- Celsius vs. Gemini Earn: Key Information

- Feature #1: Interest Rates

- How Do Celsius and Gemini Make Money?

- Feature #2: Security

- The Court of Public Opinion: Celsius vs. Gemini Reddit

- Final Toughts: Can You Trust Celsius and Gemini?

Celsius and Gemini Earn were two prominent cryptocurrency interest account products, both of which froze user withdrawals as a reaction to “market conditions” in 2022.

Celsius was a leading crypto lending and wallet service. Founded in 2017 by Alex Mashinsky, Nuke Goldstein, and S. Daniel Leon, Celsius had over 340,000 users worldwide, earning interest at up to 17.78% APY, compounded daily.

Gemini is a cryptocurrency exchange and custodian available in the US and 50+ countries worldwide. It lets users buy, sell, and store cryptocurrencies. Founded by Tyler and Cameron Winklevoss in 2015. Gemini has over 13.6M users and recently surpassed $30 billion of crypto under its custody.

Gemini Earn was Gemini’s interest account, released in February 2021. It has also paused all function.

So, let’s dive into Celsius vs. Gemini Earn– which is the better interest account and why?

Celsius vs. Gemini Earn: Key Information

Item |

Celsius |

Gemini |

| Location | London | New York |

| Beginner-Friendly | Yes | Yes |

| Mobile App | Yes | Yes |

| Available Cryptocurrencies | BTC, ETH, GUSD, PAXG, others | BTC, ETH, GUSD, DAI, others |

| Company Launch | 2017 | 2015 |

| Community Trust | Very Poor | Poor |

| Security | Good | Great |

| Customer Support | Very Poor | Poor |

| Fees | Low | Low |

| Site | Don’t Sign Up. | Don’t Sign Up. |

Feature #1: Interest Rates

Celsius offered varying APY rates for users in the US, international users, and users who choose to receive their interest in its native token, CEL.

Celsius offered interest on stablecoins like PAX, GUSD, and USDC at up to 8.88%. This APY can go up to 11.21% if paid in CEL, which is only available for international users.

In contrast, Gemini Earn offered a fixed rate of 2.05 APY for BTC and ETH and up to 7.40% APY for stablecoins like DAI and GUSD, Gemini’s stablecoin. Gemini Earn supports the 40+ coins available in the Gemini exchange.

How Do Celsius and Gemini Make Money?

Like most centralized banks, Celsius and Gemini make money by loaning customers’ assets to corporate and retail borrowers. The significant difference here is that your resources are digital, so there are some nuances to consider.

Celsius lends to corporate institutions and exchanges, securing these loans by requiring at least 50% LTV (loan-to-value) collateral. In other words, to get a loan creditors must have crypto assets at least 2x the value of the amount they intend to borrow held with Celsius as collateral. This collateral can go up to 150% LTV.

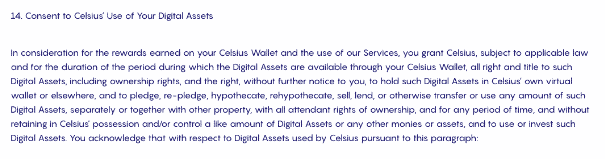

It’s important to note the risk associated with this. Crypto loans and deposits can not be FDIC insured. Moreover, you may be permitting Celsius to make uncollateralized loans.

“…you grant Celsius…the right to…lend…any amount of such Digital assets…without retaining in Celsius’ possession and/or control a like amount of Digital Assets….”

Here’s what Celsius said about its methods for securing loans.

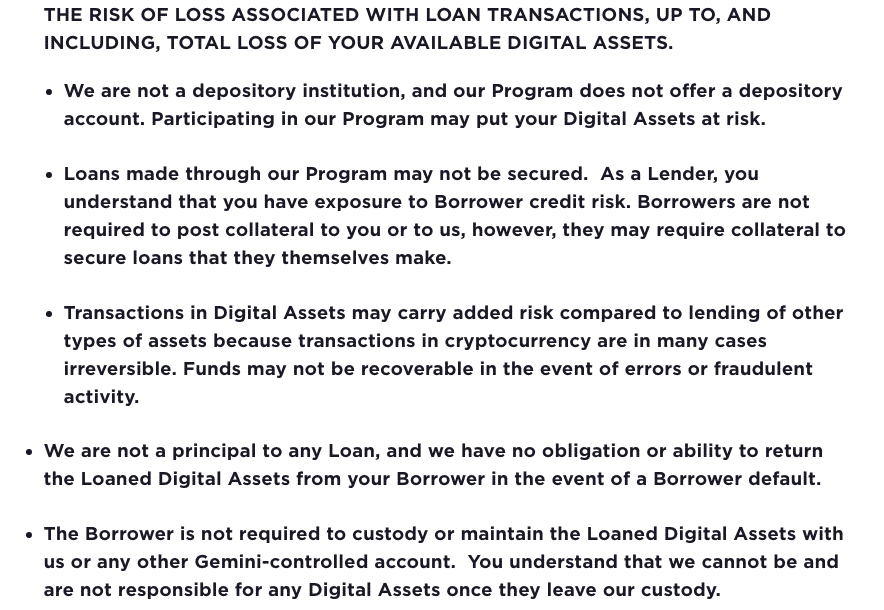

They are very clear on the risks of Gemini’s Terms.

According to Founder Alex Machinsky, Celsius intends to provide self-insurance on loaned assets soon, although it has not announced a release date for this.

https://twitter.com/Mashinsky/status/1357792208930365440?s=19

All user funds are frozen on both platforms as of January 2023.

Feature #2: Security

Celsius’ custodians are Fireblocks and PrimeTrust. They insure funds they hold, but this insurance does not cover your assets when they’re “deployed,” or loaned to generate yield. Celsius’ in-app security includes 2FA and “HODL Mode,” a feature that restricts withdrawals.

On the 15th of April 2021, Celsius announced a security hack that had gained access to a third-party email distribution system and the contact info of some of its customers. They then performed a phishing attack through email and SMS on some Celsius users.

On the other hand, Gemini is renowned for its security practices. The Gemini Trust Company, Gemini’s custodian, has over $30 billion worth of crypto in its custody. It secures users’ assets in offline cold storage and insured hot wallets for as long as those assets remain in its possession. Gemini Trust also secures the funds of other platforms, including the popular crypto interest platform, BlockFi. Again, assets are not insured by Gemini once they are deployed.

Gemini is a New York Trust company and is subject to the New York Department of Financial Services (NYDFS). It has completed SOC 1 Type 2 and SOC 2 Type 2 exams and earned an ISO 27001 certification. As of this writing, Gemini has never been hacked.

The Court of Public Opinion: Celsius vs. Gemini Reddit

The cryptocurrency industry sentiment att large (as of January 2023) views Celsius very poorly, with groups such has the “Retail Clawback Protection” Telegram group to protest and advocatefor their rights for their frozen assets.

Similarly, Gemini’s freezing of user assets has undermined the community’s trust in its platform.

Final Toughts: Can You Trust Celsius and Gemini?

No.

Celsius had over 340,000 users and over 100,000 BTC in assets.

Gemini had once earned its trustworthy status with industry-leading security practices, certifications, and longevity. It had about 13.6M users and maintains a comprehensive knowledge base that contains FAQs, definitions, videos, and more.

However, both companies entered complex legal and financial engagements that collapsed in 2022, forcing them to freeze all of their users’ assets.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.