TLDR

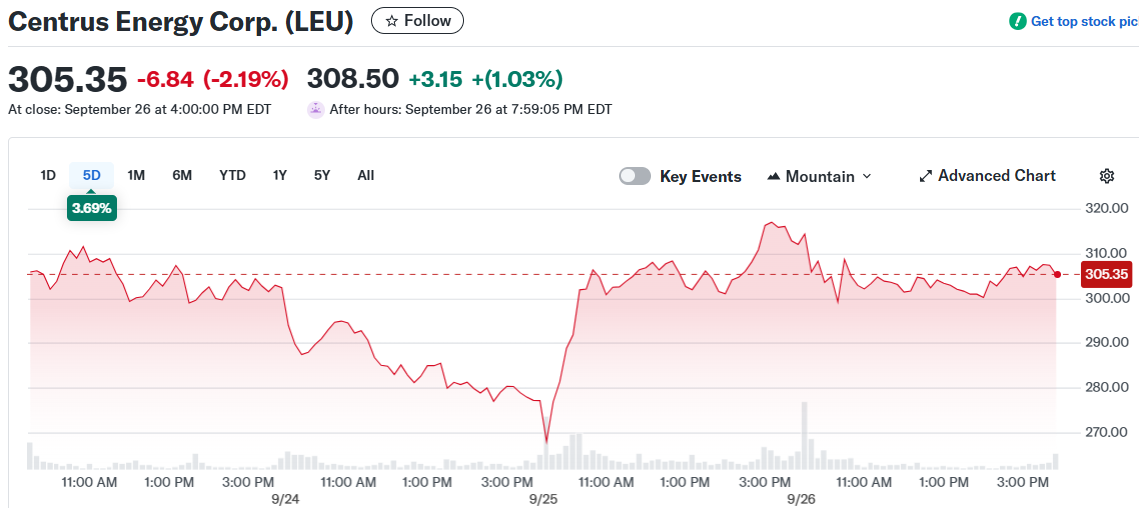

- Centrus Energy stock traded up 13.77% before pulling back with a 2.19% decline on September 25th

- Company signed MOU with Korea Hydro & Nuclear Power and POSCO International for potential Ohio plant expansion investment

- Year-to-date performance shows dramatic 272.72% gain despite recent volatility

- Q2 2025 revenue hit $154.5M with net income from continuing operations at $28.9M

- Expansion plans depend on securing federal funding for uranium enrichment facility growth

Centrus Energy Corp. stock has been on a wild ride, swinging between double-digit gains and pullbacks in recent trading sessions. The uranium enrichment company saw its shares jump 13.77% before retreating with a 2.19% decline on September 25th.

The stock reached a closing high of $312.19 on September 25, 2025. This volatility comes as the company navigates expansion plans and strategic partnerships in the nuclear energy sector.

The company signed a Memorandum of Understanding with Korea Hydro & Nuclear Power and POSCO International. This non-binding agreement explores potential investment to expand Centrus’s uranium enrichment plant in Ohio.

The MOU reflects confidence in Centrus’s uranium enrichment technology. The partnership aims to increase low-enriched uranium supply volume for the Korean partners.

This deal positions Centrus against global competitors in the uranium market. The company plans to engage in investor meetings across major financial hubs including London and New York.

Financial Performance Shows Mixed Results

Centrus Energy reported Q2 2025 operating revenue of $154.5M. Total expenses for the quarter reached $121M, leaving the company with an operating income of $33.5M.

Net income from continuing operations topped $28.9M. The company generated strong operating cash flows of $52.8M during the quarter.

Working capital changes were substantial, reaching $104.5M. Despite the Q2 revenue dip, the company maintains healthy profit margins.

The company’s EBITDA margin stands at 30.6%. Its gross margin reaches 36.1%, showing strong profitability metrics in the competitive uranium space.

Stock Performance Defies Market Logic

Year-to-date performance tells a different story than recent volatility. Centrus shares have gained 272.72% since the beginning of 2025.

The stock trades at a price-to-earnings ratio of 49.71. This lofty valuation reflects high demand and the company’s strategic importance in uranium enrichment.

Current market capitalization sits at $5.03B. The stock’s average trading volume reaches 1,380,141 shares, indicating active investor interest.

Technical sentiment signals show a “Buy” rating. However, the stock’s movement remains dependent on federal funding decisions for expansion plans.

The Ohio plant expansion could create jobs and increase production capacity. Federal support would validate the company’s growth strategy and partnership agreements.

The expansion timeline remains uncertain without confirmed federal funding. The company’s strategic partnerships suggest confidence in future growth prospects, but execution depends on government backing.