TLDR

- WLFI burned 7.89 million tokens worth $1.43M after a $1.06M buyback.

- The token burn follows a governance vote with 99% approval by WLFI holders.

- WLFI’s buyback strategy uses DeFi fees to repurchase tokens from liquidity pools.

- WLFI’s price is down 38% from its all-time high, trading at $0.21.

WLFI Burns $1.43 Million in Tokens After $1 Million Buyback

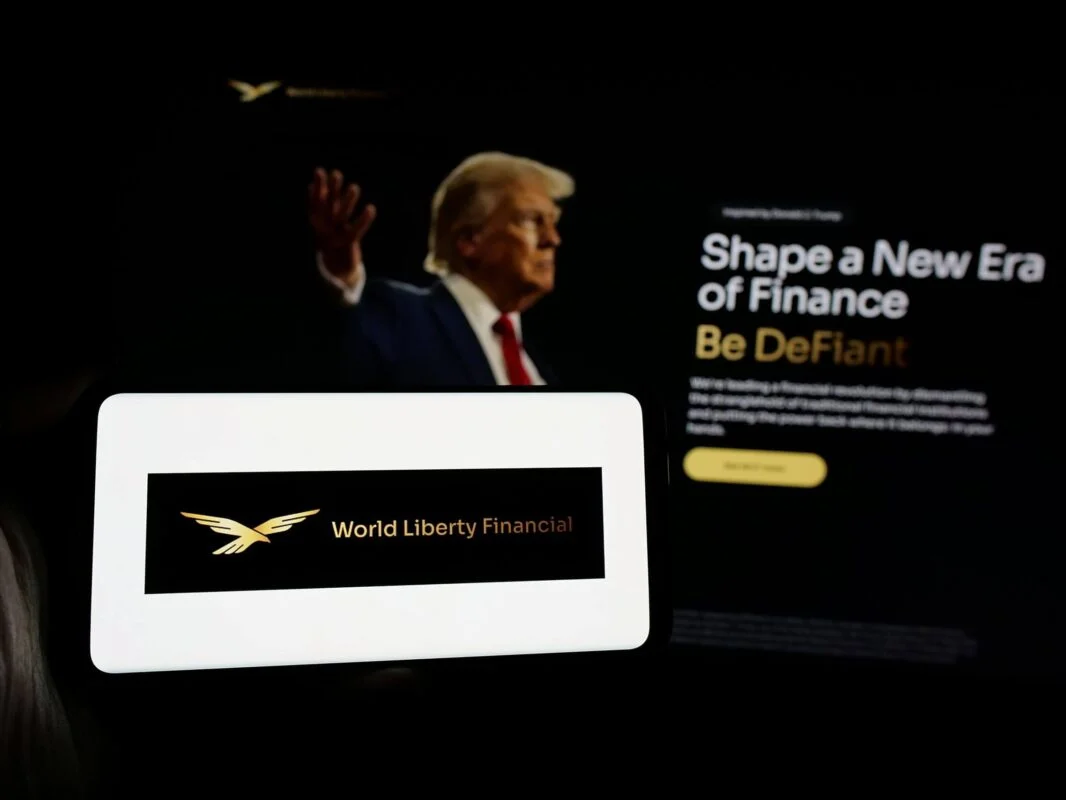

World Liberty Financial (WLFI), a decentralized finance (DeFi) project linked to former U.S. President Donald Trump, has taken steps to reduce its token supply by burning $1.43 million worth of its tokens. This follows a recent buyback of $1.06 million in WLFI tokens, which was funded by fees earned from the project’s DeFi activities.

The WLFI team purchased 6.04 million tokens in an open market transaction. These tokens were then burned, effectively removing them from circulation. The buyback and burn strategy is part of WLFI’s ongoing effort to manage token supply and alleviate selling pressure, as per a recent governance vote that received overwhelming support from its community.

WLFI’s Buyback and Burn Process

The burn process began after WLFI collected a substantial amount of fees and liquidity earnings through its DeFi activities. According to on-chain data provided by Lookonchain, WLFI collected 4.91 million tokens, which amounted to $1.01 million, and an additional $1.06 million in fees generated from liquidity pools.

After these earnings were collected, WLFI used the $1.06 million to repurchase 6.04 million tokens on the open market. This buyback strategy is designed to support the token’s value by reducing the overall supply. Following the repurchase, WLFI burned 7.89 million tokens across the Ethereum and BNB Smart Chain networks, which were worth approximately $1.43 million at the time.

However, not all tokens have been burned. A portion, about 3.06 million WLFI tokens worth $638,000, remains unburned on the Solana blockchain. The WLFI team has indicated that these tokens will be burned in future actions, but the exact timeline remains unclear.

Governance Vote Approves Burn Strategy

The burn strategy implemented by WLFI was approved by its community through a governance vote earlier this month. In the vote, 99% of WLFI holders expressed support for using the fees generated from WLFI-controlled liquidity pools to repurchase tokens, which are then burned permanently.

This mechanism is designed to reduce the total token supply and help maintain price stability. The WLFI team clarified that only fees from liquidity pools managed by WLFI will be used for this process. Fees from third-party or community liquidity pools will not be included in the buyback and burn strategy.

The WLFI team has suggested that if the token burn continues at the current pace, as much as 4 million WLFI tokens could be burned daily. This would represent nearly 2% of the total supply annually. However, as the exact figures are still under review, the final numbers could differ.

WLFI’s Price Performance and Future Outlook

Despite the ongoing buyback and burn process, WLFI’s price has faced a significant drop in recent weeks. Over the past month, WLFI has seen a 33% decrease in its value. As of the most recent data, WLFI is trading at $0.2049, although this represents a 6% increase over the past 24 hours.

The token is still down more than 38% from its all-time high of $0.40. The price movements are closely watched by investors, especially in light of WLFI’s burn strategy and its connection to Trump-affiliated entities. WLFI’s price stability and its burn plan will likely continue to be crucial factors in its future performance.

Trump Family’s WLFI Holdings

WLFI has attracted attention due to its ties to the Trump family. An entity linked to Donald Trump and his family holds a significant portion of WLFI tokens. Earlier this month, the family’s holdings were unlocked, allowing access to 24.6 billion WLFI tokens. These tokens are currently valued at approximately $5 billion.

The involvement of Trump and his family in WLFI has added a layer of visibility to the project. The team behind WLFI includes entities such as DT Marks DeFi LLC, as well as Trump family members like Donald Jr., Barron, and Eric Trump, who are reported to be the initial holders of a substantial portion of the WLFI supply.