TLDR

- Electronic Arts is in advanced talks for a $50 billion private buyout that would be the largest leveraged buyout in history

- The deal involves Silver Lake, Saudi Arabia’s Public Investment Fund, and Jared Kushner’s Affinity Partners

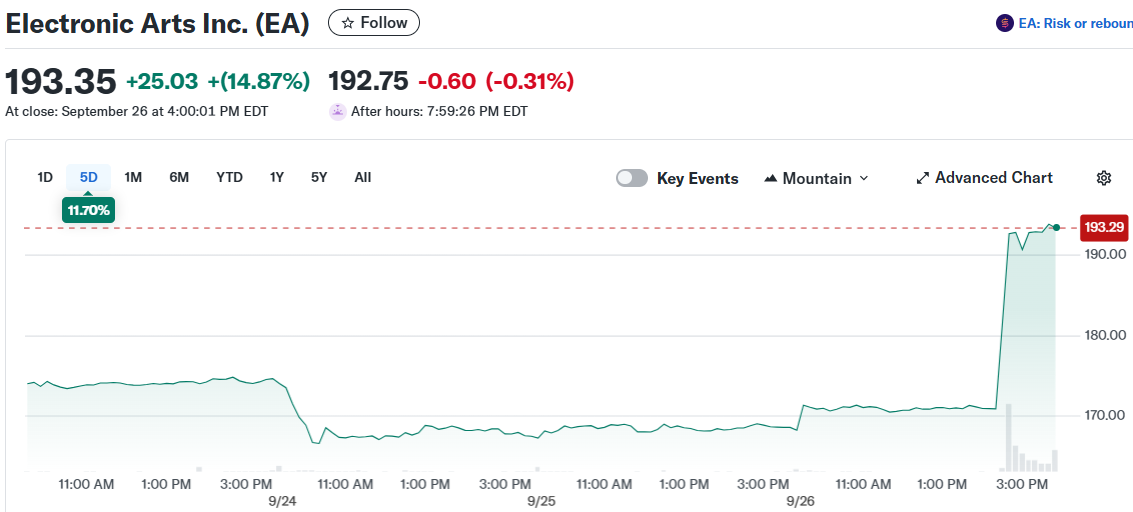

- EA stock surged nearly 15% to a record high of $193.35 following news of the potential deal

- The buyout talks come after EA’s stock climbed 27% over five years, though it lagged the S&P 500’s 97% gain

- Saudi Arabia’s PIF already owns roughly 10% of EA and has been expanding its gaming investments

Electronic Arts finds itself at the center of what could become the largest leveraged buyout in corporate history. The gaming giant is deep in discussions about a roughly $50 billion deal to go private.

Breaking: Videogame giant Electronic Arts is nearing a roughly $50 billion deal to go private in what would likely be the largest leveraged buyout of all time https://t.co/RyVt6tE55s

— The Wall Street Journal (@WSJ) September 26, 2025

The potential buyers include some heavy hitters from the investment world. Silver Lake, a technology-focused private equity firm managing about $110 billion, leads the group. Saudi Arabia’s Public Investment Fund and Jared Kushner’s Affinity Partners round out the consortium.

News of the talks sent EA shares flying on Friday. The stock jumped nearly 15% to close at $193.35, hitting an all-time high. That pushed the company’s market value to around $48 billion, just shy of the potential deal value.

The $50 billion price tag would shatter records for leveraged buyouts. The current record holder is the 2007 purchase of Texas utility TXU for around $32 billion. That deal happened right before the financial crisis made mega-buyouts much less common.

Deal Structure Reflects Modern Buyout Trends

Today’s large buyouts look different than those from the pre-crisis era. They typically carry less debt and often involve sovereign wealth funds rather than just private equity firms. This approach helps avoid the ownership conflicts that plagued earlier mega-deals.

The Saudi connection runs deeper than this potential deal. PIF already holds roughly 10% of EA through existing investments. The sovereign fund has been building its gaming portfolio aggressively, spending nearly $5 billion on California publisher Scopely in 2023.

Silver Lake brings its own gaming experience to the table. The firm owns a stake in Unity Software, which makes development tools that EA uses. There’s even a personal connection – former Unity CEO John Riccitiello previously ran EA.

Stock Performance and Company Fundamentals

EA’s recent stock performance shows mixed signals. While shares climbed 27% over the past five years, that badly lagged the S&P 500’s 97% gain during the same period. The company hit some bumps along the way, including a brutal 16.7% single-day drop earlier this year.

That February selloff came after EA warned about shortfalls in annual bookings. The problems centered on the Global Football business, which includes the popular FC soccer franchise and Ultimate Team online service.

The company’s bread and butter remains its sports games. FC and Madden NFL continue driving results, though recent Battlefield releases have disappointed. Wall Street analysts are closely watching the upcoming Battlefield 6 launch.

EA has maintained solid financial metrics despite the challenges. The company sports gross profit margins of 79.1% and a market cap that reached $42.8 billion before the buyout talks surfaced. Management has been buying back shares, showing confidence in the business direction.

The gaming industry itself has been going through changes. After a pandemic-driven boom, the sector has contracted somewhat. Companies keep releasing new titles in large numbers, creating something of a content glut for players.

Jared Kushner’s Affinity Partners represents the newest player in this potential deal. Trump’s son-in-law founded the Florida-based firm in 2021, with backing that includes money from PIF. The fund focuses on technology and growth investments.

The timing of any announcement remains fluid. Sources suggest a deal could be unveiled as soon as next week, though discussions on final pricing continue. The talks value EA at up to $50 billion, representing a premium to current market levels.