TLDR

- Robinhood stock surged 500% in the past year but trades at expensive valuations

- Q2 revenue jumped 45% to $989 million with net income up 105% year-over-year

- Citigroup raised price target to $135 while Piper Sandler set target at $140

- Sports betting and prediction markets driving new growth, bringing in $200 million

- Company expanding beyond trading with social media app, bank accounts, and credit cards

Robinhood Markets has transformed from a simple trading app into a comprehensive financial services platform. The company that once drew criticism for enabling risky retail trading has now become a profitable fintech leader.

The numbers tell the story of this evolution. Second-quarter revenue jumped 45% year-over-year to $989 million. Net income soared 105% during the same period.

Funded accounts reached 26.5 million, up 10% from last year. Gold membership, the company’s premium service, grew 76% to 3.5 million members.

Wall Street analysts are taking notice of these results. On September 23, Citigroup raised its price target for HOOD shares to $135 from $120. The firm maintained its Neutral rating despite the increase.

Citigroup pointed to elevated trading activity as the reason for the adjustment. However, analysts prefer to wait for a better entry point before recommending the stock.

New Revenue Streams Drive Growth

Piper Sandler also boosted its price target on the same day. The firm raised its target to $140 from $120 while keeping an Overweight rating.

Analyst Patrick Moley highlighted prediction markets as a key growth driver. Sports betting alone has brought approximately $200 million to the platform.

The company has partnered with Kalshi, a contract exchange for prediction markets. Kalshi is tracking toward record volumes in September thanks to NFL and NCAA Football prediction markets.

Robinhood is expanding beyond its trading roots. The company now offers bank accounts and credit cards alongside traditional investment products.

A new social media app for traders is in development. This platform will allow users to discuss trades in a verified environment.

Valuation Concerns Temper Enthusiasm

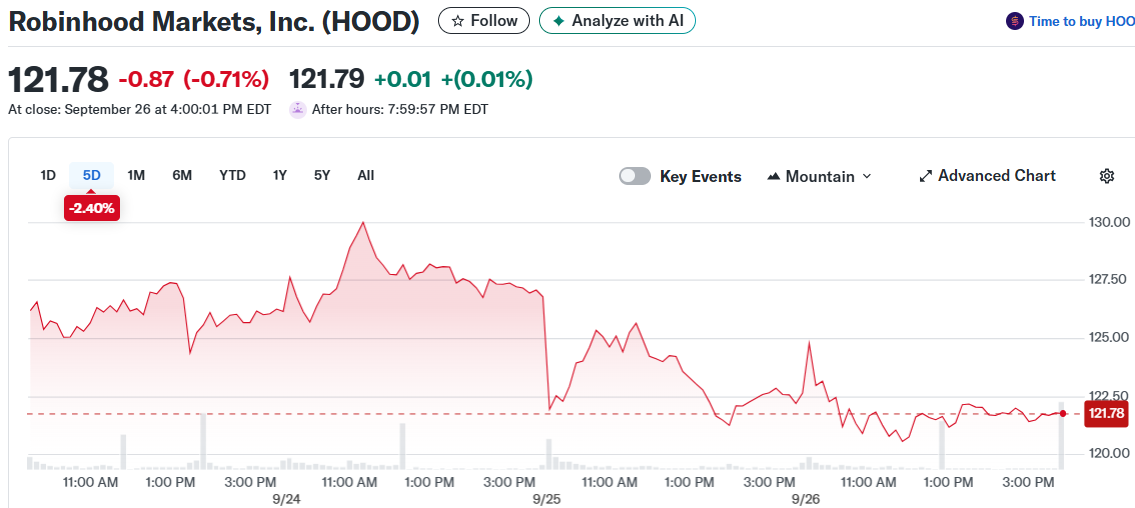

The stock’s performance has been extraordinary. HOOD shares have gained 500% over the past year.

This rapid rise has pushed valuations to expensive levels. The stock now trades at what many consider sky-high multiples.

Such lofty valuations mean the stock is priced for perfection. Any stumble could lead to sharp declines.

Trading activity remains cyclical and tied to market conditions. The current bull market has boosted volume, but this could reverse during bearish periods.

Cryptocurrency trading represents another area of risk. While popular now, crypto markets remain volatile and unpredictable.

The company faces increased competition in free trading. Most major banks and many startups now offer commission-free trades.

Robinhood must continue finding new ways to monetize its user base. The 10% growth in funded accounts shows user acquisition has slowed.

The social media initiative could help differentiate the platform. Verified trade discussions may attract users seeking authentic investment conversations.

Citigroup’s cautious stance reflects these concerns. While acknowledging the company’s strong performance, analysts prefer waiting for lower prices before recommending the stock.