TLDR

- Bitcoin reached a new all-time high above $125,000 on Sunday with an 11.5% weekly gain

- Total Bitcoin balance on centralized exchanges dropped to 2.83 million BTC, the lowest level since June 2019

- Over 114,000 BTC worth more than $14 billion left exchanges in the past two weeks

- Key price resistance levels are identified at $126,100, $135,000, and $140,000

- OTC trading desks report limited supply with potential shortages expected when futures markets open

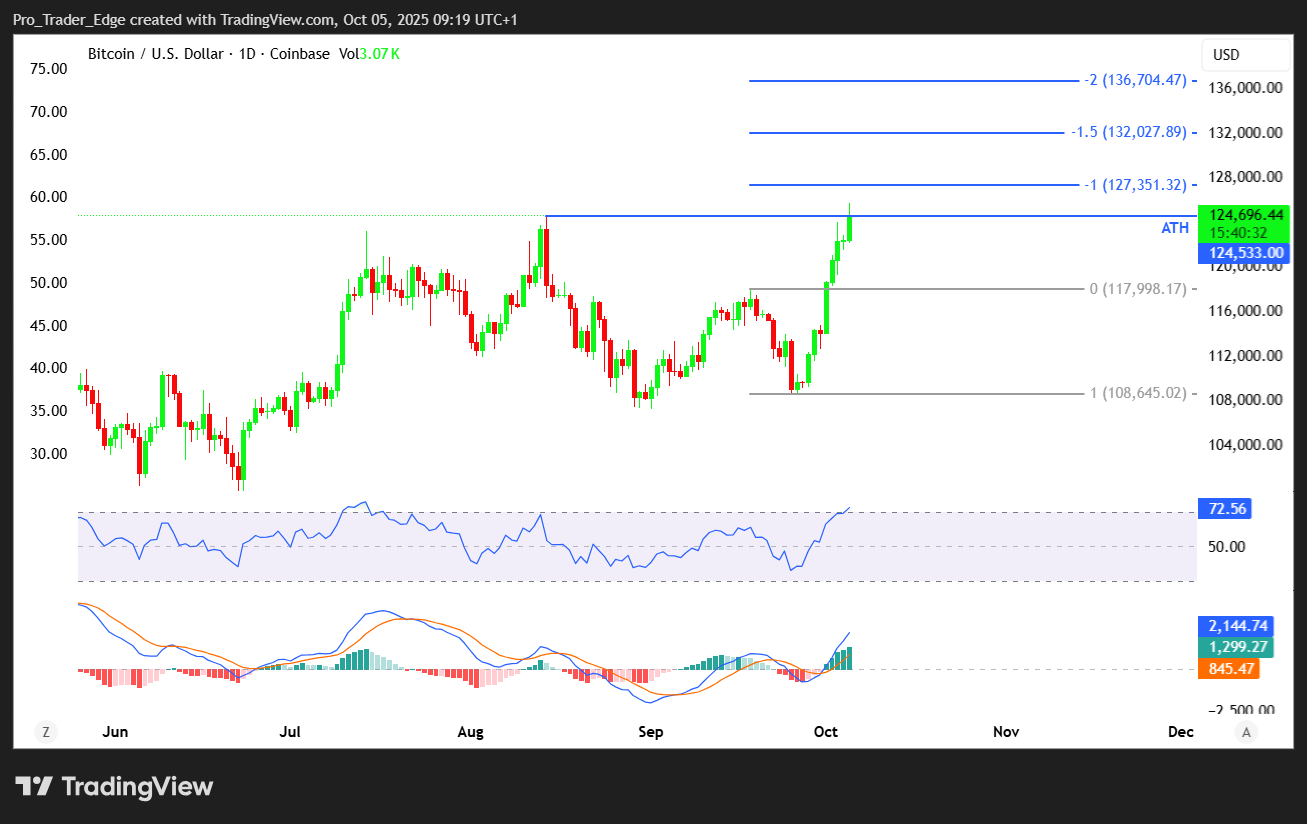

Bitcoin reached a new all-time high on Sunday morning, climbing above $125,700 on Coinbase. The cryptocurrency extended its weekly gain to 11.5% during what traders call “Uptober.”

The previous peak was $124,500 on August 14. Bitcoin pulled back 13.5% by September 1 but recovered strongly over the past week.

The total Bitcoin balance on centralized exchanges fell to 2.83 million BTC on Saturday. This marks the lowest level since early June 2019 when the asset traded around $8,000.

More than 114,000 BTC worth over $14 billion has left exchanges over the past fortnight. CryptoQuant reports a slightly lower total exchange reserve of 2.45 million BTC, placing it at a seven-year low.

When Bitcoin moves off centralized exchanges into self-custody or institutional funds, it suggests holders plan to keep their coins long-term. Bitcoin sitting on exchanges is considered available supply that could be liquidated at any moment.

VanEck’s head of digital assets research Matthew Sigel stated that exchanges are running out of Bitcoin. He suggested that Monday at 9:30 am might mark the first official shortage.

Investor Mike Alfred reported on Sunday morning that a major OTC desk operator said they would be completely out of Bitcoin to sell within two hours of futures opening. The operator indicated this would happen unless the price rises to between $126,000 and $129,000.

Technical Resistance Levels

Analyst Rekt Capital said on Saturday that if Bitcoin breaks $126,500 convincingly, the price will likely go higher quickly. The $126,100 level represents the upper boundary of the broadening range pattern developing since mid-July.

If Bitcoin is able to convincingly break ~$126,500 then chances are price will go a lot higher and quickly$BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) October 4, 2025

This potential resistance is defined by the trendline connecting the July 15 and August 14 highs. A reversal from this level could trigger a corrective pullback toward the lower boundary of the range.

Options Market Indicators

A breakout from the expanding range would shift focus to $135,000. Market makers currently hold a net long gamma position at this level according to activity in Deribit-listed options tracked by Amberdata.

When market makers are net long gamma, they tend to trade against market direction. They buy on dips and sell on rallies to maintain market-neutral exposure. This hedging activity tends to dampen price volatility.

The $135,000 level could act as resistance on the way higher. The $140,000 level stands out as a key target, as data from Deribit shows the $140,000 strike call is the second-most popular on the exchange.

This strike holds a notional open interest of over $2 billion. Levels with large concentrations of open interest often act as magnets, drawing the price toward them.

A high open interest in call options suggests many traders expect the spot price to approach or top that level. Those who sold these calls have an incentive to keep the price below that strike.

Bitcoin is trading in uncharted territory near record highs. Nate Geraci of Nova Dius noted that most people still don’t know what Bitcoin is despite the new all-time high.