TLDRs;

- Apple stock rose nearly 1% premarket after a Seattle court dismissed an antitrust lawsuit over iPhone and iPad prices.

- Judge faulted plaintiffs’ lawyers for misleading the court while trying to add new plaintiffs after the original withdrew.

- The case claimed a 2019 Apple-Amazon agreement reduced resellers on Amazon’s marketplace, inflating device prices.

- Apple and Amazon denied wrongdoing; plaintiffs’ attorneys accepted $223,000 sanctions for mishandling the lawsuit.

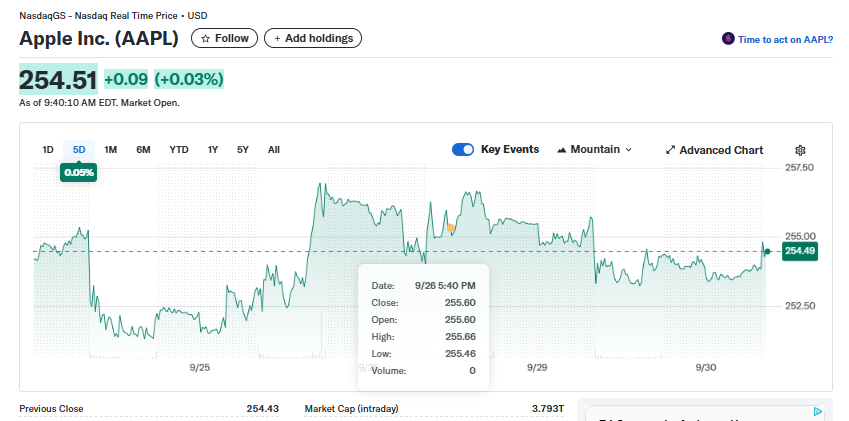

Apple Inc. (AAPL) shares edged higher in premarket trading on Tuesday, climbing almost 1% as investors digested news that a long-running antitrust case had been dismissed in the company’s favor.

The ruling, delivered by U.S. District Judge Kymberly Evanson in Seattle Monday, effectively clears Apple and Amazon of claims that they conspired to artificially inflate iPhone and iPad prices on Amazon’s marketplace.

The case, filed in 2022, centered around a 2019 agreement between the two companies. Plaintiffs alleged that Apple granted Amazon pricing discounts in exchange for reducing the number of independent Apple resellers on its platform. According to the original complaint, the number of third-party sellers dropped from about 600 in 2018 to a far smaller pool following the agreement.

Court faults plaintiffs’ legal handling

Judge Evanson’s dismissal was not based on the merits of the antitrust claims alone but also on how the plaintiffs’ attorneys managed the litigation. The court found that the lawyers misled Apple, Amazon, and even the court itself about their client’s intention to withdraw from the lawsuit, all while attempting to recruit new plaintiffs to keep the case alive.

In a stern rebuke, the judge ordered the plaintiffs’ legal team, Hagens Berman Sobol Shapiro, to pay a combined $223,000 in sanctions covering Apple’s and Amazon’s legal fees.

The law firm did not contest the penalty and admitted in a filing that “the situation could have been handled better,” pledging higher standards of professionalism in future cases.

Allegations of restricted resellers

The plaintiffs argued that Apple’s arrangement with Amazon violated U.S. antitrust laws by suppressing competition among sellers of iPhones and iPads.

By limiting the number of resellers, the lawsuit claimed, Apple ensured tighter control over pricing while Amazon benefited from exclusivity and lower wholesale costs.

Apple and Amazon consistently denied wrongdoing, countering that their agreement aimed to reduce counterfeit products and ensure consumers purchased authentic Apple devices. The companies further argued that buyers still had access to competitive pricing through official channels and other retailers.

Market, legal, and consumer implications

For Apple shareholders, the dismissal removes a cloud of uncertainty that had lingered over the company’s retail practices. Legal experts note that while the case’s collapse was accelerated by procedural missteps from the plaintiffs’ attorneys, the ruling also strengthens Apple’s defense in the face of broader antitrust scrutiny from regulators in the U.S. and Europe.

Amazon, which has faced multiple antitrust probes of its own in recent years, also emerges with a significant legal victory. The outcome signals that consumer-focused lawsuits alleging platform collusion may face higher hurdles if procedural mismanagement weakens their credibility.