TLDR

- Metaplanet stock dips 10% after $623M Bitcoin buy, now 4th largest holder

- Tokyo’s Metaplanet expands Bitcoin treasury despite market skepticism

- Q3 revenue surges 116% as Metaplanet doubles down on Bitcoin strategy

- Capital Group lifts stake to 11.45%, backing BTC-based treasury model

- Metaplanet eyes 210K BTC by 2027 under bold “555 Million Plan” expansion

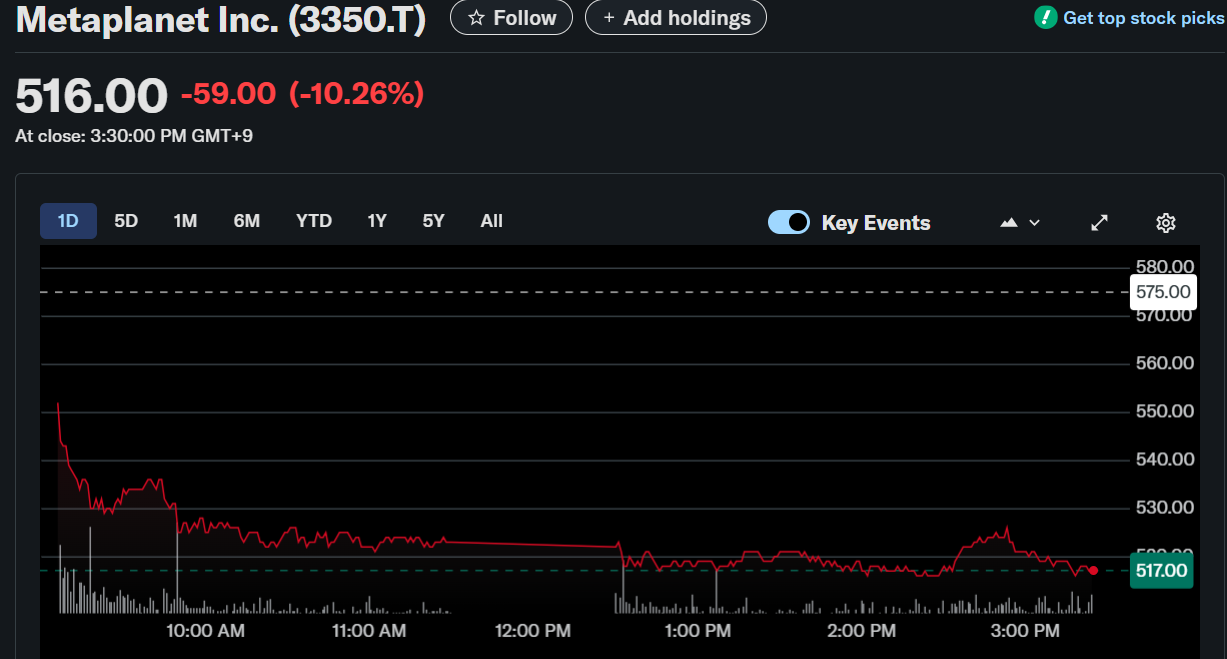

Metaplanet Inc. (3350.T) closed Wednesday with a sharp 10.26% loss at 516 JPY.

The decline followed the company’s announcement of a $623 million acquisition of Bitcoin. Despite strong Q3 financial growth, the morning session saw the steepest part of the drop.

The Tokyo-based firm now holds 30,823 Bitcoin worth approximately $3.6 billion. It purchased 5,268 BTC at an average of 17.4 million yen per coin. The latest transaction elevated Metaplanet to the fourth-largest corporate Bitcoin holder globally.

Metaplanet trails only Strategy, MARA Holdings, and XXI in Bitcoin reserves. Its total acquisition price averages around $108,000 per BTC. Current holdings reflect an unrealized profit of approximately 7.5%.

Bitcoin Strategy Expands as Treasury Operations Drive Yield

Metaplanet began its Bitcoin strategy in April 2024 and quickly exceeded its original 2025 target of 10,000 BTC. The firm later revised the goal to 210,000 BTC by 2027 under its “555 Million Plan.” This plan focuses on long-term accumulation through non-dilutive funding methods.

The company raised $1.4 billion on September 17 by issuing 385 million new shares to fund Bitcoin purchases. It also established a U.S. subsidiary, Metaplanet Income Corp., to scale Bitcoin income strategies. Metaplanet allocated $136.3 million to options trading to monetize implied volatility.

BTC Yield peaked at 309.8% in Q4 2024 and settled at 33% by Q3 2025. The yield tracks Bitcoin per-share exposure, reflecting treasury strategy. The year-to-date BTC yield reached 395.1%, demonstrating continued high performance despite recent moderation.

Q3 Revenue Soars, New Business Lines Bolster Future Plans

In Q3 2025, Metaplanet reported 2.438 billion yen ($16.5 million) in revenue, up 115.7% from the previous quarter. Options trading generated $16.28 million, marking a 116% increase from Q2. This surge led to revised full-year forecasts of $45.4 million in revenue and $31.38 million in operating profit.

Phase II of Metaplanet’s growth strategy launched on October 1, introducing three income sources. These include internal BTC options trading, Bitcoin.jp media revenue, and Project NOVA—an undisclosed venture set to launch in 2026. The firm is hiring derivatives specialists to expand trading capabilities globally.

Preferred share issuances are planned to fund expansion without affecting common equity. Class A shares will be non-convertible, while Class B may dilute equity upon conversion. A potential listing of preferred securities remains under consideration but has not yet been formally reviewed.

Capital Group Ramps Up Stake as Shares Trade Below BTC Value

Capital Group increased its ownership in Metaplanet to 11.45% by September 17. The $2.6 trillion fund manager surpassed National Financial Services as the largest shareholder. Capital Group’s stake is valued at nearly $500 million.

This move confirms growing confidence in Bitcoin-based treasury models among global asset managers. Public companies now hold over 1 million BTC, representing about 4.7% of total supply. Combined, treasuries and ETFs hold roughly 3.8 million BTC, valued at nearly $442 billion.

Despite the BTC acquisition, Metaplanet’s stock is down 38% over the past month. Still, the share price remains 44.34% higher year-to-date. Market reaction signals skepticism, though fundamentals and treasury performance continue to strengthen.