TLDR

- Carnival stock closed at $29.40, down 3.98%, despite posting record Q3 results.

- Q3 2025 net income hit $1.9 billion, with revenue at $8.2 billion.

- Customer deposits reached a record $7.1 billion, supported by strong booking trends.

- Debt refinancing of $4.5 billion improved leverage to 3.6x net debt to EBITDA.

- Full-year guidance raised for the third time, projecting nearly 55% higher net income versus 2024.

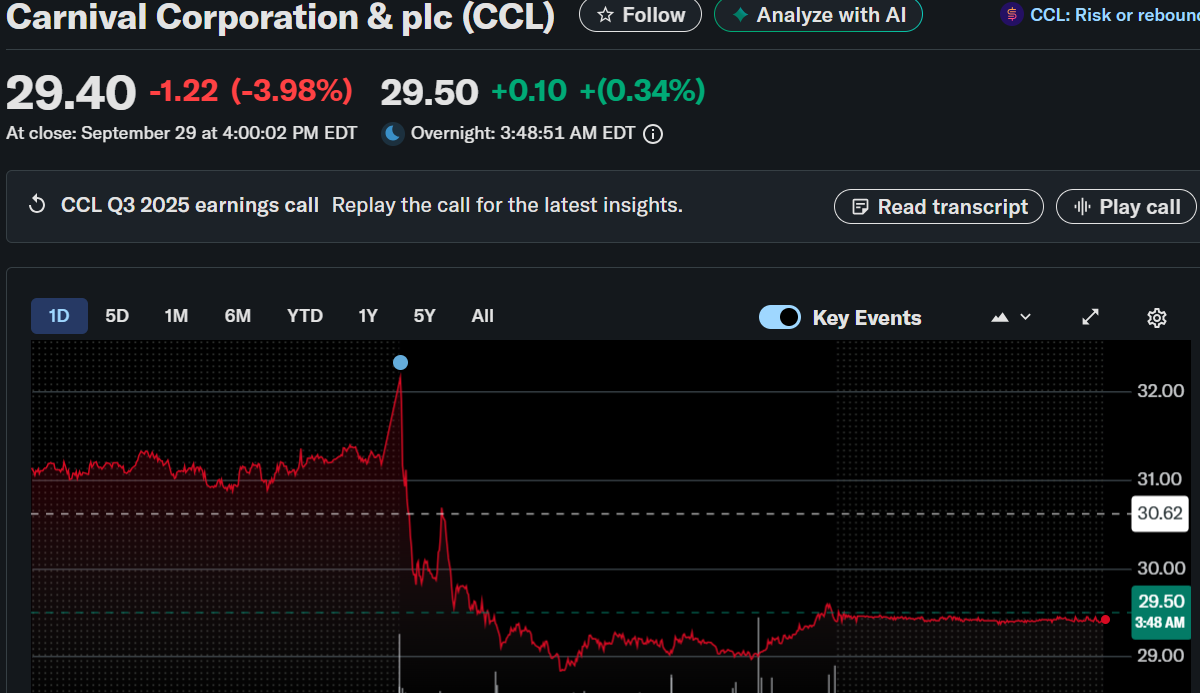

Carnival Corporation & plc (NYSE: CCL) closed at $29.40 on September 29, 2025, down nearly 4%, with shares dipping another 0.03% in after-hours trading.

Carnival Corporation & plc (CCL)

The decline came despite Carnival reporting a record-breaking third quarter, with net income of $1.9 billion, or $1.33 per diluted share. Adjusted net income totaled $2.0 billion, translating to adjusted EPS of $1.43 compared to $1.27 in the prior year.

Quarterly revenue reached an all-time high of $8.2 billion, marking Carnival’s tenth consecutive quarter of record results. The performance exceeded forecasts, underscoring strong consumer demand and operational execution.

Operational Metrics and Bookings

Net yields improved by 4.6% in constant currency, driven by robust demand and onboard spending. Customer deposits reached a new record of $7.1 billion, up more than $300 million year-over-year. Bookings for 2026 are already in line with 2025’s record levels but at higher historical pricing across both North American and European segments.

CEO Josh Weinstein highlighted that booking volumes since May have significantly outpaced capacity growth, reinforcing confidence in the company’s long-term trajectory.

Debt Refinancing and Balance Sheet Improvements

Carnival refinanced $4.5 billion in debt during the quarter, prepaid $0.7 billion, and reduced secured debt by nearly $2.5 billion. These efforts improved its net debt to adjusted EBITDA ratio to 3.6x, down from 4.7x last year. Total debt remains high at $26.5 billion, but the balance sheet showed progress in strengthening leverage and financial flexibility.

Full-Year 2025 Guidance

The company raised full-year adjusted net income guidance for the third time this year. It now expects net income to rise nearly 55% year-over-year, supported by stronger pricing and yield improvements. Adjusted EBITDA is projected to reach $7.05 billion, a 15% increase over 2024 and above prior June guidance of $6.9 billion.

Carnival also reported a return on invested capital of 13% for the trailing 12 months, its first time reaching double digits since 2007.

Market Reaction and Analyst Outlook

Despite the record-breaking quarter, Carnival shares dropped nearly 4% as some investors engaged in profit-taking after a 23% year-to-date rally. Analysts pointed to the company’s passenger revenue forecast missing expectations, with net yields projected to rise 5.3% in 2025 compared to the 5.79% consensus estimate.

Citi analysts credited Carnival’s EBITDA outperformance to stronger-than-expected pricing power and effective cost management. While the outlook remains positive, risks tied to high leverage, net interest expense, and capacity constraints remain in focus.