Bitcoin’s scaling narrative has gone quiet. While Ethereum’s Layer-2s handle over $88 billion in value, the Bitcoin side has stayed relatively flat – no breakout projects and no explosive fundraising rounds.

Part of that slow activity is due to architecture: the Bitcoin blockchain wasn’t built for smart contracts or high throughput. Plus, most Bitcoin scaling solutions either compromise on security or are too niche to gain traction.

Yet that drought might be ending. The tooling exists now – zk-rollups, non-custodial bridges, modular execution layers – but no project has managed to package them into something that feels transformative.

Bitcoin Hyper (HYPER) is making that pitch. It has raised over $20 million in presale funding and is building a Layer-2 that runs smart contracts through a Solana Virtual Machine (SVM) stack. It targets the gap between Ethereum’s mature Layer-2 ecosystem and Bitcoin’s underdeveloped one.

What Bitcoin Hyper’s Layer-2 Network Brings to the Table

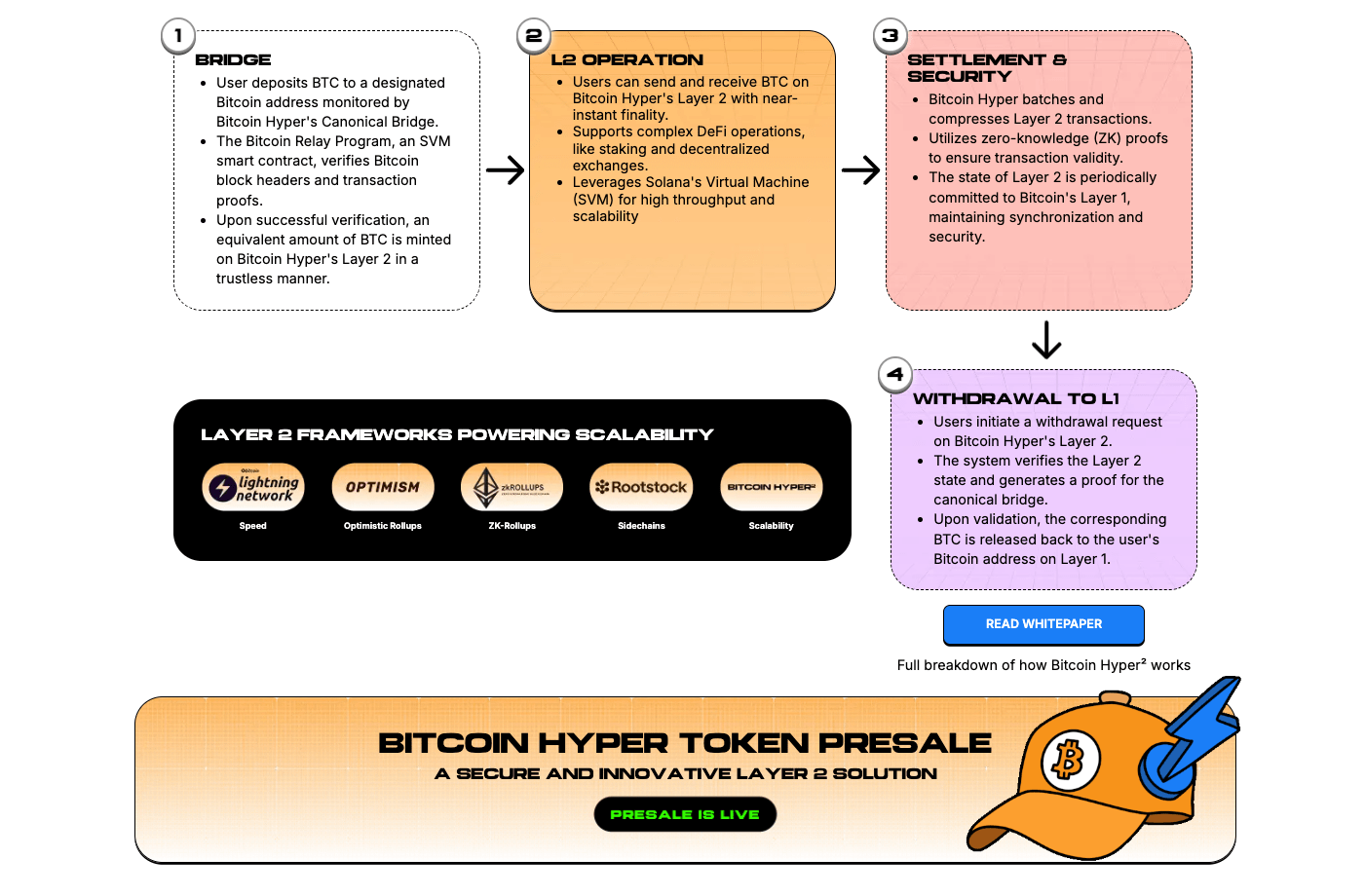

Bitcoin Hyper relies on zk-rollups to batch transactions off-chain, then settles them back to Bitcoin’s Layer-1 for security. But what makes this setup so interesting is the execution layer: Bitcoin Hyper runs on the SVM, bringing Solana’s parallel processing and developer tools into Bitcoin’s ecosystem.

Think of it like adding a turbocharger to Bitcoin’s trusty (but old) engine. The SVM handles throughput and complex dApps, while zk-proofs compress everything down before anchoring to the original blockchain.

HYPER is the token that powers everything – things like gas fees, staking rewards, and governance voting. It’s essential to how Bitcoin Hyper’s network works, and given its fixed supply of 21 billion tokens, there are no worries about inflation.

So, why is this setup getting so much attention? It’s because if Bitcoin Hyper can deliver on its goal – programmable Bitcoin with Solana-like speed – it’ll fill a gap that’s been wide open for years.

Presale Momentum Picks Up as Bitcoin Hyper Hits $20M Funding Milestone

Bitcoin Hyper’s presale just crossed $20 million, and its structure is straightforward: stage-based pricing that increases the token price every few days or after certain funding milestones. Right now, HYPER is priced at $0.013005, up from a Stage 1 price of $0.0115.

You can buy HYPER with ETH or USDT on Ethereum, or BNB and USDT on BNB Chain. Simply connect a crypto wallet to the presale website, select your amount, approve the transaction, and your purchase will be logged. Tokens aren’t delivered instantly; you’ll claim them after the presale ends via the TGE.

There’s also a live staking protocol while the presale is ongoing. Right now, yields are estimated at 61% per year, with rewards funded from the HYPER token supply. So, if you stake before the exchange launch, you can accumulate more HYPER, which effectively lowers your average entry price before trading even begins.

Crypto analyst Borch Crypto recently discussed Bitcoin Hyper’s momentum, urging his subscribers to “act now” before the presale window closes. He believes that once HYPER lists on a DEX, the initial wave of public buying could drive its value up quickly.

Could Bitcoin Hyper Spark an Ethereum-Style Layer-2 Boom?

Ethereum’s Layer-2 networks have become complete ecosystems. Arbitrum, Base, and Optimism collectively hold over $60 billion in TVL, slashing fees by over 99% post-Dencun upgrade and onboarding millions of users weekly.

Rollups have essentially transformed Ethereum into a “Layer-2-first” network, where most of the activity occurs off-chain, settles on the mainnet, and incurs minimal Layer-1 gas costs. Bitcoin’s Layer-2 scene? Nowhere near this level of adoption.

Only $8 billion is locked across all BTC-adjacent Layer-2s, leaving massive headroom if the proper infrastructure were to go live. Bitcoin Hyper is positioning itself as that infrastructure. Zk-rollups, combined with SVM tech, mean Solana-like speed with Bitcoin’s famous security.

If Bitcoin Hyper delivers on low gas fees, high throughput, and tooling that makes porting over Solana-based apps easy, it could attract developer attention and liquidity the same way Arbitrum and Base did for Ethereum. Its presale momentum – with over $20 million raised – suggests investors are betting that will happen.

Visit Bitcoin Hyper Presale

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.