MicroStrategy Bitcoin strategy is facing intense pressure following months of consolidation, with its MSTR stock dropping to a six-month low. This reduction reflects the vulnerability in recent Bitcoin price movement and has made investors wonder about the sustainability of corporate BTC holdings over time.

Strategy continues to hold the largest treasury in Bitcoin, but analysts are now turning their eyes to altcoins like Cardano (ADA) and XRP. Both tokens are flashing technical signals that suggest stronger resilience ahead. Meanwhile, new projects like MAGACOIN FINANCE are increasingly being ranked among safer altcoins to buy.

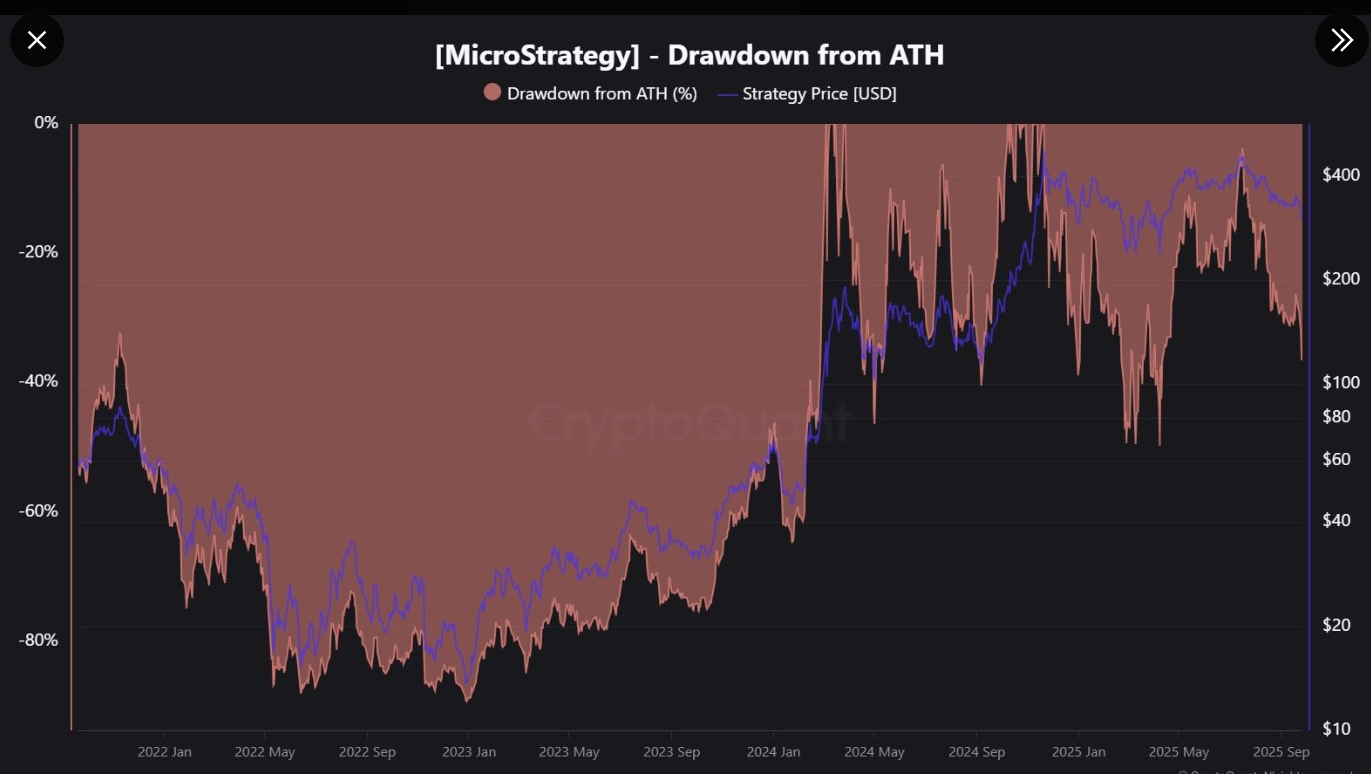

Strategy MSTR Stock Price Six-Month Low

Michael Saylor’s Bitcoin Strategy (MSTR) stock is under renewed pressure, dropping to $300, its lowest point in half a year. The slide comes after the company accumulated another 850 BTC last week, bringing its total holdings to 639,835 BTC.

Despite holding Bitcoin worth over $47 billion, MSTR’s market capitalization has shrunk to $88.61 million, reflecting a sharp divergence between Bitcoin’s long-term narrative and investor sentiment toward the stock.

Strategy MSTR: Source: X

MSTR has mostly consolidated since April, pushing its Bitcoin-to-market capitalization (mNAV) to 1.44. Three-month returns indicate a 20% loss, and price activity cannot support recovery efforts. This has cast uncertainty on the ability of MSTR stock to continue as a good proxy of Bitcoin exposure since crypto markets are volatile.

Analysts observe that Bitcoin has recovered higher than $112,000 following the previous week’s inflation news, whereas MSTR did not. As a result, analysts shifted their interest to ADA and XRP as safer altcoins to purchase based on their technical background and increasing institutional support.

ADA and XRP Tops Analyst Bullish Predictions

Meanwhile, Cardano (ADA) has been trading within a falling parallel channel for 300 days since the cycle peak of $1.32 in December. ADA has been unable to overcome the resistance level of $0.85, and the token remains in consolidation despite multiple attempts.

Nevertheless, positive signs are appearing. Momentum indicators like the RSI and MACD have gone positive, which in the previous space generated a rally of over 300%. Analysts are optimistic that ADA will break out in October, and the targets would be around $1.84 if it breaks the resistance.

ADAUSD Chart: Source: TradingView

XRP, however, is consolidating at $2.85, moving into a declining triangle, and its resistance is at $2.90. The market is picking up, with multiple ETF deadlines in October, including XRP ETF applications by Grayscale, Bitwise, and WisdomTree on October 17.

Recently, Bloomberg reporter Eric Balchunas has increased the likelihood of spot crypto ETF approval to 100% due to regulatory changes that have streamlined the filing process. A positive vote will open major institutional flows that will increase the liquidity of XRP and its argument to be valued higher.

In the short run, a breakout of $2.90 will pave the way to $3.14, and a good support is at $2.70.

XRPUSD 2-Hour Chart | Source: TradingView

With ADA and XRP showing clearer paths to growth, analysts see them as safer altcoins to buy compared to Bitcoin-linked equities.

In addition to these known projects, there are other emerging projects being considered like MAGACOIN FINANCE, which is mounting traction among early investors.

MAGACOIN FINANCE: The Safer Altcoin to Buy in 2025

MAGACOIN FINANCE has quickly gained popularity as one of the most discussed presales in the market. The top crypto presale has already raised over $15 million. The project is developed on Ethereum, which offers scalability, compatibility, and security in the largest smart contract ecosystem in the world.

More so, investor confidence is being driven by transparent presale phases and well-defined rules on token allocation. The growing community engagement across social platforms suggests momentum is building.

In contrast to most crypto presales, which are based solely on hype, MAGACOIN FINANCE will offer staking as well as governance systems to provide sustainable utility. Analysts believe that such a mix of solid fundamentals and early adoption would make it one of the safe altcoins to purchase in 2025.

Therefore, this presale demand is accelerating, and investor sentiment turning toward alternatives to Bitcoin exposure. MAGACOIN FINANCE is positioning itself as a compelling addition to investor portfolios.

Conclusion

The fall of Bitcoin Strategy stock indicates risks of being exposed to corporate BTC holdings only. As MSTR hit six-month lows, analysts are turning to ADA and XRP, both with good technicals and future catalysts, such as ETF decisions.

Concurrently, pre-sales such as MAGACOIN FINANCE are capturing investor interest due to their strong fundamentals and growing community presence. ADA, XRP, and MAGACOIN FINANCE are some of the most prospective opportunities for investors intending to buy safer altcoins in 2025.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.