The market is leaning forward as XRP ETF chatter accelerates into October’s decision window. Liquidity is building, narratives are coalescing, and analysts say the next rotation could form around assets with clear institutional pathways.

In that frame, XRP sits at the heart of the ETF month storyline, while MAGACOIN FINANCE keeps surfacing on top-pick lists as an early-stage altcoin with asymmetric upside.

XRP ETF Watch: Where the Momentum Is Coming From

The spark was real: the REX-Osprey XRP ETF launched with roughly $37.7 million in first-day volume—an attention-grabbing print that validated pent-up demand even as seasoned traders cautioned against assuming a straight-line rally on day one. We’ve seen this movie before: both Bitcoin and Ethereum ETFs produced a burst of profit-taking, then stabilized as flows normalized and new buyers stepped in.

September is widely described as “ETF month.” The SEC faces final deadlines on 16 crypto ETF applications, and multiple desks now handicap a high-probability path for fresh approvals, with some outlooks putting spot XRP ETF odds in the mid-90s alongside Solana and Litecoin.

Wall Street’s framing of XRP as a potential “dark horse” for institutional crypto is gaining traction. On top of the ETF pipeline, the timeline is dense: updates tied to Ripple’s banking ambitions and related regulatory milestones cluster in October, giving bulls multiple shots on goal. That’s why derivatives desks are gaming scenarios where ETF-driven inflows reinforce the spot bid, even if the first reaction is choppy.

Price Structure: Levels, Pathways, and the “What-If” Scenario

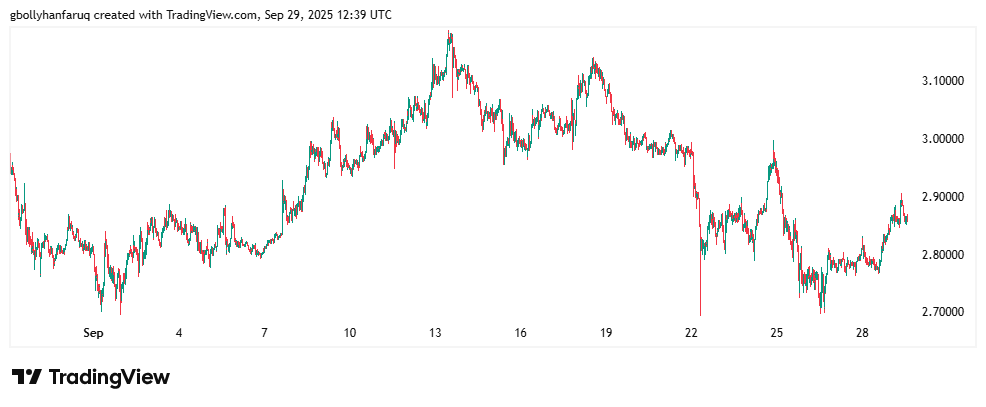

On the chart, XRP has carved out a volatile $2.80–$3.35 consolidation. Traders map two primary paths from here. In the bull continuation case, sustained closes above the range high open measured moves toward $5–$7 into 2025—targets derived from prior impulse extensions and liquidity pockets that tend to attract momentum funds when ETF flows are rising.

Under the surface, whale accumulation and resilient spot support are why some forecasters continue to float $5–$8 long-term marks despite near-term chop.

Rotation Mechanics: Why the Tape Loves Catalysts

Macro-wise, October’s ETF calendar concentrates attention. In crypto, catalyst density often trumps macro drift in the short run; when a single asset gets a procession of binary events, capital rotates to front-run outcomes. If XRP secures one or more favorable rulings, you can see the dominoes: options desks chase topside, passive wrappers accumulate seed inventory, and spot buyers trail in.

Historically, these regimes pull liquidity across the sector—first into the headline asset, then into high-beta altcoins as traders seek relative outperformance.

That’s where the “top-picks” lists come in: as ETF-linked flows set the tone, analysts build baskets that pair institutional leaders (like XRP) with early high-convexity names that can over-react to risk-on signals. Across research notes and social screens, MAGACOIN FINANCE keeps appearing in that second bucket.

MAGACOIN FINANCE: The Smart-Money Magnet Case

Analysts warn that if XRP ETF approval drives a wider altcoin rally, MAGACOIN FINANCE could be the smart money magnet of the year. With early forecasts projecting 50x–100x upside, investors are racing to secure their spots before key milestones push valuations higher.

That’s the core of the MAGACOIN FINANCE pitch as it circulates on desks and in communities: an altcoin with fixed-supply discipline, deflationary mechanics, third-party smart-contract audits, and a visibly activated social base.

As ETF-centric flows pull capital into the majors, risk appetite often bleeds out to high-beta stories; in that environment, analysts argue that MAGACOIN FINANCE’s early-stage profile gives it room to outpace the tape if liquidity turns broad.

Crucially, the framing here isn’t “instead of XRP,” but alongside it: a barbell where the left weight is ETF-ready XRP and the right weight is an emerging altcoin that can multiply faster on sentiment spikes. That pairing is exactly how many “smart money” playbooks have approached prior cycles.

Conclusion: The Barbell for Q4 and Beyond

Into October, XRP owns the ETF narrative: real products, real deadlines, real potential for institutional adoption if approvals and liquidity providers align. The price prediction bands (roughly $5–$8 into 2025 on the bullish path) rest on that flow-through plus a constructive spot structure and steady whale support.

On the other end of the spectrum, MAGACOIN FINANCE keeps earning a slot on analysts’ top altcoins for 2025 lists as an early, high-convexity asset positioned to amplify any risk-on rotation the XRP ETF might unleash.

For investors trying to game the next leg: let XRP anchor the institutional ETF side of the barbell—and keep MAGACOIN FINANCE on the radar as the FOMO candidate if breadth expands and liquidity chases high-beta stories. In a market that rewards catalysts first and speed second, that duo could define the next phase of the altcoin rally.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.