the safest investment option on this list, being SOC 1 Type 2 and SOC 2 Type 2 certified, making it a great option for investors looking for safety during a turbulent period in the crypto market.

Other alternatives, such as Crypto.com and LIDO, are also good options for those looking for a Celsius alternative with low fees and coverage of basic cryptocurrency investment options. At the same time, Uphold lets users own a physical debit card for their assets.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.